- United States

- /

- Hospitality

- /

- NYSE:CCL

Does Carnival Corporation’s 17.6% Rally After Ship Deployment Signal More Room to Run in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Carnival Corporation & stock? You’re not alone. With travel rebounding and the company’s share price rising a remarkable 40.6% over the past year, there’s a lot to take in. After a setback earlier in the pandemic era, Carnival has caught the eye of investors again, climbing an eye-popping 228.9% in the past three years. Even the most recent five-year chart shows a strong 114.4% gain, suggesting that long-term holders have been rewarded for their patience, though the last 30 days have seen a minor dip of 3.2% following a recent rally.

What’s behind all this movement? Just last week, Carnival announced additional deployments for its most efficient new ships, reflecting confidence in post-pandemic demand. There’s also chatter around improved occupancy rates and more flexible booking options, making investors more optimistic about the cruise giant’s ability to adapt. After a historically risky stretch, it seems like Wall Street perceives the company’s risk has decreased, giving the stock more room to rise, as evidenced by the 17.6% jump since the start of the year.

Of course, big gains naturally prompt a big question: is Carnival still undervalued, or has the growth run its course? Our valuation score gives Carnival a 5 out of 6, pointing to undervaluation in five separate checks, and there’s more to say about how those numbers were calculated. Let’s break down the common valuation approaches investors use to analyze Carnival, before moving on to an even more insightful way to understand what the stock is really worth.

Approach 1: Carnival Corporation & Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach seeks to answer what the business is truly worth based on how much cash it is expected to generate.

Carnival Corporation & currently reports Free Cash Flow (FCF) of approximately $1.46 Billion. Analysts expect healthy growth in these cash flows, with projections showing FCF reaching up to $3.94 Billion by 2029. While analysts typically forecast up to 5 years out, extra-long-range estimates are extended by Simply Wall St to round out the 10-year view. Each year’s cash flow is adjusted to reflect its present value, given the time value of money.

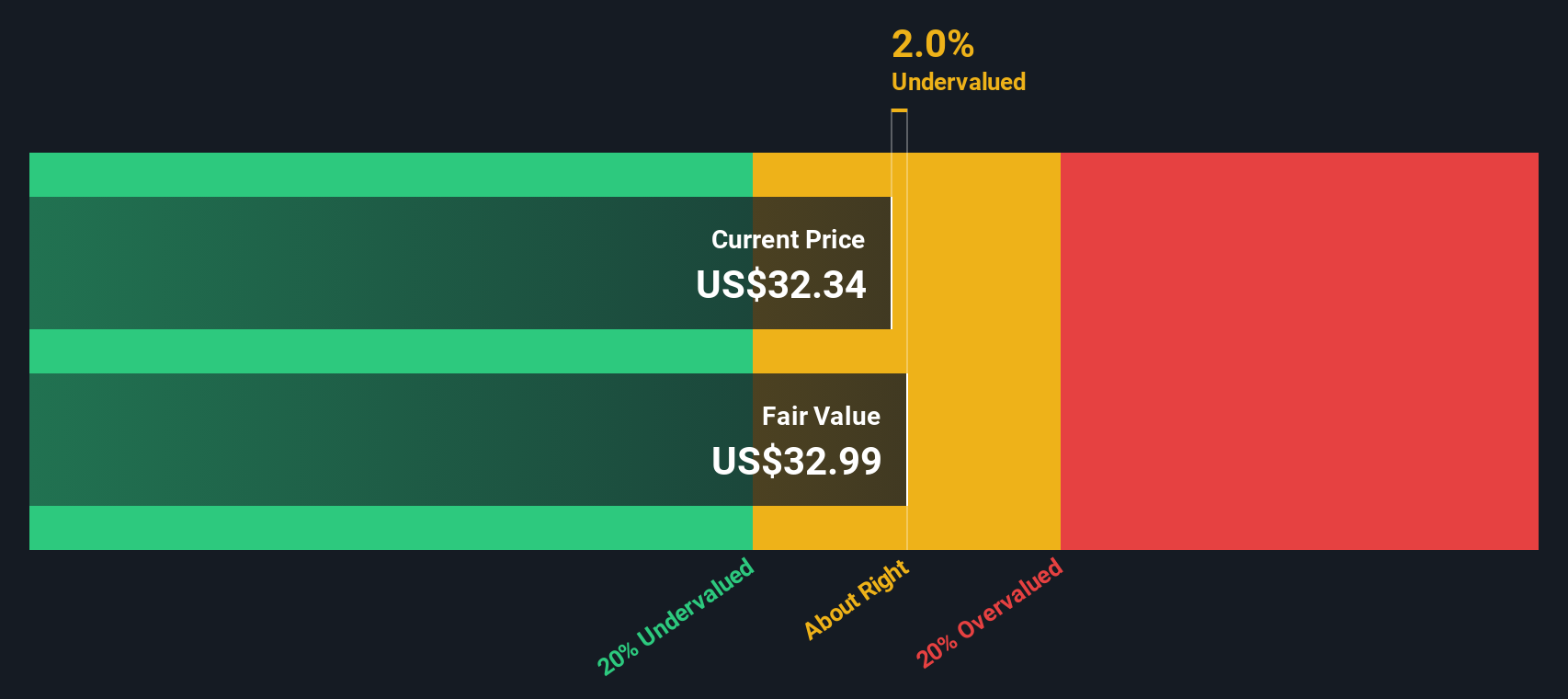

After calculating these projections, the estimated intrinsic value for Carnival’s shares is $30.44. This figure suggests the stock is around 3.4% undervalued compared to its current market price, indicating a valuation that closely reflects its fundamentals.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Carnival Corporation &'s valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Carnival Corporation & Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often considered the gold standard for valuing profitable companies like Carnival Corporation &. This metric tells investors how much they are paying for each dollar of current earnings, making it intuitive when profits are reliable and consistent.

What counts as a “normal” PE ratio depends heavily on growth expectations and risk levels. Companies with strong earnings growth and stable prospects typically command higher PE multiples, while riskier or slower-growing firms see lower ones. Essentially, the PE ratio reflects not just what a business has earned, but what the market expects it can earn in the future and the confidence investors have in those expectations.

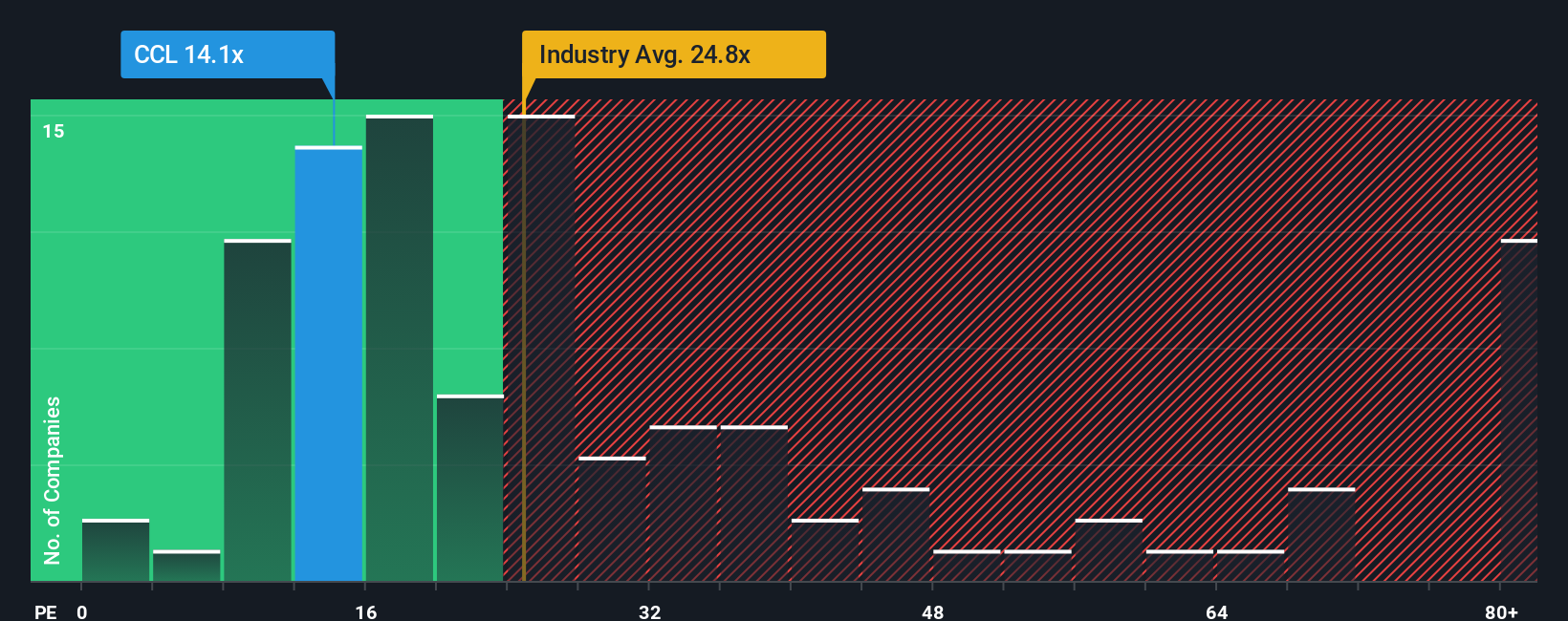

Carnival’s current PE ratio is 14.6x. For context, this sits below both the peer average of 26.1x and the hospitality industry average of 23.9x. On the surface, this could make the stock look attractively priced. However, Simply Wall St’s proprietary “Fair Ratio” provides a deeper perspective. Unlike raw comparisons to peers or broad industry groups, the Fair Ratio is calculated by weighing Carnival’s own growth outlook, risk, margins, industry dynamics, and market cap. This tailored approach aims to pinpoint what a reasonable PE should be for this exact company at this stage in its cycle.

Simply Wall St’s Fair Ratio for Carnival stands at 29.4x, almost exactly double its current PE. Because this comprehensive benchmark incorporates the factors most relevant to Carnival’s real-world prospects, it gives us more useful insight than a peer or sector comparison alone. With Carnival’s actual PE well below its Fair Ratio, the stock appears to be undervalued based on this framework.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carnival Corporation & Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company’s future, combining your insights on where the business is headed with your assumptions for fair value, revenue, earnings, and profit margins. Narratives connect the dots between the company’s real-world story, a financial forecast, and the resulting fair value. This makes it an accessible way for investors of any experience level to sharpen their decisions.

On Simply Wall St, you can use Narratives right on the Community page, joining millions of other investors. With Narratives, you get a flexible tool that clarifies whether today’s price is a bargain or not by comparing the fair value from your Narrative to the current market price. When new news or earnings come out, Narratives update automatically, keeping your perspective and forecast fresh in real time.

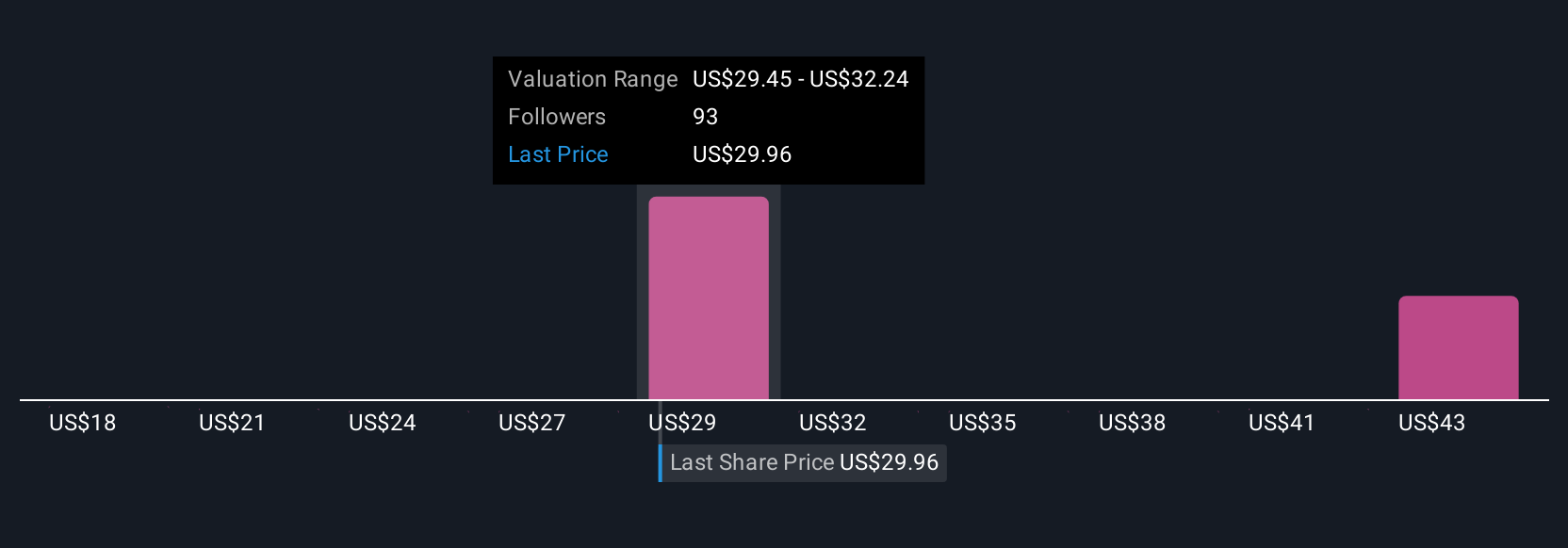

For Carnival Corporation &, for example, some investors see the company’s global expansion and loyalty programs as a path to a fair value above $43 per share. Others take a more cautious perspective, citing debt and competition, and imply a fair value closer to $24. This diversity shows how Narratives help you capture your own view and quickly act when your price aligns with your story.

Do you think there's more to the story for Carnival Corporation &? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives