- United States

- /

- Hospitality

- /

- NYSE:CCL

Carnival (CCL) Is Up 12.6% After Record 2025 Results And Dividend Restart - What's Changed

Reviewed by Sasha Jovanovic

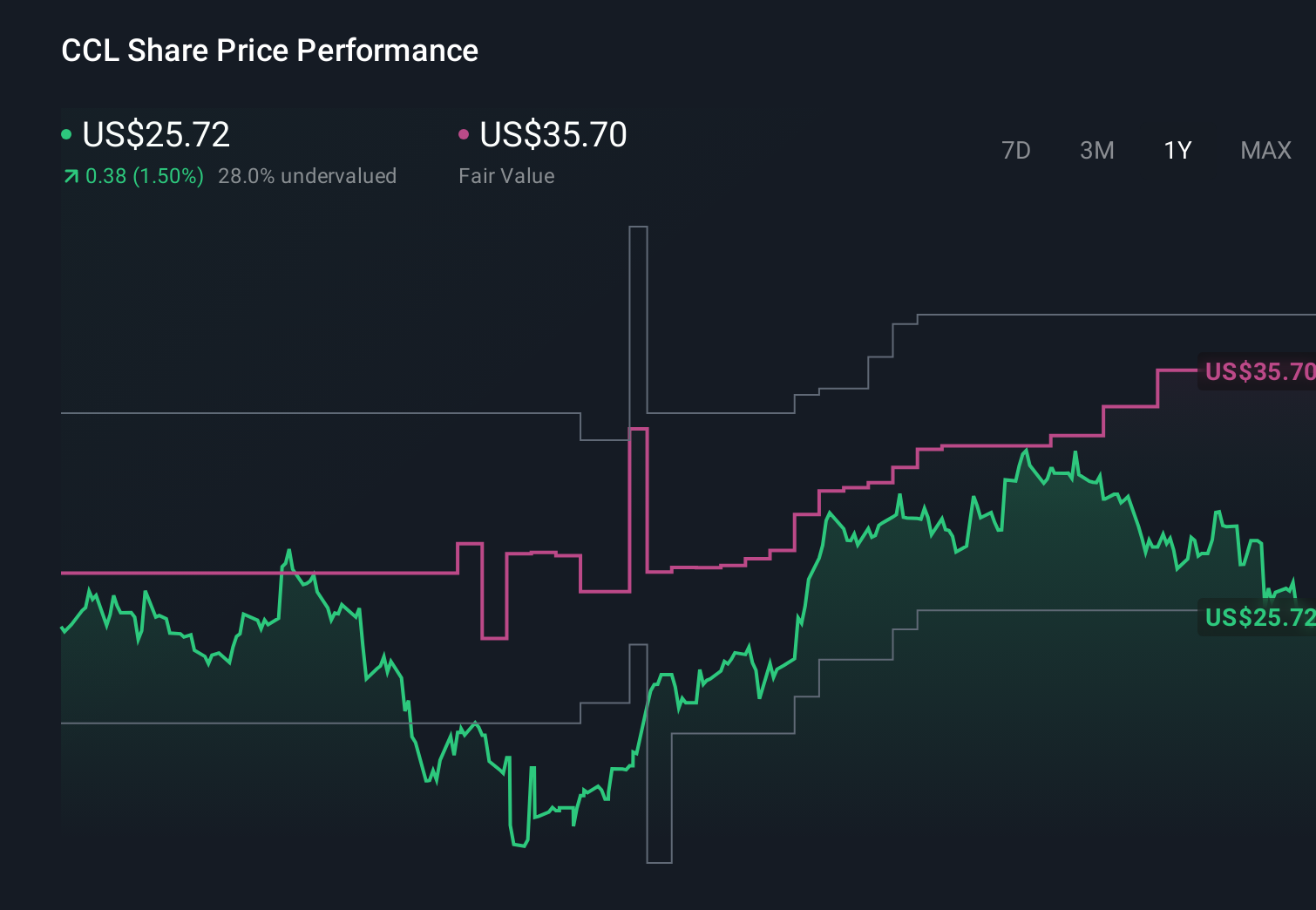

- Carnival Corporation & plc recently reported record full-year 2025 results, with revenue rising to US$26.62 billion and net income reaching US$2.76 billion, and the board approved reinstating a quarterly dividend of US$0.15 per share starting with a February 27, 2026 payment.

- The company also proposed unifying its dual-listed structure into a single Bermuda-incorporated entity listed on the NYSE, aiming to simplify governance, cut administrative costs, and potentially improve share liquidity while preserving shareholder rights.

- We’ll now examine how the dividend reinstatement and record profitability reshape Carnival’s investment narrative and longer-term risk‑reward balance.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Carnival Corporation & Investment Narrative Recap

Carnival’s investment case still rests on resilient global cruise demand, improving margins and steady deleveraging, with record 2025 profits and the US$0.15 quarterly dividend reinforcing that story. In the near term, the key catalyst remains strong pricing and onboard spend, while the biggest risk is that geopolitical shocks or capacity shifts disrupt booking and itinerary plans; the latest results and dividend news do not remove that exposure, but they do underline improved financial flexibility to absorb bumps.

Among the recent announcements, the proposed unification into a single Bermuda incorporated company with a sole NYSE listing stands out, because it directly ties into liquidity and governance, two areas investors often focus on when a business is trying to convert stronger earnings and dividends into a more widely held stock. If approved, the simplified structure could sit alongside the dividend reinstatement as a second pillar supporting Carnival’s near term catalyst of stronger institutional interest and better trading conditions.

Yet despite the good news, investors should be aware that Carnival’s sizeable pandemic era debt load still leaves the company exposed if...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation &'s narrative projects $29.0 billion revenue and $3.7 billion earnings by 2028. This requires 3.8% yearly revenue growth and about a $1.2 billion earnings increase from $2.5 billion today.

Uncover how Carnival Corporation &'s forecasts yield a $35.76 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community span roughly US$24.61 to US$52.84, highlighting just how differently you and other investors might view Carnival’s potential. Set against that spread, the company’s heavy debt and ongoing interest burden remain central to how its improved earnings and new dividend could translate into long term financial resilience.

Explore 11 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 64% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion