- United States

- /

- Hospitality

- /

- NYSE:CAVA

Should Investors Reassess CAVA Group After Shares Fall Over 55% in 2025?

Reviewed by Bailey Pemberton

- Wondering if CAVA Group stock is a hidden bargain or a value trap? You are not alone, as plenty of investors are scratching their heads over the recent price swings and are hungry for some clarity.

- The shares have tumbled sharply lately, dropping 16.8% in just the last week and down a steep 55.1% so far this year, which is getting attention among value-focused investors and risk-watchers alike.

- Market chatter suggests concerns over shifting consumer demand and competition in the fast-casual space have been weighing on CAVA Group, fueling some of the recent volatility. Broader worries about rising costs and industry headwinds are also making their mark in the restaurant sector overall.

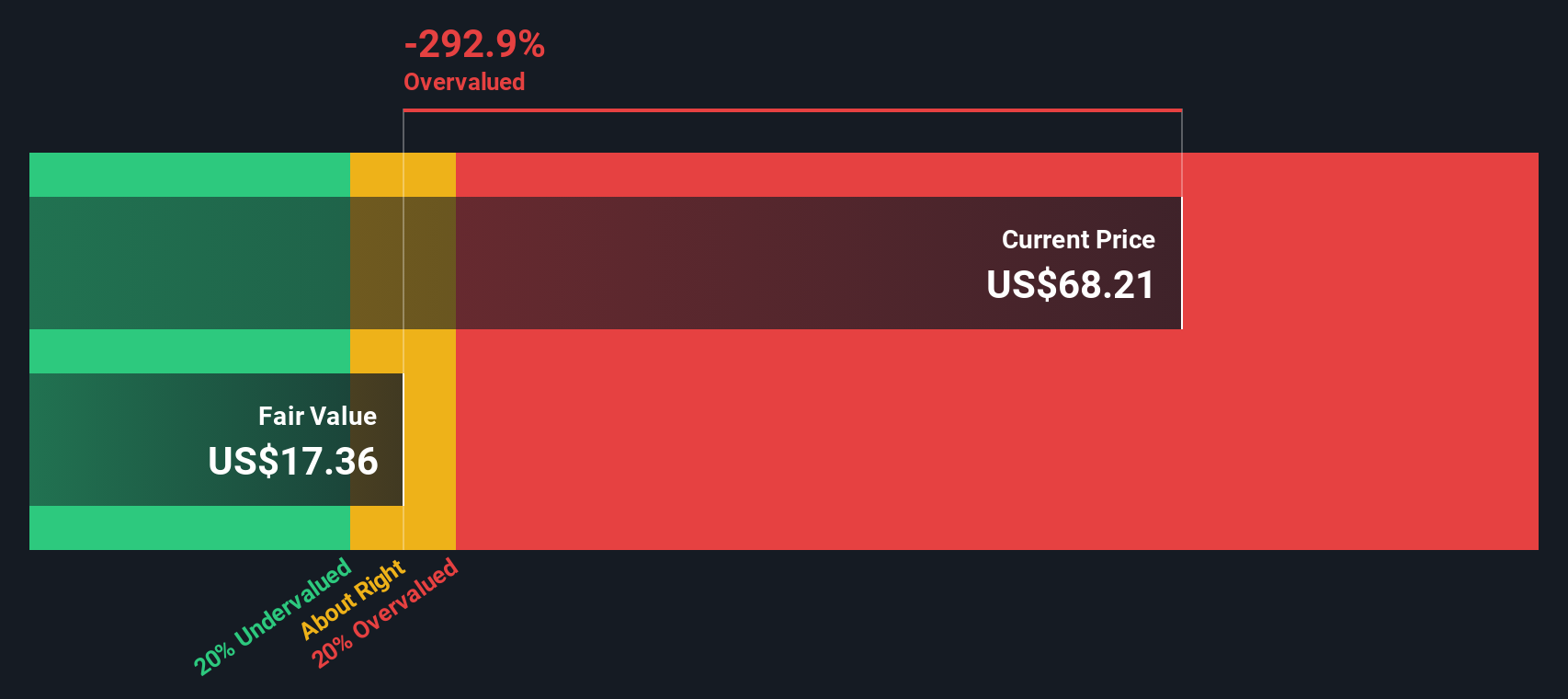

- On our valuation checks, CAVA Group scores a 1 out of 6, signaling limited undervaluation right now, at least by conventional standards. We will dig into the methods behind this score and explore whether there is an even smarter way to spot value, so stick around for a fresh take by the article’s end.

CAVA Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CAVA Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This helps investors determine what the business may truly be worth, based on its expected ability to generate free cash for shareholders over time.

For CAVA Group, current Free Cash Flow stands at $11.45 million. Analyst forecasts extend for the next five years, with projected Free Cash Flow reaching $195.00 million by the end of 2029. Beyond analyst estimates, further FCF growth is extrapolated through later years using reasonable assumptions, following the two-stage Free Cash Flow to Equity approach.

Using this DCF approach, the calculated intrinsic value per share is $38.49. However, the latest share price is about 34.3% higher than this estimated valuation, meaning the stock is currently considered overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CAVA Group may be overvalued by 34.3%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CAVA Group Price vs Earnings (PE Ratio)

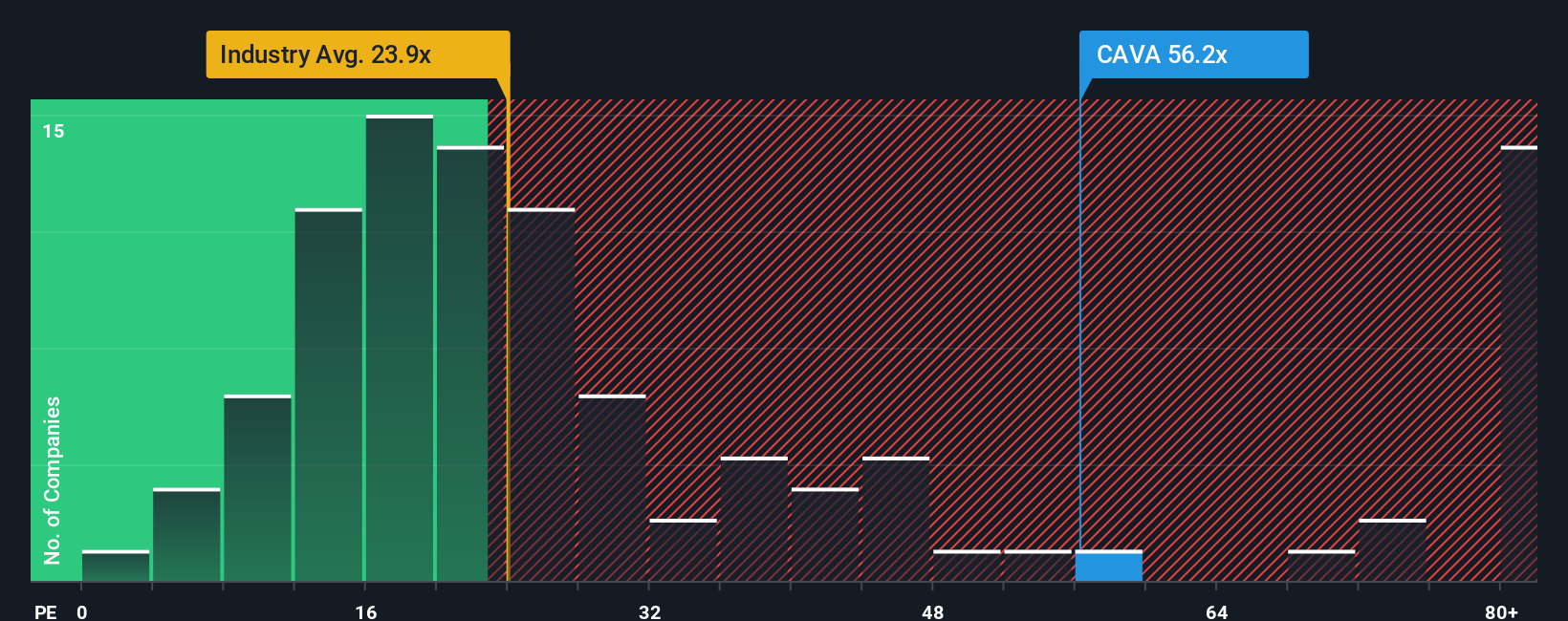

The price-to-earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies since it compares a company’s current share price to its earnings per share. This helps investors gauge whether the stock price reflects its actual earning power, making it a logical starting point for companies with positive profits like CAVA Group.

Growth expectations and risk both play a big part in where a stock’s PE "should" land. High expected earnings growth can justify a higher PE, while greater risks or lower profit margins should push it lower. Comparing against the industry average and direct peers gives some context, but it is not the full picture since every business has its unique strengths and challenges.

CAVA Group currently trades at a PE ratio of 42.6x, which is much higher than the hospitality industry’s average of 23.4x. It is still below the peer average of 65.0x, reflecting its strong growth profile but also some caution in its valuation. Simply Wall St’s proprietary “Fair Ratio” for CAVA Group stands at 20.6x. This Fair Ratio is calculated using factors like expected earnings growth, profit margins, risk profile, industry position, and market capitalization, offering a more tailored view than industry or peer averages alone.

Comparing the actual PE ratio (42.6x) to the Fair Ratio (20.6x), CAVA Group’s stock appears quite expensive using this earnings yardstick.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CAVA Group Narrative

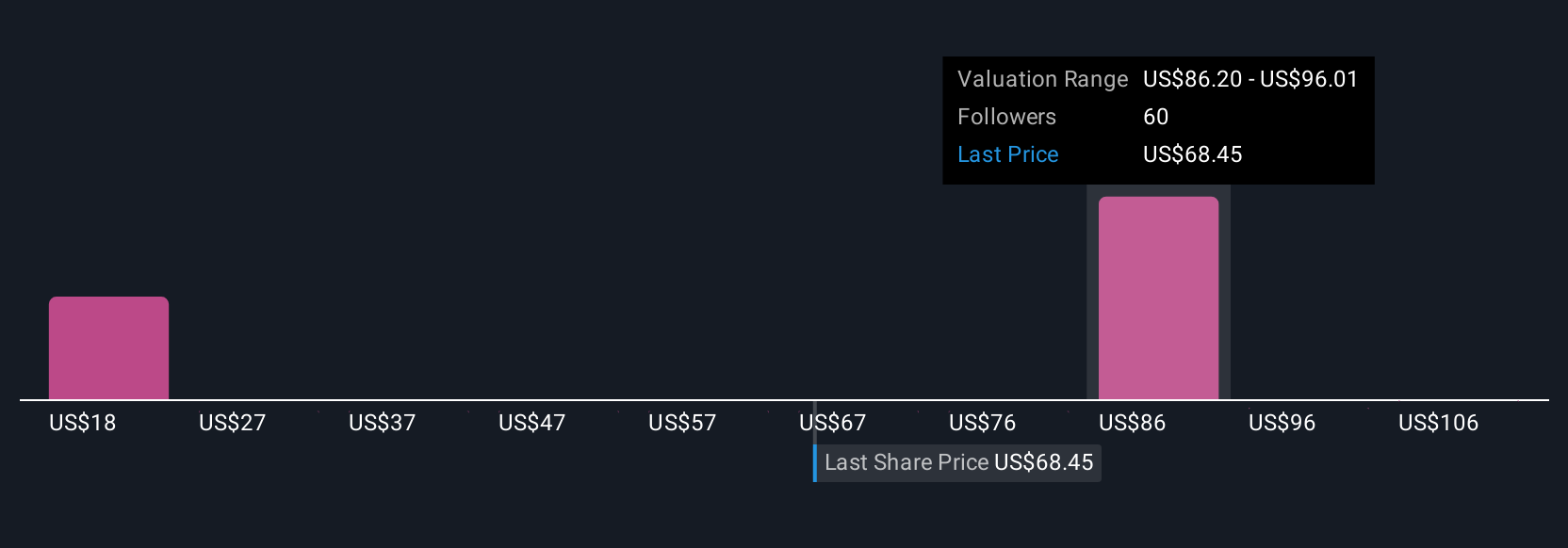

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative, in investing, is your story for a company, a personal perspective on its future that goes beyond raw numbers. Narratives let you connect what you know or believe about a business, such as growth drivers or challenges, to a set of financial forecasts like revenue, earnings, and margins, and from there to a fair value estimate.

These Narratives are not complicated or reserved for experts. In fact, they are easy to create and update using Simply Wall St’s platform, where millions of investors share their stories on the Community page. Narratives show you what assumptions are baked into fair value calculations and give you clear signals to buy or sell by comparing that Fair Value to today’s Price.

What makes Narratives powerful is their dynamic nature. The assumptions and fair value estimates update automatically as new news or company results come in, ensuring your decisions are always based on the latest information. For example, some investors believe CAVA’s technology adoption and rapid expansion justify price targets as high as $125 per share, while others, wary of rising costs and market risks, see a fair value as low as $72. By exploring these different Narratives, you can adopt, adapt, or create your own investment view in minutes.

Do you think there's more to the story for CAVA Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives