- United States

- /

- Hospitality

- /

- NYSE:CAVA

Can CAVA Group’s (CAVA) New Lifestyle Push Strengthen Its Brand Loyalty and Market Position?

Reviewed by Sasha Jovanovic

- CAVA Group recently opened its first ever online merchandise store, The CAVA Shop, offering apparel and accessories themed around its signature Mediterranean flavors and fan favorites.

- This move expands the company's brand presence beyond food and into lifestyle products, aiming to deepen engagement with its most loyal customer base.

- We'll explore how the merchandise launch and shifting investor confidence could impact CAVA Group's longer-term growth and market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CAVA Group Investment Narrative Recap

Owning shares of CAVA Group means believing in the long-term expansion potential of Mediterranean fast-casual dining, underpinned by ongoing geographic growth and brand loyalty. While the launch of The CAVA Shop may foster deeper customer engagement and diversify revenue streams, it does not materially address the company's most immediate catalyst, same-restaurant sales growth, or its largest current risk, which remains declining investor confidence following weaker earnings and reduced growth guidance.

Among recent company announcements, the plan to open 68 to 70 new restaurants in 2025 aligns more directly with CAVA’s core growth narrative. This expansion remains pivotal, especially given recent concerns about the sustainability of same-restaurant sales growth and the potential for brand fatigue in established markets as CAVA rapidly increases its footprint.

Yet for investors, it is equally important to consider how overreliance on the Mediterranean-focused menu may expose CAVA to...

Read the full narrative on CAVA Group (it's free!)

CAVA Group's outlook projects $1.9 billion in revenue and $126.2 million in earnings by 2028. This is based on a 20.4% annual revenue growth rate, but earnings are expected to decline by $14.5 million from the current $140.7 million.

Uncover how CAVA Group's forecasts yield a $67.89 fair value, a 49% upside to its current price.

Exploring Other Perspectives

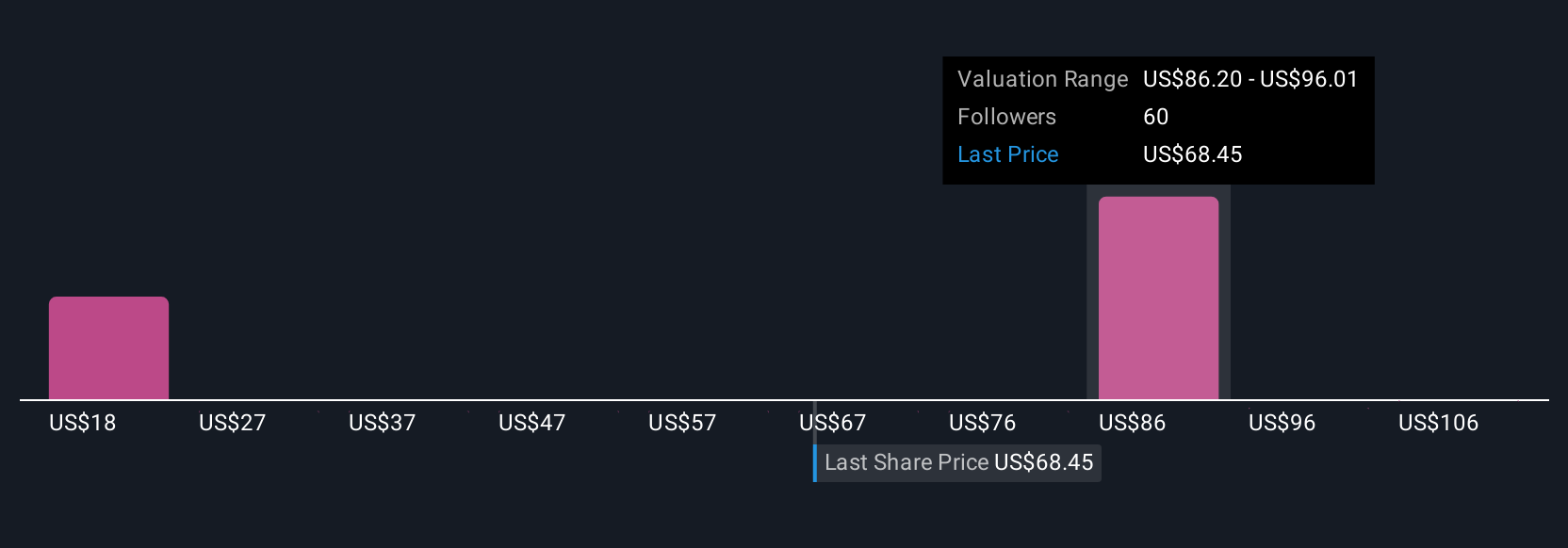

Simply Wall St Community members have posted 12 fair value estimates for CAVA ranging from US$38.45 to US$118.75 per share. As you assess these varying perspectives, keep in mind that aggressive expansion plans could heighten operational risks and impact long-term profitability, shaping differing views on potential outcomes.

Explore 12 other fair value estimates on CAVA Group - why the stock might be worth over 2x more than the current price!

Build Your Own CAVA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CAVA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CAVA Group's overall financial health at a glance.

No Opportunity In CAVA Group?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives