- United States

- /

- Hospitality

- /

- NYSE:BRSL

Did Brightstar Lottery's (BRSL) Avanti Deal Just Shift Its Global Growth Narrative?

Reviewed by Sasha Jovanovic

- On October 22, 2025, Brightstar Lottery PLC announced a five-year exclusive licensing agreement with Avanti Licensing Inc. to create and distribute omnichannel lottery games based on Avanti's humorous greeting cards worldwide.

- This collaboration introduces a new intersection of humor and gaming, tapping into Avanti's established brand to potentially broaden Brightstar's global reach and audience engagement.

- We'll explore how expanding into branded, humor-driven lottery products could impact Brightstar Lottery's growth outlook and investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Brightstar Lottery Investment Narrative Recap

For shareholders in Brightstar Lottery, the core investment thesis is rooted in the company’s ability to capture digital lottery growth while managing its heavy reliance on large jackpot cycles, with regulatory risks in Italy and other key markets always top of mind. The recent Avanti Licensing deal adds a new dimension to the product mix; however, its impact on earnings volatility tied to mega-jackpot cycles appears limited in the near term, as the biggest catalyst remains sustained digital adoption and contract renewals, while the risk from jackpot unpredictability persists.

Brightstar’s recent sale of its Gaming & Digital business and the return of approximately $1.1 billion to shareholders is the most relevant prior announcement given its potential to reshape the company’s capital base and strategic focus. This transaction provided a special dividend and a buyback, highlighting management's efforts to enhance shareholder returns, though the outcome will depend on success in expanding digital and branded lottery offerings, like the Avanti partnership, to offset ongoing volatility in core markets.

By contrast, one risk investors should keep in mind is the unpredictability of revenues driven by the irregular occurrence of very large jackpots, especially since…

Read the full narrative on Brightstar Lottery (it's free!)

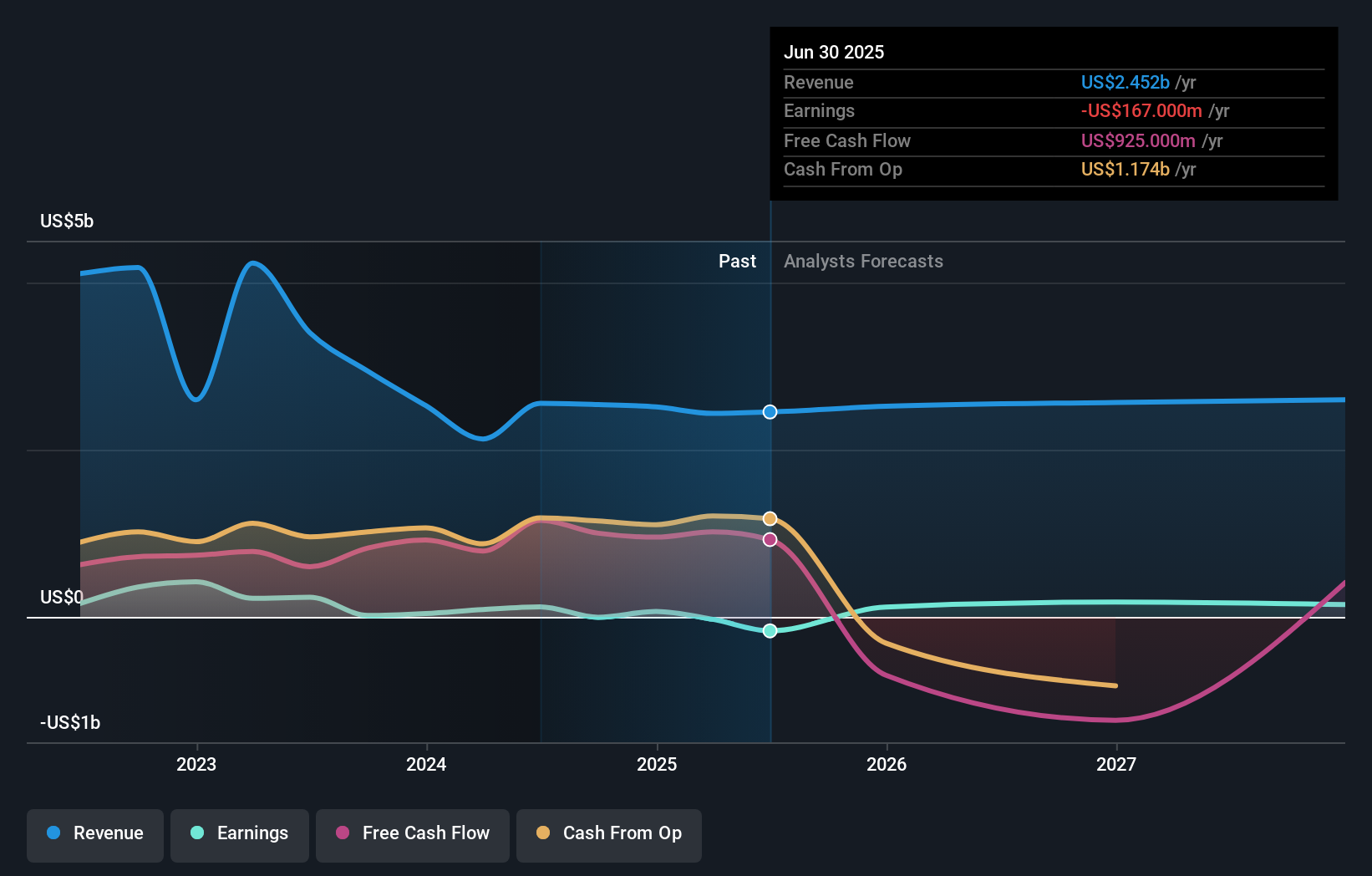

Brightstar Lottery's narrative projects $2.6 billion in revenue and $295.9 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $462.9 million earnings increase from current earnings of -$167.0 million.

Uncover how Brightstar Lottery's forecasts yield a $18.52 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Brightstar Lottery range from US$6.09 to US$18.52, based on 2 member perspectives. With broad fair value opinions, the ongoing dependence on episodic mega-jackpots continues to challenge revenue stability and keeps investor focus sharply divided.

Explore 2 other fair value estimates on Brightstar Lottery - why the stock might be worth as much as 11% more than the current price!

Build Your Own Brightstar Lottery Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brightstar Lottery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brightstar Lottery's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightstar Lottery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRSL

Brightstar Lottery

Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives