Last Update 22 Nov 25

BRSL: Future Jackpot Activity Will Drive Next Phase Of Share Upside

Analysts have increased their price target for Brightstar Lottery from $18 to $22 per share, citing recent jackpot-driven upside and accelerating organic growth as key factors behind the upward revision.

Analyst Commentary

Bullish Takeaways- Recent jackpot activity, particularly from Powerball and Mega Millions, is driving near-term revenue upside and supporting higher estimates for the upcoming quarter.

- Multiple growth vectors are cited as contributing to an impending inflection point in organic growth, which signals potential for sustained momentum.

- Ongoing investor engagement with company management has increased confidence in the trajectory of both revenue growth and margin expansion.

- Upside to the valuation is supported by normalization of jackpot levels, which analysts expect will foster a positive re-rating of the company’s shares.

What's in the News

- Signed a two-year contract extension with the Texas Department of Licensing and Regulation, solidifying Brightstar's role as technology provider for the Texas Lottery through August 2028 (Client Announcements).

- Declared a 10% increase in the quarterly cash dividend to $0.22 per common share. Payment is scheduled for December 2, 2025 (Dividend Increases).

- Reaffirmed fiscal year 2025 revenue guidance at approximately $2.5 billion. Projected 2028 revenue is $2.75 billion, reflecting over 5% organic CAGR driven by U.S. and Italy iLottery expansion (Corporate Guidance, New/Confirmed).

- Announced an exclusive five-year global licensing agreement with Avanti Licensing Inc. to develop lottery games inspired by Avanti's humorous greeting cards (Client Announcements).

Valuation Changes

- The discount rate has risen slightly, moving from 12.96% to 13.11%, reflecting a modest increase in perceived risk.

- Revenue growth assumptions have been revised lower, decreasing from 1.38% to 1.24% for forward projections.

- Net profit margin has increased from 10.94% to 12.02%, indicating expectations of stronger profitability in coming years.

- The future P/E ratio has fallen from 15.27x to 14.02x, suggesting a more attractive valuation given the updated earnings outlook.

- The fair value estimate remains unchanged at $19.07 per share, despite adjustments to other key metrics.

Key Takeaways

- Expansion of digital channels and contract renewals are providing stable, long-term revenue growth and higher-margin opportunities.

- Investments in technology, cost-cutting, and product innovation enhance customer engagement, reduce expenses, and strengthen recurring revenues.

- Regulatory risks, earnings volatility, geographic concentration, rising competition, and high contract costs threaten revenue stability, margin growth, and financial flexibility.

Catalysts

About Brightstar Lottery- Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

- Accelerating digital adoption and smartphone penetration are driving double-digit growth in iLottery wagers globally (over 30% growth cited), with Italy and US adoption rates outpacing the overall market-likely supporting higher future revenue growth and improving the business mix toward higher-margin digital channels.

- Regulatory liberalization and successful contract renewals (notably Italy Lotto secured through 2034 and new/extended deals in Missouri, Portugal, and France) are expanding the addressable market and extending Brightstar's average revenue-weighted contract life to 7 years, thus providing long-term revenue stability and enhanced cash flow visibility.

- Ongoing investment in proprietary digital platforms (including the MYLOTTERIES app and integrated OMNIA solution) is reducing customer acquisition costs while bolstering direct-to-consumer engagement, suggesting further net margin expansion as platform scale and technology investments pay off.

- Implementation and expansion of structural cost-cutting initiatives (OPtiMa 3.0) are expected to drive $50 million in annualized savings by 2026 (60% realized this year), helping to offset temporary profit headwinds and support a rebound to normalized EBITDA and free cash flow, directly benefiting earnings in the coming years.

- Secular trends toward gamification and instant play, combined with innovation in ticket technology (Gleam, Infinity Instants) and expanded instant ticket printing capacity (running 25% above last year's output), position Brightstar to capture sustained demand and cross-selling opportunities, increasing both recurring revenues and customer lifetime value.

Brightstar Lottery Future Earnings and Revenue Growth

Assumptions

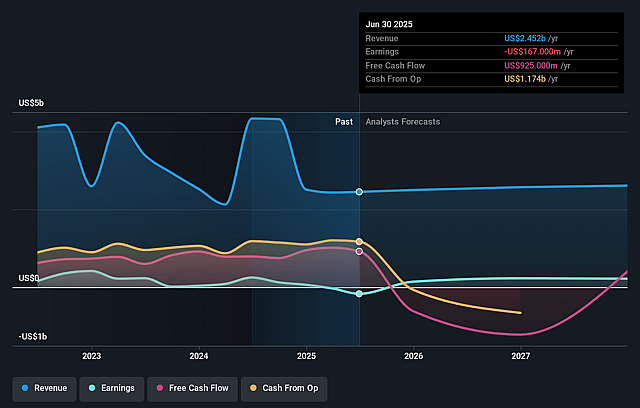

How have these above catalysts been quantified?- Analysts are assuming Brightstar Lottery's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.8% today to 11.2% in 3 years time.

- Analysts expect earnings to reach $295.9 million (and earnings per share of $0.87) by about September 2028, up from $-167.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.5x on those 2028 earnings, up from -18.5x today. This future PE is lower than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.28%, as per the Simply Wall St company report.

Brightstar Lottery Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and possible tightening of gambling regulations or tax changes in key markets (such as the U.S., Italy, or emerging international markets) could limit growth opportunities, heighten compliance costs, or reduce overall profitability, negatively impacting revenue and net margins.

- Heavy reliance on extremely large, sporadic multistate jackpots for windfall periods of higher revenue creates ongoing earnings volatility and uncertainty, as periods without such jackpots have already shown EBITDA compression and weaker momentum in top line growth and profit, affecting both revenue and earnings stability.

- Geographic concentration risk remains, as Italy is described repeatedly as the company's most important market and a major profit driver; any adverse regulatory, economic, or competitive changes in Italy could significantly disrupt the company's revenue streams and earnings consistency.

- The lottery sector faces intensifying competition from both new digital entrants (including private operators and government-backed platforms) and alternative entertainment options (like digital gaming and esports), which may erode Brightstar's market share, create pricing pressures, and stagnate or reduce ticket sales, impacting long-term revenue growth and net margins.

- The high upfront capital requirements and ongoing amortization costs of securing long-term operator contracts (as seen with the Italy Lotto license) may pressure cash flows and constrain financial flexibility; if growth or margin expansion does not offset these significant obligations, free cash flow and profitability could be negatively affected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.517 for Brightstar Lottery based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $12.52.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $295.9 million, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 13.3%.

- Given the current share price of $16.29, the analyst price target of $18.52 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.