- United States

- /

- Hospitality

- /

- NYSE:BROS

Dutch Bros (BROS): Rethinking Valuation After Strong Q3 Growth, Analyst Upgrades, and Expansion Momentum

Reviewed by Simply Wall St

Dutch Bros (BROS) has been getting fresh attention after a strong third quarter, with higher same shop sales, upbeat 2025 guidance, and growing momentum from its Order Ahead app and store expansion.

See our latest analysis for Dutch Bros.

Those upbeat numbers and steady shop openings have helped Dutch Bros regain some ground, with an 8.1% year to date share price return and a punchy 87.4% three year total shareholder return suggesting momentum is building again.

If this kind of growth story has your attention, it is worth broadening your search to discover fast growing stocks with high insider ownership.

With analysts lifting price targets and growth humming along, investors now have to ask whether Dutch Bros shares still trade below their caffeine fueled potential, or if the market has already fully priced in the next leg of expansion.

Most Popular Narrative Narrative: 19.5% Undervalued

With Dutch Bros last closing at $60.89 against a narrative fair value of $75.61, the story centers on whether rapid growth can sustain a premium earnings multiple.

The analysts have a consensus price target of $82.625 for Dutch Bros based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $73.0.

Want to see how fast revenue, rising margins, and a lofty future earnings multiple all fit together, and what kind of long term shop rollout that assumes?

Result: Fair Value of $75.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and the risk of overextending store growth could pressure margins and same shop sales, which may challenge the current undervaluation story.

Find out about the key risks to this Dutch Bros narrative.

Another Angle on Valuation

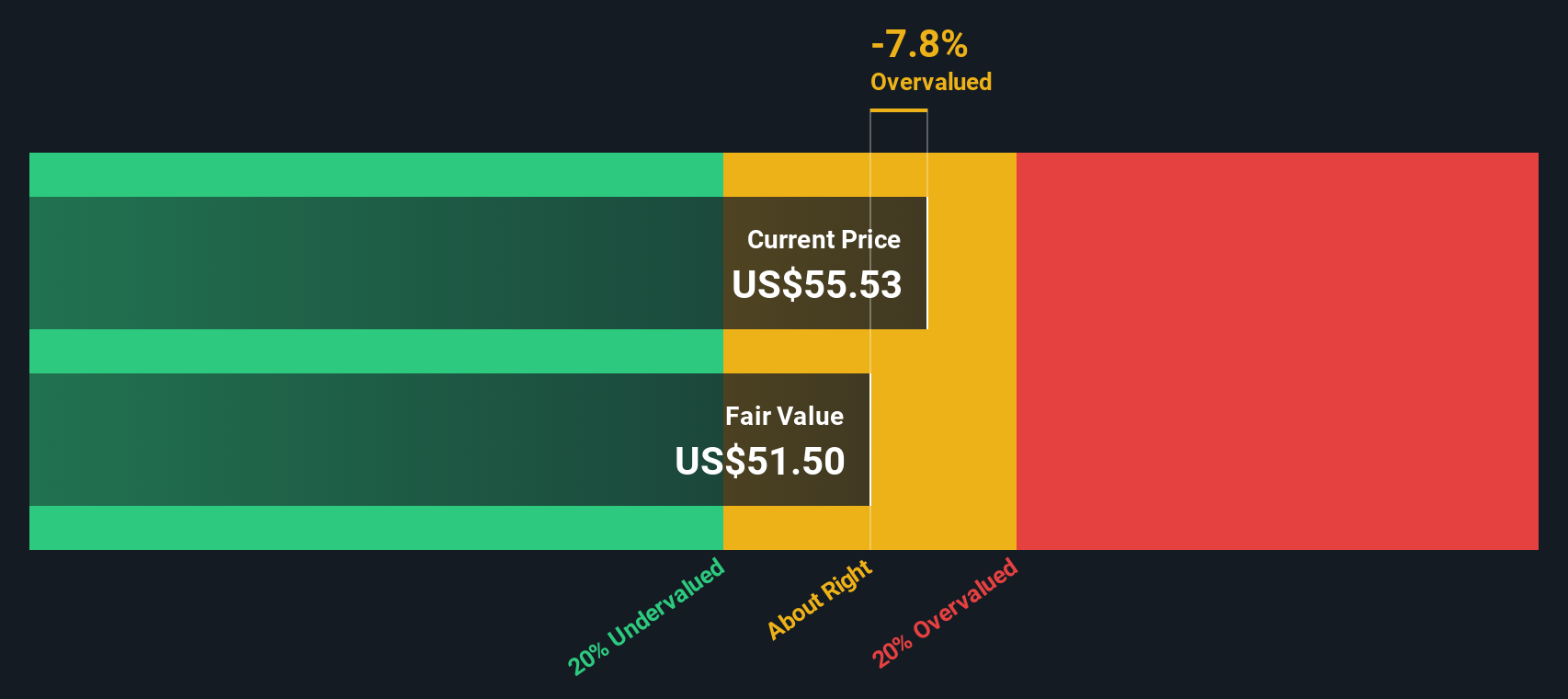

Our SWS DCF model paints a different picture, suggesting Dutch Bros is overvalued at $60.89 versus a fair value of $47.35. That implies the optimistic growth story may already be more than priced in, so what happens if execution or sentiment slips?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dutch Bros Narrative

If you see the numbers differently or prefer to dive into the details yourself, you can build a custom Dutch Bros view in just minutes: Do it your way.

A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart investing angle?

Before you move on, consider your next move with fresh ideas from the Simply Wall Street Screener so you are not leaving potential returns on the table.

- Capture early stage potential by targeting these 3575 penny stocks with strong financials that already show robust balance sheets and improving fundamentals.

- Ride powerful technology trends by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that combine reliable payouts with room for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026