- United States

- /

- Hospitality

- /

- NYSE:BROS

Dutch Bros (BROS): Exploring Valuation Following Upbeat Q3 Earnings and Raised Full-Year Outlook

Reviewed by Kshitija Bhandaru

Dutch Bros (BROS) delivered an upbeat third-quarter earnings report, outpacing expectations due to better same-shop transaction growth. The company also lifted its full-year revenue and EBITDA guidance, which drew increased attention from investors.

See our latest analysis for Dutch Bros.

Momentum is building for Dutch Bros as the company accelerates its store openings and continues to expand into new states, attracting positive attention from analysts and commentators. The recent string of upbeat company developments has fueled a strong 1-year total shareholder return of nearly 57%, even as share price remains well above last year’s levels. This shows broad enthusiasm for Dutch Bros’ long-term growth story.

If recent growth moves from Dutch Bros have your attention, this could be the perfect time to widen your search and discover fast growing stocks with high insider ownership

With shares rallying and fresh analyst endorsements piling up, the question remains whether Dutch Bros is still undervalued in light of recent growth or if investors have already priced in its ambitious expansion. Is there still a real buying opportunity here, or is future potential already reflected in the stock’s premium valuation?

Most Popular Narrative: 32.7% Undervalued

According to the most widely followed narrative, Dutch Bros' fair value, calculated at $81.59, stands notably higher than the recent closing price of $54.91. This gap highlights bold expectations for ongoing expansion, even as the analyst consensus builds around upbeat revenue forecasts and an aggressive store rollout plan.

"Dutch Bros' aggressive expansion into high-growth, suburban, and Sun Belt markets leverages ongoing U.S. population shifts and urban sprawl, positioning the company to drive sustained unit growth and higher average unit volumes (AUVs), positively impacting long-term revenue growth. The company's drive-thru only model and continued focus on speed, convenience, and throughput improvement capitalize on accelerating consumer demand for off-premise, convenient beverage solutions, supporting higher transaction volumes and boosting same-store sales and operating margins over time."

Want to unravel the optimistic math behind Dutch Bros’ high target price? Underneath the valuation lies a set of ambitious growth assumptions and a future profit model that breaks the mold for this sector. Curiosity piqued? Discover which financial forecasts and competitive shifts are driving this lively debate over the company’s true worth.

Result: Fair Value of $81.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained wage pressure or slower-than-hoped sales growth could challenge Dutch Bros’ ambitious expansion story and test the strength of current optimism.

Find out about the key risks to this Dutch Bros narrative.

Another View: What Do Market Multiples Say?

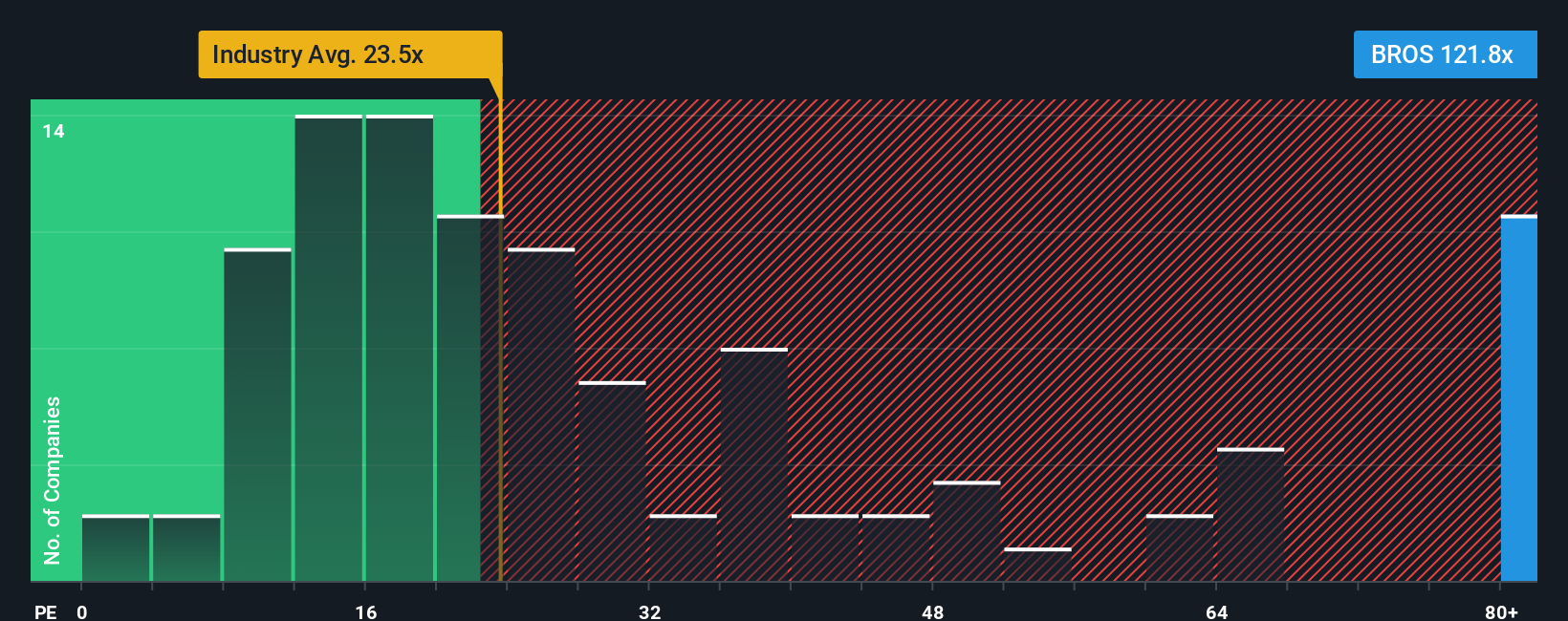

While the widely followed narrative pegs Dutch Bros as undervalued based on growth and earnings forecasts, a closer look at its current price-to-earnings ratio tells a different story. Dutch Bros trades at about 122 times earnings, significantly higher than the US Hospitality industry average of 23.5 and the peer average of 37.2. The estimated fair ratio is just 35.8, highlighting how far market optimism has pushed the stock above most comparables. Does this premium price suggest real risk for new buyers, or lasting conviction from believers in long-term growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If these analyses spark your curiosity, you can dive into the data and develop your own perspective in just a few minutes. Do it your way

A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let standout opportunities pass you by. Put yourself in front of the stocks making headlines in tomorrow’s markets. Make your next smart move now with these fresh ideas:

- Unlock steady income by checking out these 18 dividend stocks with yields > 3% offering compelling yields and reliable returns beyond the usual suspects.

- Spot emerging innovation when you tap into these 24 AI penny stocks, highlighting companies at the forefront of artificial intelligence breakthroughs and future-ready growth.

- Seize value plays before the crowd by analyzing these 878 undervalued stocks based on cash flows, packed with stocks showing serious potential based on robust cash flows and market mispricings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives