- United States

- /

- Consumer Services

- /

- NYSE:BEDU

Revenues Working Against Bright Scholar Education Holdings Limited's (NYSE:BEDU) Share Price Following 25% Dive

Bright Scholar Education Holdings Limited (NYSE:BEDU) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 2.7% in the last year.

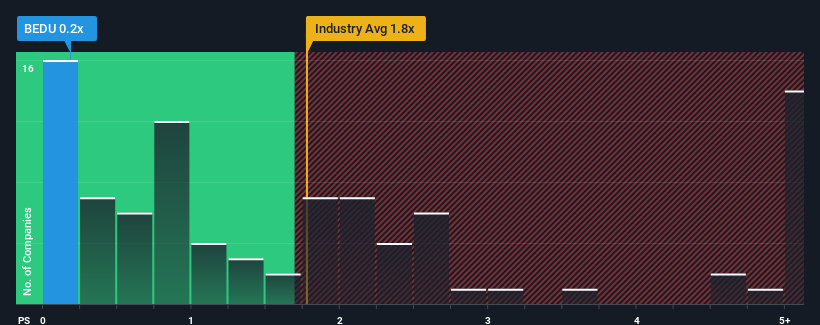

Following the heavy fall in price, considering around half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.8x, you may consider Bright Scholar Education Holdings as an solid investment opportunity with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Bright Scholar Education Holdings

How Bright Scholar Education Holdings Has Been Performing

For example, consider that Bright Scholar Education Holdings' financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Bright Scholar Education Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bright Scholar Education Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Bright Scholar Education Holdings' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 25% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Bright Scholar Education Holdings' P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From Bright Scholar Education Holdings' P/S?

Bright Scholar Education Holdings' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Bright Scholar Education Holdings maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Bright Scholar Education Holdings (including 1 which shouldn't be ignored).

If these risks are making you reconsider your opinion on Bright Scholar Education Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bright Scholar Education Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BEDU

Bright Scholar Education Holdings

An education service provider, operates and provides K-12 schools and complementary education services in China, the United Kingdom, Hong Kong, the United States, and Canada.

Good value with adequate balance sheet.