- United States

- /

- Consumer Services

- /

- NYSE:BEDU

Is Bright Scholar Education Holdings Limited (NYSE:BEDU) A Great Dividend Stock?

Today we'll take a closer look at Bright Scholar Education Holdings Limited (NYSE:BEDU) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

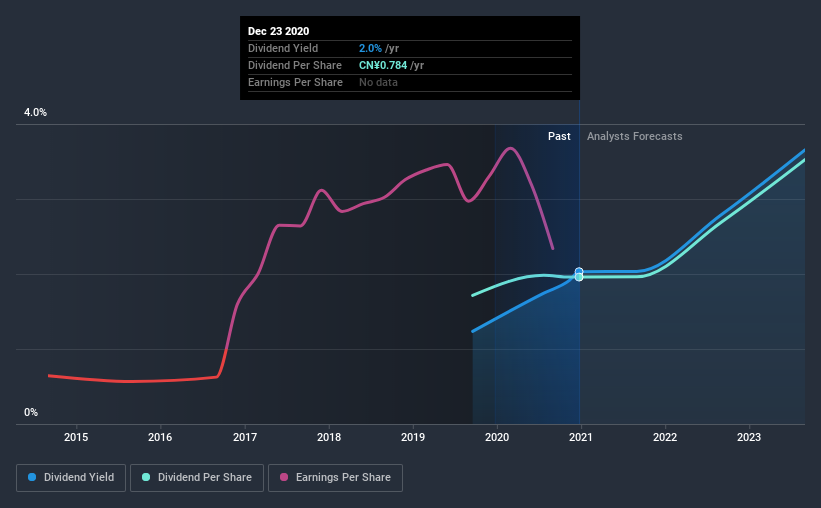

Some readers mightn't know much about Bright Scholar Education Holdings's 2.0% dividend, as it has only been paying distributions for a year or so. The company also bought back stock during the year, equivalent to approximately 8.9% of the company's market capitalisation at the time. There are a few simple ways to reduce the risks of buying Bright Scholar Education Holdings for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 61% of Bright Scholar Education Holdings' profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

While the above analysis focuses on dividends relative to a company's earnings, we do note Bright Scholar Education Holdings' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Bright Scholar Education Holdings' financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time.

Bright Scholar Education Holdings has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Bright Scholar Education Holdings has grown its earnings per share at 28% per annum over the past five years. With recent, rapid earnings per share growth and a payout ratio of 61%, this business looks like an interesting prospect if earnings are reinvested effectively.

Conclusion

To summarise, shareholders should always check that Bright Scholar Education Holdings' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Bright Scholar Education Holdings' payout ratio is within an average range for most market participants. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Bright Scholar Education Holdings has a credible record on several fronts, but falls slightly short of our standards for a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for Bright Scholar Education Holdings (of which 1 is concerning!) you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading Bright Scholar Education Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bright Scholar Education Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BEDU

Bright Scholar Education Holdings

An education service provider, operates and provides K-12 schools and complementary education services in China, the United Kingdom, Hong Kong, the United States, and Canada.

Good value with adequate balance sheet.