- United States

- /

- Consumer Services

- /

- NYSE:BEDU

Bright Scholar Education Holdings' (NYSE:BEDU) Stock Price Has Reduced 72% In The Past Three Years

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Bright Scholar Education Holdings Limited (NYSE:BEDU), who have seen the share price tank a massive 72% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 34% lower in that time. There was little comfort for shareholders in the last week as the price declined a further 2.0%.

See our latest analysis for Bright Scholar Education Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

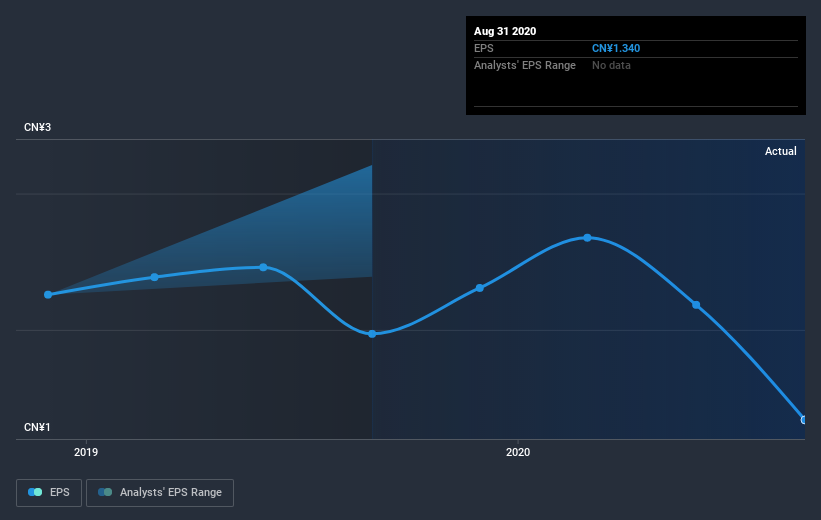

During the three years that the share price fell, Bright Scholar Education Holdings' earnings per share (EPS) dropped by 6.5% each year. The share price decline of 34% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Bright Scholar Education Holdings' earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Bright Scholar Education Holdings shares, which cost holders 33%, including dividends, while the market was up about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 20% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It's always interesting to track share price performance over the longer term. But to understand Bright Scholar Education Holdings better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Bright Scholar Education Holdings you should be aware of, and 1 of them shouldn't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Bright Scholar Education Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bright Scholar Education Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BEDU

Bright Scholar Education Holdings

An education service provider, operates and provides K-12 schools and complementary education services in China, the United Kingdom, Hong Kong, the United States, and Canada.

Adequate balance sheet low.

Market Insights

Community Narratives