- United States

- /

- Consumer Services

- /

- NYSE:BEDU

Bright Scholar Education Holdings (NYSE:BEDU) Has Announced A Dividend Of US$0.11

The board of Bright Scholar Education Holdings Limited (NYSE:BEDU) has announced that it will pay a dividend of US$0.11 per share on the 16th of August. This makes the dividend yield 2.9%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Bright Scholar Education Holdings' stock price has reduced by 36% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

See our latest analysis for Bright Scholar Education Holdings

Bright Scholar Education Holdings' Earnings Easily Cover the Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. The last dividend was quite easily covered by Bright Scholar Education Holdings' earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, earnings per share could rise by 8.5% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 7.4% by next year, which we think can be pretty sustainable going forward.

Bright Scholar Education Holdings Doesn't Have A Long Payment History

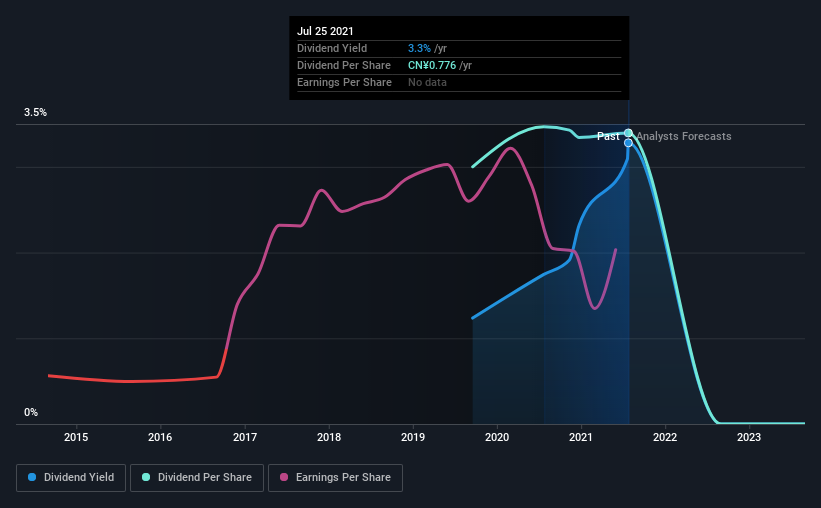

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The dividend has gone from CN¥0.69 in 2019 to the most recent annual payment of CN¥0.78. This works out to be a compound annual growth rate (CAGR) of approximately 6.4% a year over that time. Bright Scholar Education Holdings has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

The Dividend Has Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see Bright Scholar Education Holdings has been growing its earnings per share at 8.5% a year over the past five years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

We Really Like Bright Scholar Education Holdings' Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for Bright Scholar Education Holdings you should be aware of, and 1 of them is a bit concerning. We have also put together a list of global stocks with a solid dividend.

When trading Bright Scholar Education Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bright Scholar Education Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BEDU

Bright Scholar Education Holdings

An education service provider, operates and provides K-12 schools and complementary education services in China, the United Kingdom, Hong Kong, the United States, and Canada.

Good value with adequate balance sheet.