- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Double-Digit Net Income Growth Could Be a Game Changer for Adtalem Global Education (ATGE)

Reviewed by Sasha Jovanovic

- In recent months, Adtalem Global Education has reported double-digit net income growth and attracted investor interest amid analysis suggesting its shares may be undervalued based on discounted cash flow models.

- Even as analysts point to potential slowing revenue growth and questions about capital efficiency, the company’s strong recent performance continues to generate positive sentiment among market participants.

- We’ll examine how Adtalem’s strong net income growth shapes its investment narrative alongside debate over long-term growth potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Adtalem Global Education's Investment Narrative?

To see potential in Adtalem Global Education as a shareholder, you need to buy into the story of sustained profit growth rooted in healthcare-focused education demand, cost controls, and management’s willingness to invest in returns for shareholders, with share buybacks and fresh leadership appointments as signals. The latest news of strong one-year and multi-year total returns, alongside suggestions of undervaluation from discounted cash flow analysis, serves as a short-term catalyst, fueling fresh momentum. However, the evolving narrative is not without caveats: analysts now expect slower revenue growth ahead, and there are still questions about capital efficiency, getting more attention as the stock price rises. The company's price-to-earnings ratio remains higher than sector averages, and recent insider selling means investors should stay alert. Overall, this news cycle raises the stakes on execution but doesn’t fundamentally alter the company’s principal risks or key drivers.

On the other hand, the company’s lower return on equity compared to industry peers is something investors should be mindful of.

Exploring Other Perspectives

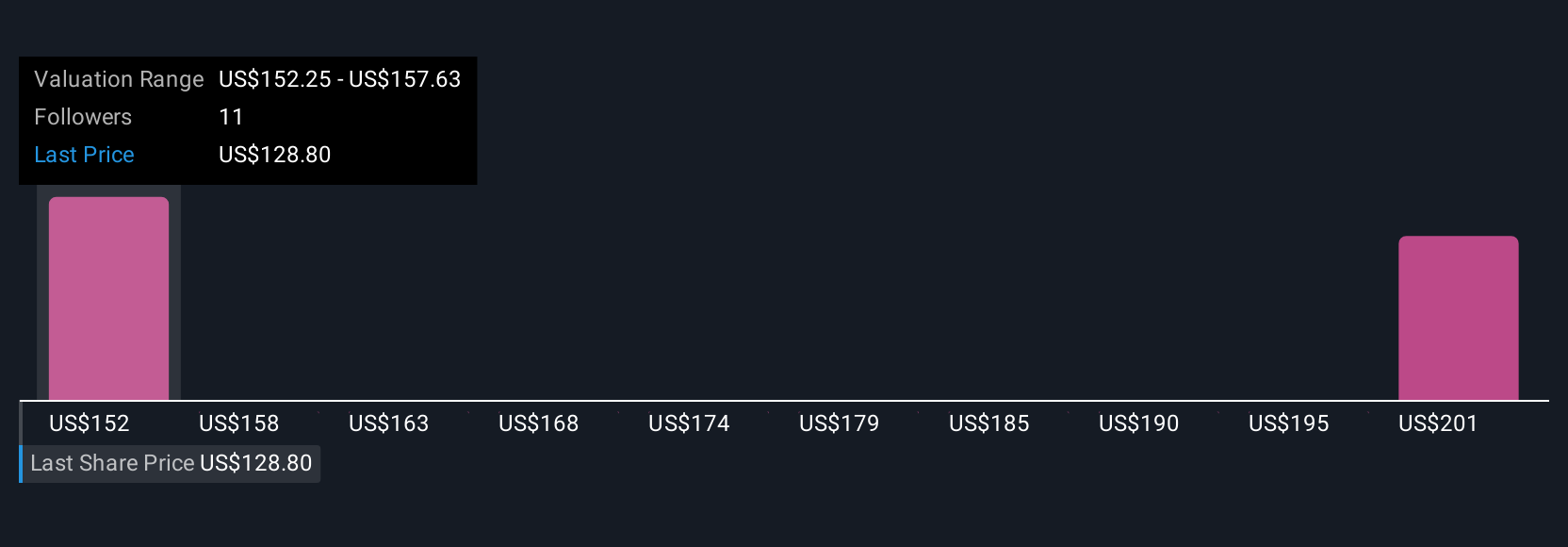

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth just $160.25!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Solid track record and fair value.

Market Insights

Community Narratives