- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Adtalem Global Education (ATGE): Assessing Valuation After Recent 10% Share Price Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for Adtalem Global Education.

This latest lift in Adtalem Global Education’s share price builds on a gradual but real trend over the past year, as sentiment turns more constructive. While the 1-month share price return is up over 10% and the year-to-date return sits just above 60%, it is the 1-year total shareholder return of 104% that really stands out. This signals momentum might be picking up for the long haul.

Curious to see what else is showing strength? Consider expanding your search to discover fast growing stocks with high insider ownership

But after a remarkable run, is Adtalem’s valuation still attractive or might investors be getting ahead of themselves? The real question now is whether this means a buying window or if the market has already priced in its growth prospects.

Price-to-Earnings of 22.9x: Is it justified?

Adtalem Global Education is currently trading at a price-to-earnings ratio of 22.9x, notably higher than its industry and most of its peers. With a recent closing price of $148.49, this suggests the market may be pricing in elevated earnings expectations or a premium for Adtalem’s performance.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for a dollar of earnings. For Adtalem, this metric is particularly relevant given its rapid recent profit growth and role as a leader in the US Consumer Services sector.

Currently, Adtalem commands a P/E ratio of 22.9x, which is well above both the US Consumer Services industry average of 18.3x and its peer average of 22.2x. Despite this premium, its P/E ratio is close to the estimated “Fair” Price-to-Earnings Ratio of 23.4x. This suggests that while the stock trades at a high multiple, it remains in line with its growth and quality profile as determined by regression-based fair value models. The market may see further upside if fundamentals continue improving.

Explore the SWS fair ratio for Adtalem Global Education

Result: Price-to-Earnings of 22.9x (OVERVALUED)

However, slower-than-expected revenue growth or margin pressure could challenge Adtalem’s momentum and cause investors to reevaluate its premium valuation.

Find out about the key risks to this Adtalem Global Education narrative.

Another View: What Does Our DCF Model Suggest?

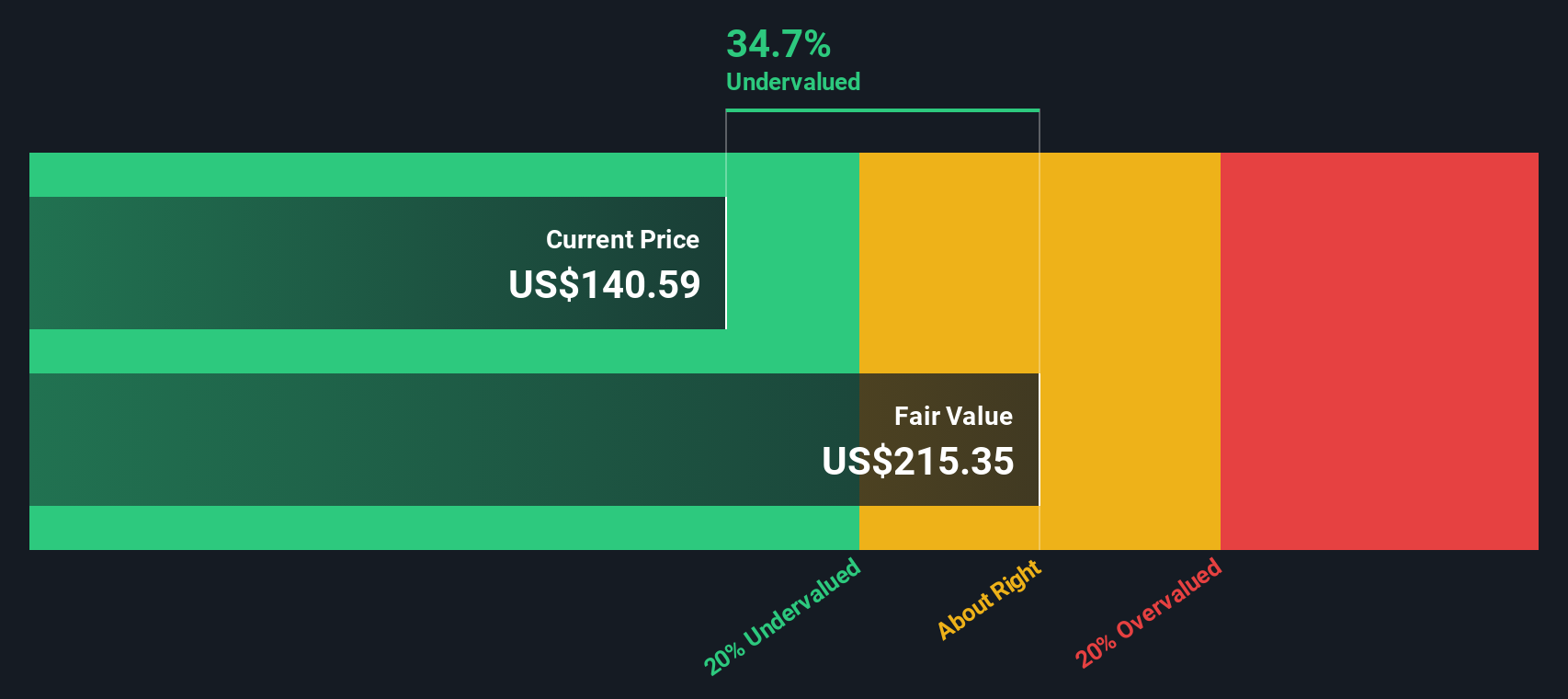

While the current price-to-earnings ratio places Adtalem Global Education in expensive territory compared to its industry, our DCF model presents a different outlook. The SWS DCF model estimates Adtalem’s fair value at $211.42, which is significantly above its trading price of $148.49. This suggests that the shares may actually be undervalued. Could the market be overlooking the company’s long-term cash flow strength?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adtalem Global Education for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Adtalem Global Education Narrative

If you see things differently or want to dig deeper, you can quickly craft your own perspective based on the data in just a few minutes. Do it your way

A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one opportunity when you can browse high-potential stocks tailored to your interests? Get ahead and secure your edge today.

- Explore futuristic tech and see which companies are making waves with these 26 quantum computing stocks leading quantum breakthroughs and innovation.

- Capitalize on market mispricings and spot compelling bargains by using these 887 undervalued stocks based on cash flows based on strong cash flow fundamentals.

- Enhance your passive income strategy by checking out these 19 dividend stocks with yields > 3% with attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Very undervalued with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026