- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Adtalem Global Education (ATGE): Assessing Valuation After Q4 Enrollment Surge and Upbeat Analyst Sentiment

Reviewed by Simply Wall St

Adtalem Global Education (ATGE) just served up a fiscal fourth-quarter performance that caught the market’s attention. The company didn’t just meet consensus expectations; it outpaced them on both earnings and revenue, with fresh enrollment growth and operational improvements acting as key drivers. This latest update has energized investor sentiment, especially as Adtalem continues rolling out new learning technology and scales up its healthcare education model. These are clear signals that the company is both evolving and finding traction with its strategic priorities.

That context helps explain why Adtalem’s stock has put up such strong numbers lately. With shares up 13% over the past three months and outperforming much of its Consumer Discretionary sector, the company’s momentum has been building throughout the year, now topping 48% year to date. Behind that rally are not just better headline results, but the market’s recognition of improving fundamentals, including double-digit student enrollment increases and a business model that’s delivering consistent returns. Even with rising expenses in certain segments, Adtalem’s progress and expanded vision have kept investors interested.

After this impressive run, the real question is whether Adtalem’s valuation still leaves room for upside, or if investors are already paying up for all that future growth. Is there still opportunity in ATGE, or is the market looking too far ahead?

Price-to-Earnings of 21.2x: Is it Justified?

Adtalem’s shares currently trade at a price-to-earnings (P/E) ratio of 21.2x, which makes the company appear slightly more expensive than its US Consumer Services industry peers. The sector average sits at 19.9x.

The P/E ratio is one of the most widely used measures for comparing company valuations because it expresses how much investors are willing to pay for each dollar of current earnings. For a company in the education and consumer services space, the P/E multiple can reflect investor confidence in its growth trajectory and ability to deliver consistent financial results, especially when comparing sector trends.

Adtalem’s above-average P/E suggests the market is optimistic about the business’s continuing momentum and future returns. Even if earnings and revenue growth forecasts are not dramatically ahead of the market, whether this premium is warranted will depend on the company’s ability to maintain quality growth and margin improvement in the coming quarters.

Result: Fair Value of $137.31 (ABOUT RIGHT)

See our latest analysis for Adtalem Global Education.However, even with recent strength, unexpected shifts in enrollment trends or regulatory challenges could disrupt Adtalem's positive outlook in the months ahead.

Find out about the key risks to this Adtalem Global Education narrative.Another View: Discounted Cash Flow Perspective

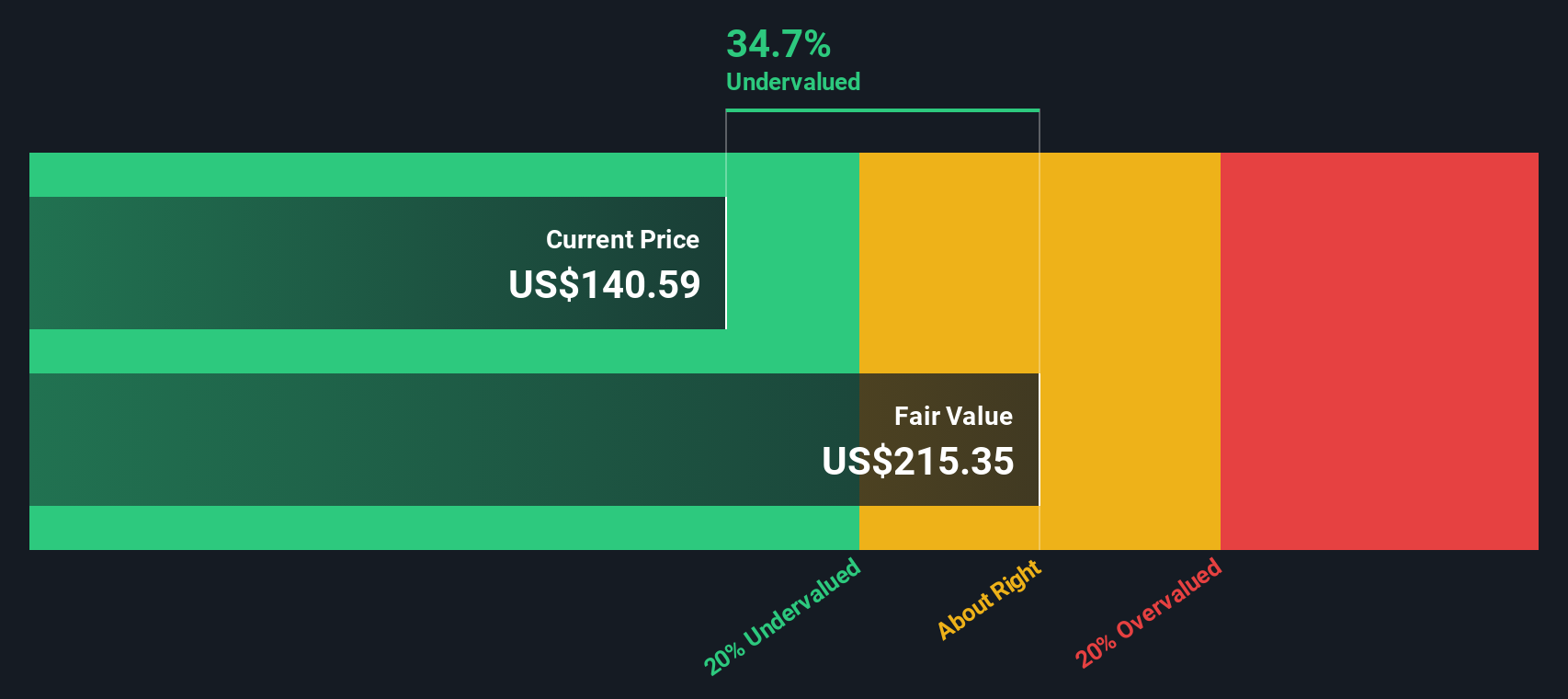

While earnings multiples suggest the price is about right, our DCF model tells a very different story. This method sees the shares as trading well below estimated fair value, raising new questions about hidden upside.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Adtalem Global Education Narrative

If you want to test your own assumptions, or see how your view compares, you can build a custom narrative for Adtalem in just minutes. Do it your way

A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Make your next smart investing move by tapping into opportunities others might miss. Find companies riding powerful trends, setting up for outsized returns, or quietly leading innovation with these hand-picked themes:

- Capitalize on the next wave of financial disruption by checking out cryptocurrency and blockchain stocks. See which businesses are driving adoption of blockchain-powered solutions.

- Target stable cash flows and attractive yields by using dividend stocks with yields > 3% to uncover companies rewarding shareholders through strong dividend payouts over 3%.

- Get ahead of the pack with AI penny stocks to track pioneers pushing boundaries in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Solid track record and fair value.

Market Insights

Community Narratives