- United States

- /

- Hospitality

- /

- NYSE:ARMK

A Fresh Look at Aramark’s (ARMK) Valuation Following Its New AI Culinary Co-Pilot Launch

Reviewed by Kshitija Bhandaru

Aramark (NYSE:ARMK) just introduced its new AI-powered Culinary Co-Pilot, which aims to make menu personalization and operations more efficient. Early results, especially in education, show real reductions in planning time and smoother workflows.

See our latest analysis for Aramark.

Momentum around Aramark has picked up following a string of digital innovations and strategic deals, such as its Culinary Co-Pilot launch and a fresh agreement with the University of Pennsylvania Health System. While the 1-year total shareholder return is down slightly at -1.3%, the stock delivered an impressive 56.7% total return over three years and 88% over five, reflecting solid long-term value despite some recent share price volatility.

If Aramark’s tech-driven updates have you curious about broader opportunities, there’s never been a better time to discover fast growing stocks with high insider ownership

With strong digital progress and recent tech investments making headlines, the question now is whether Aramark’s current share price undervalues these advances, or if the market has already priced in the company’s future growth. Is there a buying opportunity, or has any upside already been accounted for?

Most Popular Narrative: 14.1% Undervalued

With Aramark's fair value estimate at $45.10, which is significantly higher than its last close of $38.73, the narrative argues the market may be underestimating the company's growth and innovation potential. Investors are watching to see if key business wins and tech investments can deliver the leap implied by this sizable upside.

Accelerating wins of large, multi-year contracts, particularly in Sports & Entertainment, Education, and Healthcare, as organizations turn to outsourcing non-core services, point to sustained, above-trend future revenue growth and long-term contract expansion. Expansion in international markets, with double-digit organic growth in regions like the U.K., Chile, and Spain, and strategic wins in healthcare and entertainment sectors, demonstrates a deliberate move to diversify and lower cyclicality, which should bolster overall revenue and earnings stability.

Are analysts too bold? The full consensus narrative lifts the curtain on the ambitious growth rates and future margins that could make or break this fair value. The real drivers may surprise you.

Result: Fair Value of $45.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and the shift toward remote work could challenge Aramark’s growth and put pressure on its future margins.

Find out about the key risks to this Aramark narrative.

Another View: Market Ratios Raise a Note of Caution

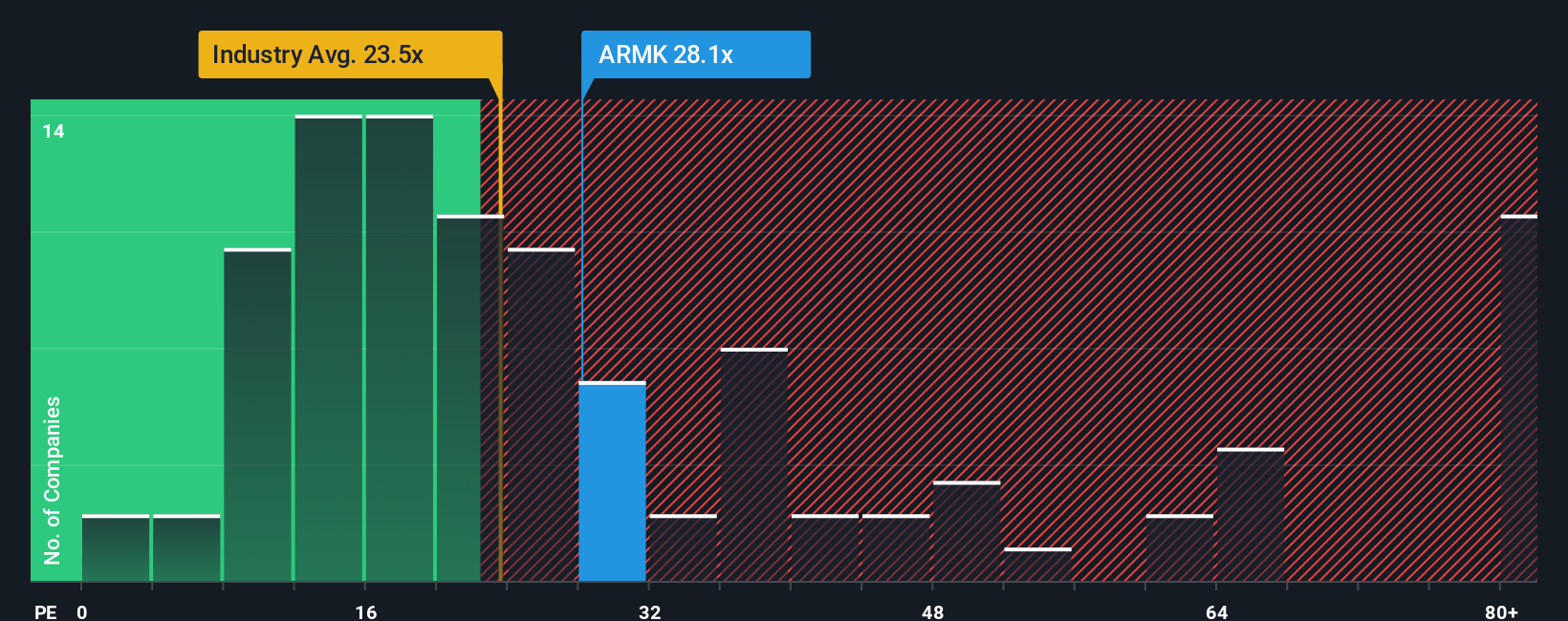

Taking a step back from fair value estimates, Aramark’s market ratio tells a different story. Its price-to-earnings ratio stands at 28.1x, notably higher than the US Hospitality industry average of 23.5x and very close to the fair ratio of 28x. Compared to its peers, however, Aramark actually looks cheap, with many trading at much loftier levels of 47.5x.

This gap highlights real tension. On one hand, Aramark is priced above the industry, but in line with what regression trends might support, and discounting the even higher multiples many competitors fetch. Is this a warning about valuation risk, or a rare value window?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aramark Narrative

Whether you’re skeptical about these conclusions or want to draw your own, it takes less than three minutes to dive into the details and shape a personal view, so why not Do it your way

A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always on the hunt for tomorrow’s winners. Broaden your perspective and spot your next opportunity before the crowd catches on.

- Supercharge your growth portfolio by checking out these 24 AI penny stocks, which are disrupting established industries with groundbreaking artificial intelligence strategies and innovations.

- Capitalize on steady passive income by reviewing these 18 dividend stocks with yields > 3%, which consistently outperform with robust yields and financial strength.

- Tap into early-stage growth with these 3596 penny stocks with strong financials, poised for major breakthroughs and high-upside potential in emerging sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARMK

Aramark

Provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives