- United States

- /

- Hospitality

- /

- NYSE:AGS

Here's Why Shareholders Should Examine PlayAGS, Inc.'s (NYSE:AGS) CEO Compensation Package More Closely

Shareholders will probably not be too impressed with the underwhelming results at PlayAGS, Inc. (NYSE:AGS) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 01 July 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for PlayAGS

Comparing PlayAGS, Inc.'s CEO Compensation With the industry

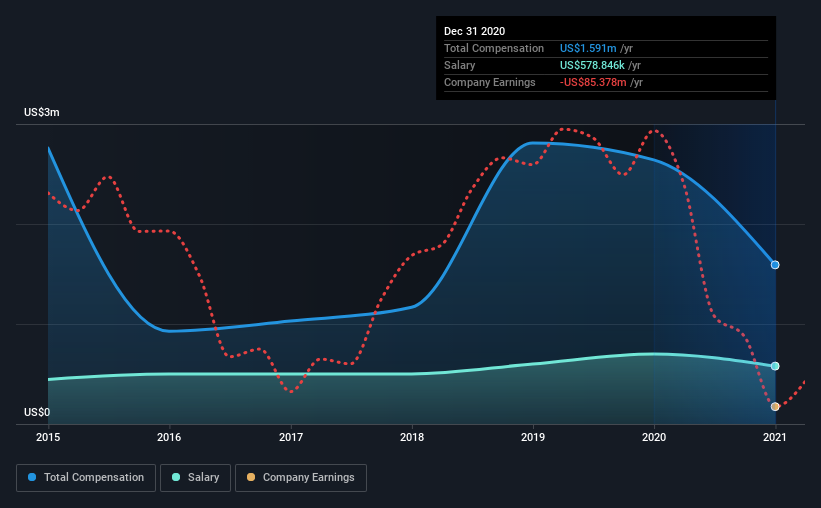

Our data indicates that PlayAGS, Inc. has a market capitalization of US$378m, and total annual CEO compensation was reported as US$1.6m for the year to December 2020. We note that's a decrease of 40% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$579k.

In comparison with other companies in the industry with market capitalizations ranging from US$200m to US$800m, the reported median CEO total compensation was US$2.0m. This suggests that PlayAGS remunerates its CEO largely in line with the industry average. Furthermore, David Lopez directly owns US$2.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$579k | US$700k | 36% |

| Other | US$1.0m | US$1.9m | 64% |

| Total Compensation | US$1.6m | US$2.6m | 100% |

On an industry level, around 22% of total compensation represents salary and 78% is other remuneration. According to our research, PlayAGS has allocated a higher percentage of pay to salary in comparison to the wider industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

PlayAGS, Inc.'s Growth

PlayAGS, Inc. has reduced its earnings per share by 38% a year over the last three years. It saw its revenue drop 41% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has PlayAGS, Inc. Been A Good Investment?

With a total shareholder return of -59% over three years, PlayAGS, Inc. shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for PlayAGS that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading PlayAGS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade PlayAGS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:AGS

PlayAGS

Designs and supplies gaming products and services for the gaming industry in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives