- United States

- /

- Consumer Services

- /

- NYSE:ADT

How ADT's (ADT) Smart Home Launch and UK Unit Auction Could Shape Its Investment Profile

Reviewed by Sasha Jovanovic

- ADT recently introduced a new Smart Home Security System that offers professional monitoring and flexible installation options, featuring deep integration with Google Nest devices as part of the company's partnership with Google, while the auction of its UK division has drawn interest from private equity firm Exponent and other bidders.

- This combination of technological advancement and merger activity points to ADT's efforts to enhance its smart home ecosystem, diversify its offering, and potentially reshape its international presence.

- We'll now assess how ADT's launch of an upgraded smart home solution in collaboration with Google could influence the investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ADT Investment Narrative Recap

To be a shareholder in ADT right now, you’d want to believe the company can successfully transition toward technology-driven, higher-margin smart home solutions and achieve profitable growth, despite rising competition from DIY security offerings and its high debt level. The new product launch and potential UK division sale underscore ADT’s focus on innovation and international portfolio management, yet the most important near-term catalyst continues to be effective execution on smart home integration, while persistent stagnation in subscriber growth remains the biggest risk. For now, the recent news appears positive, but doesn't fundamentally shift either the main risk or catalyst in the short term.

Among the latest developments, ADT’s expanded partnership with Google and the launch of an upgraded Smart Home Security System are worth highlighting, as they align directly with the push for deeper recurring revenue and broader market appeal through connected home technology, areas central to ADT’s growth plan and investor expectations.

However, investors should be aware that if organic subscriber growth fails to materialize in this new environment...

Read the full narrative on ADT (it's free!)

ADT's outlook forecasts $5.7 billion in revenue and $857.3 million in earnings by 2028. This implies a 3.9% annual revenue growth rate and a $217.3 million earnings increase from the current $640.0 million.

Uncover how ADT's forecasts yield a $9.58 fair value, a 13% upside to its current price.

Exploring Other Perspectives

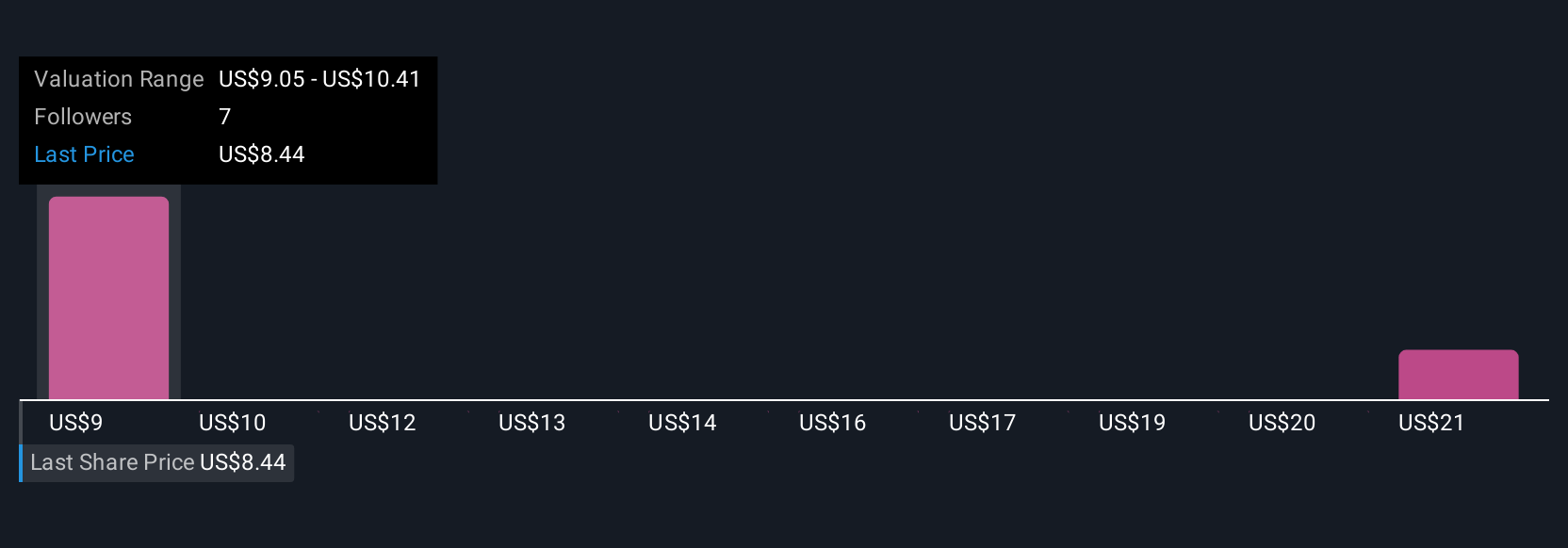

Simply Wall St Community members have fair value estimates for ADT ranging from US$9.05 to US$21.32 across 3 analyses. In contrast, competition from DIY solutions remains a key concern shaping broader expectations of ADT’s long-term revenue potential; readers can explore these varied viewpoints to get a fuller picture.

Explore 3 other fair value estimates on ADT - why the stock might be worth over 2x more than the current price!

Build Your Own ADT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADT's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADT

ADT

Provides security, interactive, and smart home solutions in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026