- United States

- /

- Consumer Services

- /

- OTCPK:ZVOI

Such Is Life: How Zovio (NASDAQ:ZVO) Shareholders Saw Their Shares Drop 68%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Zovio Inc (NASDAQ:ZVO) shareholders should be happy to see the share price up 13% in the last month. But don't envy holders -- looking back over 5 years the returns have been really bad. In fact, the share price has declined rather badly, down some 68% in that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. We'd err towards caution given the long term under-performance.

Check out our latest analysis for Zovio

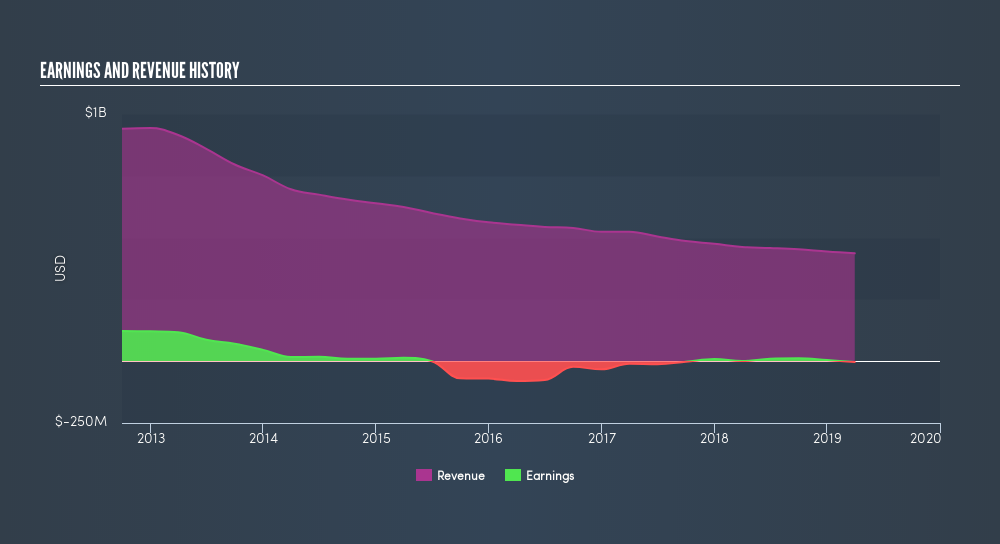

Given that Zovio didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Zovio reduced its trailing twelve month revenue by 9.3% for each year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 20% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

This free interactive report on Zovio's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Zovio had a tough year, with a total loss of 47%, against a market gain of about 6.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 20% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Zovio better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:ZVOI

Zovio

Operates as an education technology services company in the United States.

Slight with weak fundamentals.

Similar Companies

Market Insights

Community Narratives