- United States

- /

- Consumer Services

- /

- OTCPK:ZVOI

Further weakness as Zovio (NASDAQ:ZVO) drops 19% this week, taking three-year losses to 81%

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Zovio Inc (NASDAQ:ZVO), who have seen the share price tank a massive 81% over a three year period. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 51%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With the stock having lost 19% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Zovio

Zovio isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Zovio's revenue dropped 9.8% per year. That's not what investors generally want to see. The share price fall of 22% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

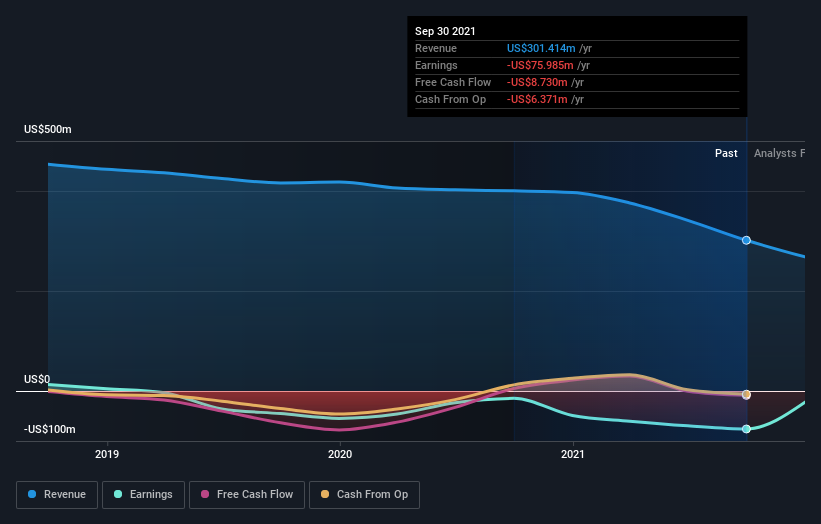

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Zovio

A Different Perspective

Investors in Zovio had a tough year, with a total loss of 51%, against a market gain of about 39%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Zovio better, we need to consider many other factors. For example, we've discovered 5 warning signs for Zovio (2 are a bit unpleasant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zovio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:ZVOI

Zovio

Operates as an education technology services company in the United States.

Slight with weak fundamentals.

Similar Companies

Market Insights

Community Narratives