- United States

- /

- Consumer Services

- /

- NasdaqCM:ZCMD

Zhongchao Inc. (NASDAQ:ZCMD) Surges 76% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, Zhongchao Inc. (NASDAQ:ZCMD) shares have been powering on, with a gain of 76% in the last thirty days. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 78% share price drop in the last twelve months.

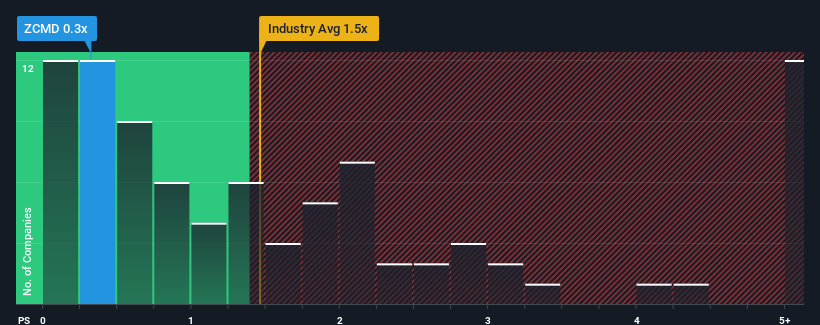

In spite of the firm bounce in price, it would still be understandable if you think Zhongchao is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in the United States' Consumer Services industry have P/S ratios above 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Zhongchao

What Does Zhongchao's P/S Mean For Shareholders?

Recent times have been quite advantageous for Zhongchao as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhongchao's earnings, revenue and cash flow.How Is Zhongchao's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Zhongchao's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. As a result, it also grew revenue by 8.0% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Zhongchao's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift Zhongchao's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Zhongchao confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Zhongchao that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhongchao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZCMD

Zhongchao

Provides healthcare information, education, and training services to healthcare professionals under their MDMOOC brand in the People’s Republic of China.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026