- United States

- /

- Consumer Services

- /

- NasdaqCM:XWEL

We Think The Compensation For XpresSpa Group, Inc.'s (NASDAQ:XSPA) CEO Looks About Right

Performance at XpresSpa Group, Inc. (NASDAQ:XSPA) has been rather uninspiring recently and shareholders may be wondering how CEO Doug Satzman plans to fix this. At the next AGM coming up on 30 September 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for XpresSpa Group

Comparing XpresSpa Group, Inc.'s CEO Compensation With the industry

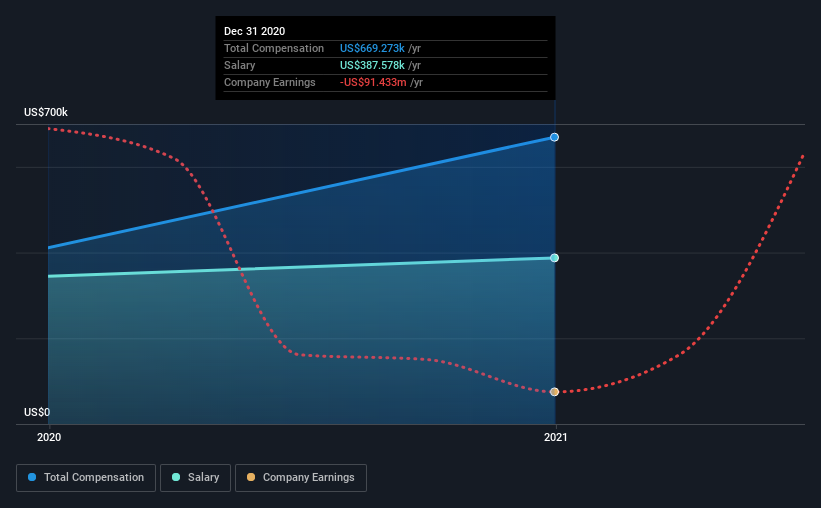

At the time of writing, our data shows that XpresSpa Group, Inc. has a market capitalization of US$169m, and reported total annual CEO compensation of US$669k for the year to December 2020. That's a notable increase of 63% on last year. We note that the salary of US$387.6k makes up a sizeable portion of the total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$1.8m. This suggests that Doug Satzman is paid below the industry median. What's more, Doug Satzman holds US$101k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$388k | US$345k | 58% |

| Other | US$282k | US$67k | 42% |

| Total Compensation | US$669k | US$411k | 100% |

On an industry level, roughly 18% of total compensation represents salary and 82% is other remuneration. XpresSpa Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

XpresSpa Group, Inc.'s Growth

Over the past three years, XpresSpa Group, Inc. has seen its earnings per share (EPS) grow by 101% per year. In the last year, its revenue is down 40%.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has XpresSpa Group, Inc. Been A Good Investment?

With a total shareholder return of -83% over three years, XpresSpa Group, Inc. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key focus for the board and management will be how to align the share price with fundamentals. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for XpresSpa Group you should be aware of, and 1 of them doesn't sit too well with us.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade XpresSpa Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:XWEL

XWELL

Provides health and wellness services to travelers in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives