- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

Is There Still Upside in Wynn After Strong 40% Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Wynn Resorts stock? You are not alone. Investors across the board have kept a watchful eye on this gaming and hospitality powerhouse, especially after a year full of headline-grabbing price swings. After a notably strong run, with the stock soaring 40.6% year-to-date and posting a remarkable 105.7% gain over the past three years, Wynn Resorts has become a hot topic among traders and long-term holders alike.

The last month or so has shown a pullback, with shares down 4.4% in the last 30 days and slipping 1.7% this week. It is natural to wonder if market sentiment is shifting or if this is just a breather after a significant climb. Some see these dips as buying opportunities, while others are cautious, curious if the recent rally has run out of steam. Broader market developments, such as renewed optimism around travel demand and recent buzz about regulatory changes in key casino regions, have both helped and hindered the ride for Wynn’s share price. No surprise, then, that opinions about its current value are just as divided.

Here is where things get interesting: in our standard valuation framework, Wynn Resorts scores a 1 out of 6 on the undervaluation checks. Not a glowing report card, but numbers only tell part of the story. Next, we will walk through each valuation method, and at the end, I will share an even more insightful way to think about what Wynn Resorts might really be worth.

Wynn Resorts scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Wynn Resorts Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting those figures back to today’s value. This approach hinges on the idea that a stock’s worth comes from the total amount of cash it can generate for shareholders, adjusted for the time value of money.

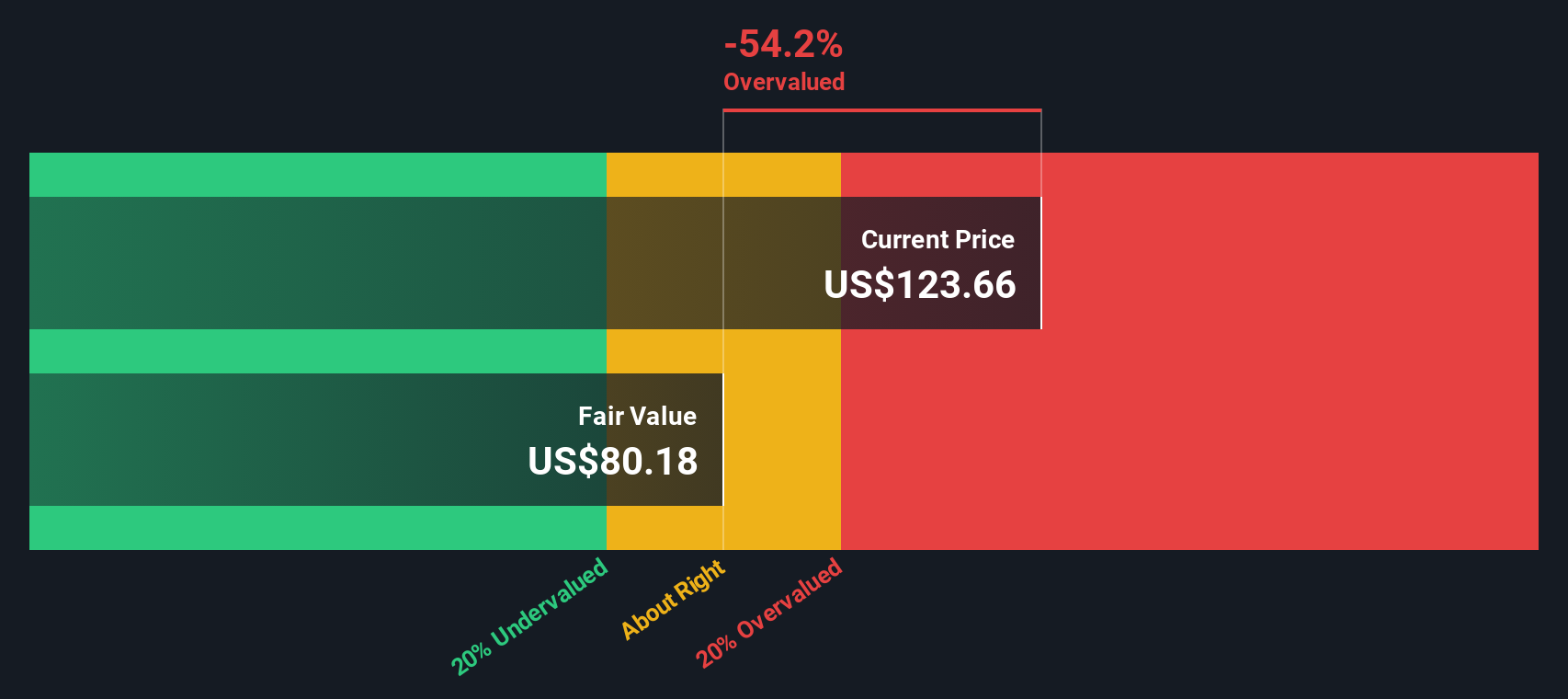

For Wynn Resorts, the latest available Free Cash Flow sits at $798.5 Million. Analysts have forecast a future cash flow of $1.05 Billion by the end of 2024, but estimates beyond five years rely on extrapolations. Looking out ten years, projections by Simply Wall St show Wynn’s annual free cash flow tending to hover between $732 Million and $832 Million. These figures suggest moderate growth, with a slight decline in some years and minor upticks in others.

After running these projections through the DCF model, the estimated fair value for Wynn Resorts lands at $78.58 per share. Compared to the current share price, this suggests the stock is trading at a 49.9% premium to its intrinsic value. In other words, it appears overvalued by a significant margin.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wynn Resorts may be overvalued by 49.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Wynn Resorts Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Wynn Resorts because it connects the share price to the company's actual earnings. A higher PE often reflects investor optimism regarding future earnings growth or lower perceived risk, while a lower PE can point to slower growth expectations or higher risk.

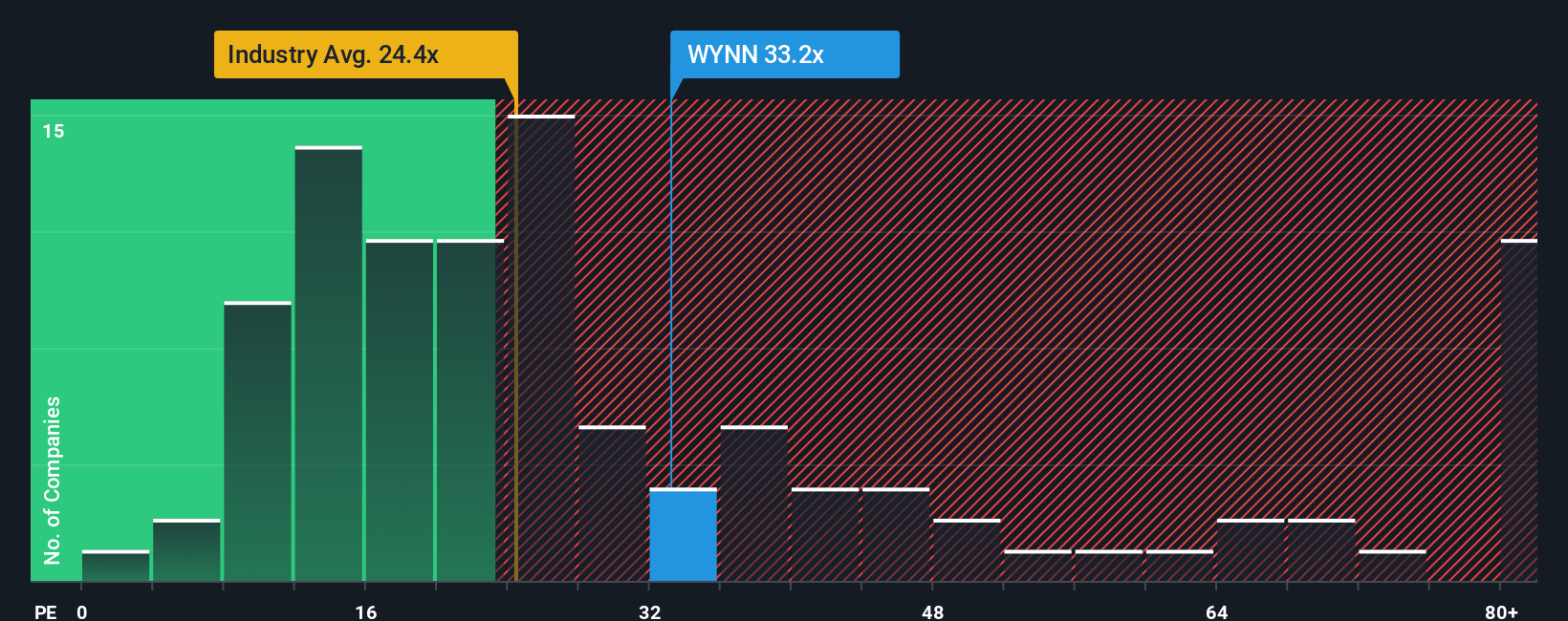

Wynn Resorts currently trades at a PE ratio of 31.6x. To put that in perspective, this is above the hospitality industry average of 23.5x and also higher than the average of its closest peers at 34.3x. However, PE comparisons are only part of the story as what is considered a "normal" multiple also depends on factors such as the company's future growth prospects, the stability of its earnings, and broader industry conditions.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio, calculated as 26.6x for Wynn Resorts, is a proprietary metric that incorporates the company’s expected earnings growth, profit margin, industry dynamics, company size, and business risks. Unlike simple peer or industry comparisons, this approach aims to reflect the unique blend of factors that influence what multiple a company deserves in today’s market.

Wynn’s actual PE of 31.6x is appreciably above the Fair Ratio of 26.6x, implying the stock might be valued a bit too richly based on its fundamentals right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wynn Resorts Narrative

Earlier, we mentioned there is an even better way to approach valuation, so let us introduce Narratives. A Narrative is your own story and perspective about a company’s future: you combine your expectations for its growth, profitability, and risks, then see how those assumptions translate into estimated future earnings, fair value, and a price target.

Instead of relying solely on models or comparison multiples, Narratives connect your view of what drives Wynn Resorts’ business to a financial forecast and, ultimately, a fair value. This method turns investing from a numbers-only exercise into a dynamic, personal process. You can easily try this approach for yourself within the Simply Wall St Community page, trusted by millions of investors worldwide.

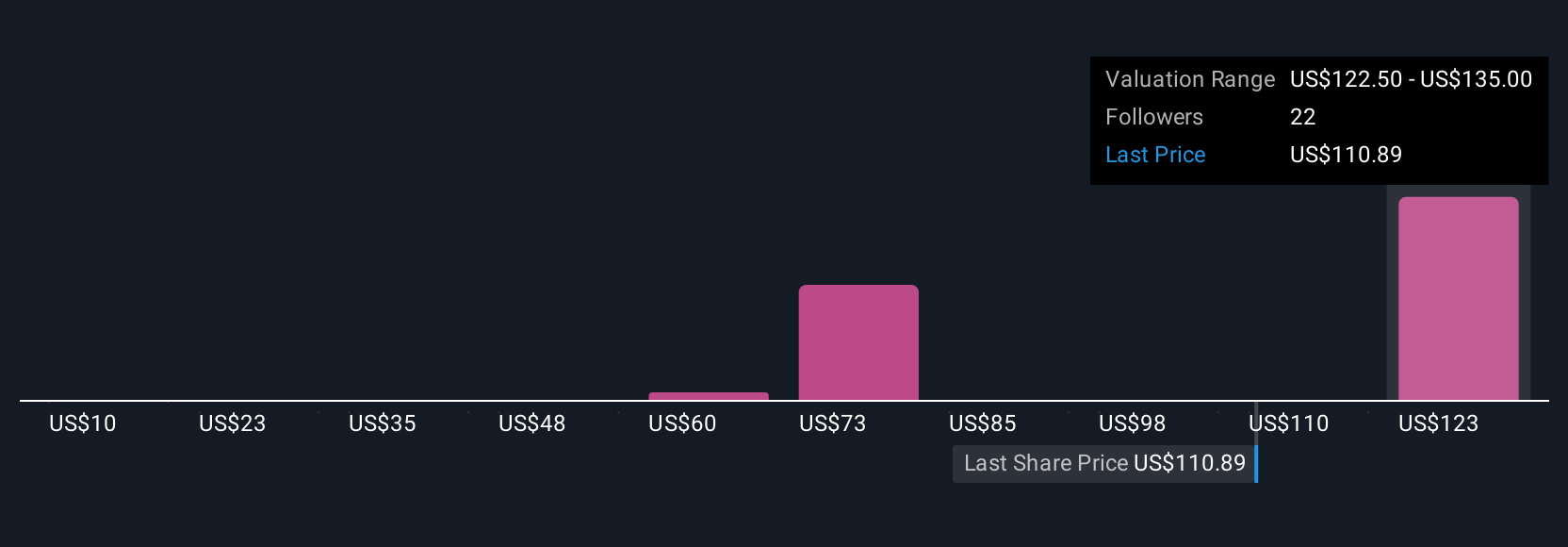

Narratives help you quickly compare your fair value estimate with today’s share price, giving you more context for buy and sell decisions and letting you update your view as new company news or results arrive. For example, some investors might create a bullish Narrative for Wynn Resorts, assuming expansive growth in Asia and the Middle East, leading to a high fair value around $147 per share. Others might focus on risk factors like Macau dependence and see fair value closer to $110.

Do you think there's more to the story for Wynn Resorts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives