- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

Can Wynn Resorts (WYNN) Redefine Its Investment Story With Luxury Tourism Beyond Gaming?

Reviewed by Sasha Jovanovic

- Following several analyst upgrades and industry optimism, Wynn Resorts has highlighted plans for expanded nongaming attractions in Macau and previewed its upcoming integrated resort in the United Arab Emirates, scheduled to open in 2027.

- This multifaceted approach, combined with Macau’s ongoing tourism diversification efforts and robust event programming, underscores Wynn’s emphasis on building resilience beyond its gaming revenues.

- To understand the potential impact, we’ll examine how Wynn’s focus on luxury tourism and non-gaming offerings could influence its investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wynn Resorts Investment Narrative Recap

To be a shareholder in Wynn Resorts, you need to believe in the company’s focus on luxury tourism and integrated resorts driving future growth, while accepting potential volatility from its Macau exposure. The recent dip in share price after weaker U.S. consumer confidence and political tension appears to have little impact on Wynn’s most important near-term catalyst, Macau’s tourism recovery, though it does highlight how sensitive the stock can be to broader market disruptions.

Among Wynn’s recent announcements, the launch of the “Wynn Signature – 2025 Hypercar Exhibition” in Macau is a clear example of its push to enhance non-gaming revenue streams and support the city’s tourism diversification. This move is closely linked to the company’s larger catalyst: capturing affluent travelers and expanding luxury experiences, which may help soften some of the risks associated with its gaming-centric business model.

Yet, despite these positive developments, it’s essential for investors to remember that any shift in Macau’s regulatory or geopolitical climate could...

Read the full narrative on Wynn Resorts (it's free!)

Wynn Resorts' outlook anticipates $8.0 billion in revenue and $624.0 million in earnings by 2028. This implies a 4.6% annual revenue growth rate and a $240.1 million increase in earnings from the current $383.9 million level.

Uncover how Wynn Resorts' forecasts yield a $129.85 fair value, a 3% downside to its current price.

Exploring Other Perspectives

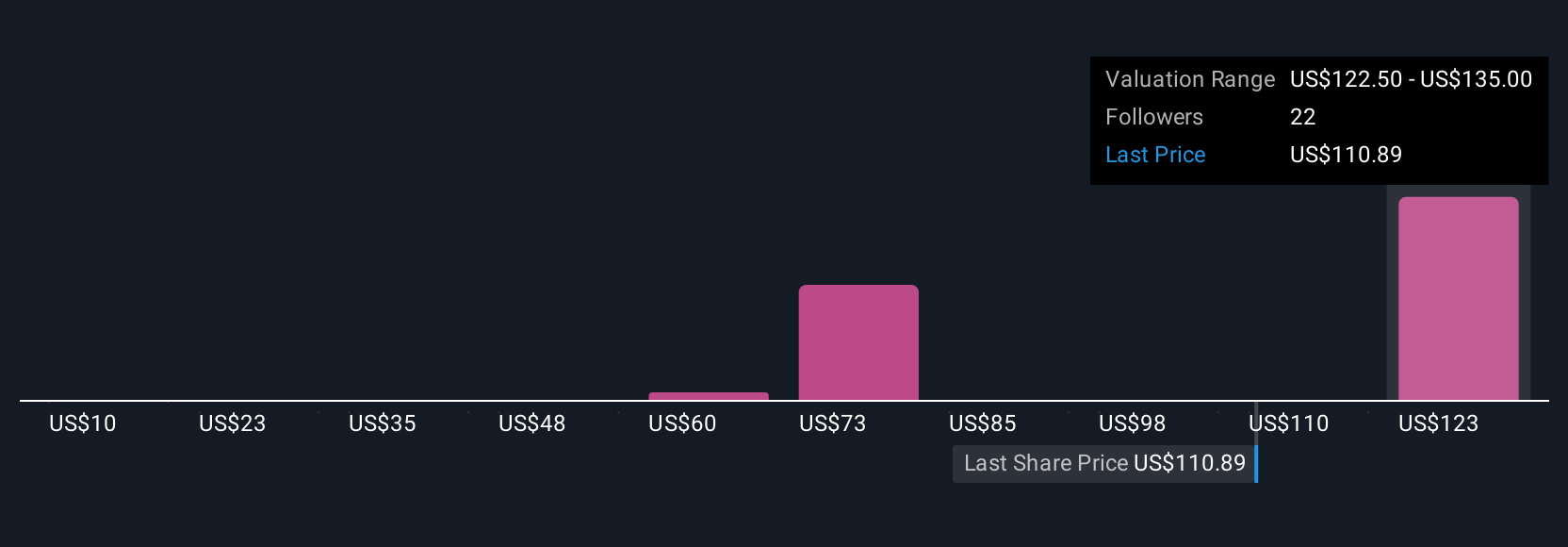

Fair value estimates from nine Simply Wall St Community members cover a wide range from US$10 to US$129.85 per share. With such a spread of opinions, remember that Wynn’s reliance on Macau means abrupt shifts in policy or external tensions could reshape both forecasts and actual results, see how others are weighing future possibilities now.

Explore 9 other fair value estimates on Wynn Resorts - why the stock might be worth as much as $129.85!

Build Your Own Wynn Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wynn Resorts research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Wynn Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wynn Resorts' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives