- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

A Fresh Look at Wynn Resorts (WYNN) Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Wynn Resorts (WYNN) shares have edged up, catching the eyes of investors who are watching for shifts in the performance of the hospitality and gaming sector. With recent momentum, there is growing curiosity about how the stock’s valuation compares with its broader track record.

See our latest analysis for Wynn Resorts.

WYNN’s latest share price climb to $117.81 puts a bright spot on a year highlighted by consistent momentum, with a strong 40.6% year-to-date share price return and impressive three- and five-year total shareholder returns of 113.96% and 64.52%, respectively. The recent short-term rally points to renewed optimism as investors consider both the company’s growth potential and shifting risk appetite.

If Wynn’s momentum has you looking for what else is on the move, it could be a great time to check out fast growing stocks with high insider ownership.

This recent surge raises a crucial question for investors: is Wynn Resorts trading at an attractive discount that signals further upside, or has the market already priced in all expected future growth?

Most Popular Narrative: 12.1% Undervalued

Wynn Resorts’ current share price trails the latest fair value estimate, suggesting the market hasn't fully priced in the potential outlined in the leading narrative. This gap could present an interesting opportunity for investors attuned to the forces shaping premium hospitality and international gaming markets.

The imminent launch of Wynn Al Marjan Island, with first-mover advantage and limited near-term competition in a potentially multi-billion-dollar new market, is a major forward catalyst that is currently underappreciated by investors and could drive a meaningful step-change in both consolidated revenue and EBITDAR.

Curious what's fueling this valuation? There’s one unconventional financial forecast at play and a global expansion move most analysts have missed. Want the details powering these bold numbers? Uncover the surprising assumptions and market shifts that push this valuation beyond the current share price. Read on to see what the broader market may be overlooking.

Result: Fair Value of $134.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks persist, particularly because of Wynn's reliance on Macau and ongoing cost pressures. These factors could challenge earnings if growth momentum softens or regulatory changes emerge.

Find out about the key risks to this Wynn Resorts narrative.

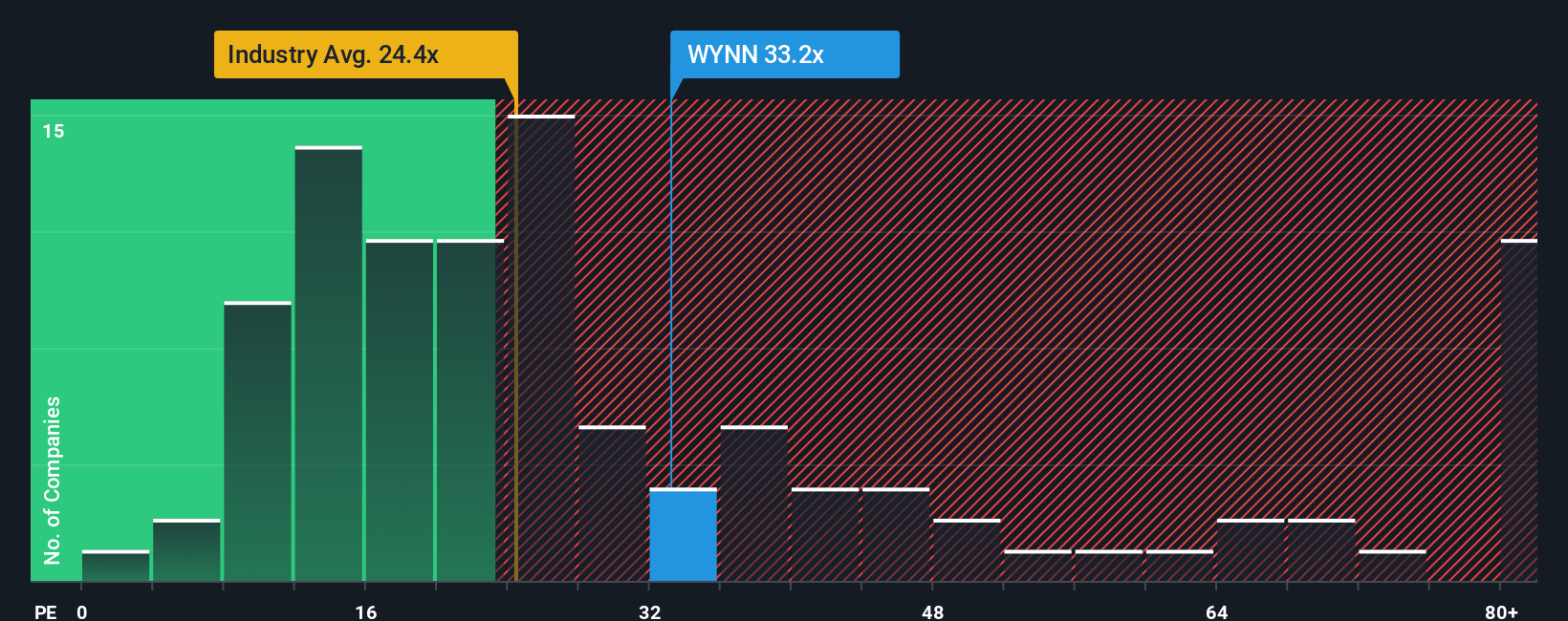

Another View: What About Earnings Multiples?

Taking a different angle, Wynn Resorts is currently trading at a price-to-earnings ratio of 31.6x. This is notably higher than both the US Hospitality industry average of 23.5x and the company's estimated fair ratio of 26.7x. This premium could signal that investors are paying up for growth, but it also increases the risk if lofty expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wynn Resorts Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own unique take in just a few minutes. Do it your way.

A great starting point for your Wynn Resorts research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your horizon and seize fresh opportunities before everyone else. Simply Wall Street’s screener makes it easy to spot standouts across the market.

- Unlock high yield possibilities in your portfolio by checking out these 18 dividend stocks with yields > 3% with the strongest income streams and consistent payouts.

- Tap into the next wave of innovation by following these 24 AI penny stocks, identifying pioneers driving artificial intelligence forward in every industry.

- Capture hidden value by browsing these 873 undervalued stocks based on cash flows, revealing overlooked companies that could offer compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives