- United States

- /

- Hospitality

- /

- NasdaqGS:WEN

Will Wendy's (WEN) New Chicken Tenders Mark a Turning Point for Menu Innovation?

Reviewed by Sasha Jovanovic

- In late September 2025, Wendy's introduced its all-new Chicken Tenders nationwide, accompanied by six new dipping sauces and themed in-store experiences, as part of a major menu update.

- As part of its broader Project Fresh initiative, Wendy's is aiming to revitalize its brand and drive growth through menu innovation, enhanced hospitality, and fresh marketing approaches.

- We’ll assess how Wendy’s Chicken Tenders and Project Fresh may influence its investment narrative, especially regarding consumer engagement and menu innovation.

Find companies with promising cash flow potential yet trading below their fair value.

Wendy's Investment Narrative Recap

For anyone considering Wendy’s as an investment, the core thesis centers on the company’s ability to revive sales and brand relevance through menu innovation and operational improvements aimed at stabilizing U.S. franchise performance. The launch of Chicken Tenders, aligned with Project Fresh, is designed to reignite customer excitement but its material impact on same-store sales trends, the key short-term catalyst, remains to be seen, while risks around competitive pressure and franchisee margins still loom large.

Among recent announcements, the upcoming Q3 2025 earnings release on November 7 is highly relevant, particularly as it should provide insight into early consumer responses to the new Chicken Tenders range. Investors will be watching closely for any signs that these initiatives are gaining traction or whether continuing challenges around store-level margins and declining sales persist.

Yet, despite new products and growth initiatives, investors also need to keep in mind lingering risks such as...

Read the full narrative on Wendy's (it's free!)

Wendy's narrative projects $2.3 billion revenue and $210.4 million earnings by 2028. This requires 1.2% yearly revenue growth and an $18.3 million earnings increase from current earnings of $192.1 million.

Uncover how Wendy's forecasts yield a $11.86 fair value, a 36% upside to its current price.

Exploring Other Perspectives

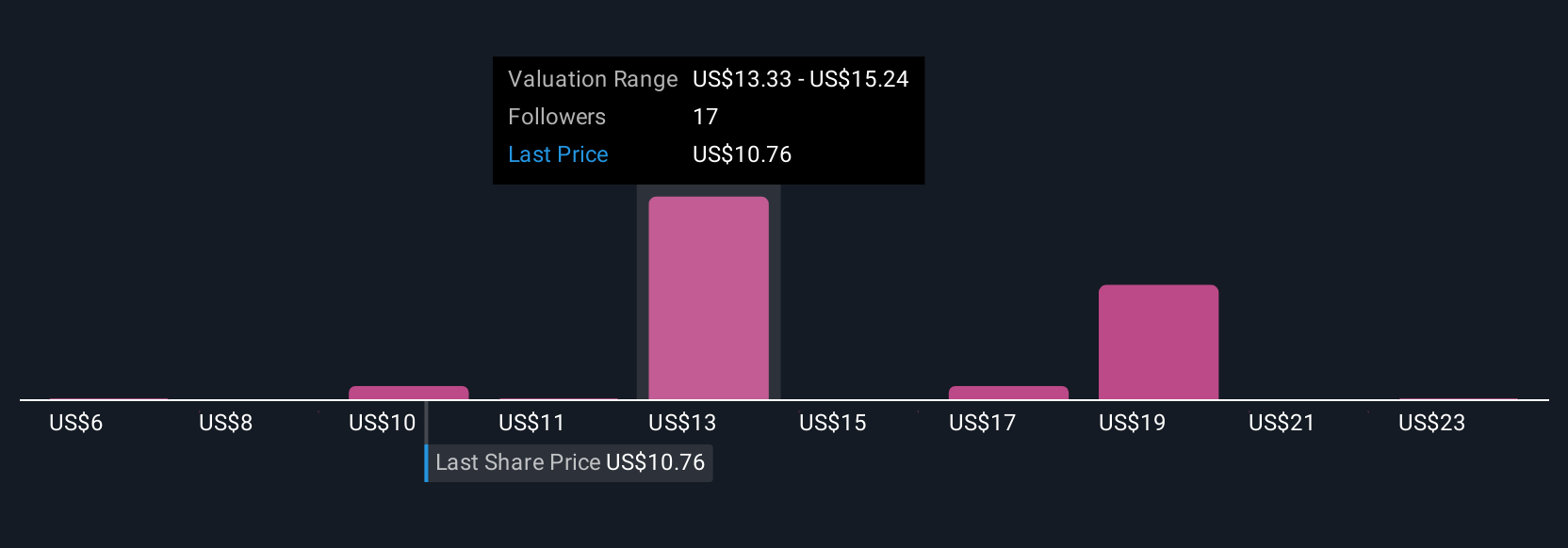

Simply Wall St Community members see fair values for Wendy’s ranging from US$10.00 to US$24.79, reflecting ten distinct approaches. With menu innovation at the forefront, keep in mind that shifting consumer preferences have broader implications for long-term revenue resilience, explore a range of perspectives before making any assessment.

Explore 10 other fair value estimates on Wendy's - why the stock might be worth over 2x more than the current price!

Build Your Own Wendy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wendy's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wendy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wendy's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wendy's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WEN

Wendy's

Operates as a quick-service restaurant company in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion