- United States

- /

- Hospitality

- /

- NasdaqGS:TXRH

Texas Roadhouse (TXRH): What New Leadership Moves Mean for Its Valuation and Future Growth Potential

Reviewed by Simply Wall St

Texas Roadhouse (TXRH) just shook up its leadership team, and that has sparked some fresh attention from market watchers trying to gauge where the stock heads next. With Gerald L. Morgan tapped as Executive Vice Chairman while keeping CEO duties and Lloyd Paul Marshall landing the brand-new Chief Growth Officer title, management is making a clear statement about preparing for future growth. The recent addition of Hugh J. Carroll, with deep international expertise, to the board highlights a focus on new markets and scaling its family-friendly steakhouse experience beyond U.S. borders.

These strategic appointments come as Texas Roadhouse continues to carve out market share in a tough operating climate. The stock has climbed 7% over the past year but is off about 11% in the past 3 months, which signals that some near-term momentum has cooled even as the company posts steady revenue and profit growth. Investors remember that the three- and five-year returns are well over 100% and 200%, respectively, so there is a history of compounding gains here even if the latest price action feels more mixed.

With management tightening its grip on succession and growth, it is natural to wonder: are these strategic moves the catalyst for another wave of gains, or has the market already priced in much of Texas Roadhouse’s future potential?

Most Popular Narrative: 10% Undervalued

According to community narrative, Texas Roadhouse is viewed as trading below fair value, with expectations that recent strategic moves and operational improvements could justify a higher price in the years ahead.

Successful digital integration, enhancements to the mobile app, improved waitlist and to-go experience, and broad rollout of digital kitchen technology are boosting operational efficiency and guest convenience. These changes are likely to drive both sales growth and margin improvement.

How did analysts land on that bold price target? The secret sauce lies in ambitious growth assumptions for both revenue and profit margins. This narrative claims Texas Roadhouse is gearing up for a breakout, underpinned by a dynamic mix of operational upgrades and aggressive expansion plans. Want the numbers and reasoning that could really set this valuation apart? Check out the rationale that has Wall Street buzzing.

Result: Fair Value of $197 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent beef inflation or slower adoption of digital tools could easily disrupt Texas Roadhouse's optimistic outlook and growth trajectory.

Find out about the key risks to this Texas Roadhouse narrative.Another View: What Does the DCF Model Say?

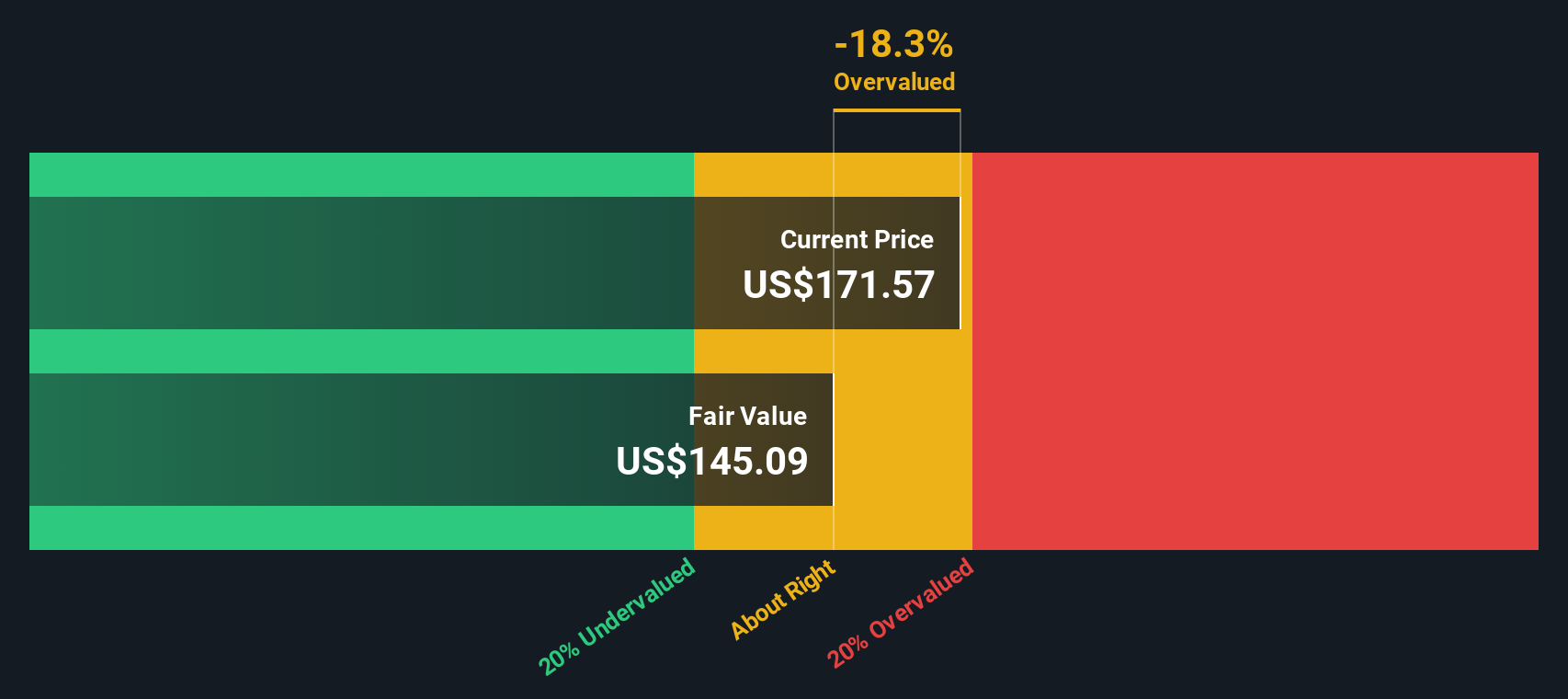

While analysts using market multiples call Texas Roadhouse undervalued, our DCF model presents a different perspective. It suggests that some optimism may already be reflected in the price. Is the consensus overlooking hidden risks, or is it becoming too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Texas Roadhouse Narrative

If these conclusions do not align with your own outlook, or you would rather dig into the numbers yourself, shaping your own perspective is just a few minutes away. do it your way.

A great starting point for your Texas Roadhouse research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the moment and give your portfolio an edge with new investment opportunities beyond Texas Roadhouse. The Simply Wall Street Screener surfaces unique stocks that could be flying under your radar. Take smart action and ensure you are not missing the next big winner with these standout themes:

- Capture the momentum of healthcare innovation by targeting trailblazers in artificial intelligence within the sector. Explore our handpicked selection of healthcare AI stocks.

- Unlock the potential of consistent returns with a shortlist of top companies known for providing generous yields. View them with dividend stocks with yields > 3%.

- Ride the next wave of technology by backing companies that are driving breakthroughs in quantum computing. Discover them through our curated set of quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Roadhouse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXRH

Texas Roadhouse

Operates casual dining restaurants in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives