Stock Analysis

- United States

- /

- Consumer Services

- /

- NasdaqGS:TWOU

2U, Inc. (NASDAQ:TWOU) Not Doing Enough For Some Investors As Its Shares Slump 36%

The 2U, Inc. (NASDAQ:TWOU) share price has fared very poorly over the last month, falling by a substantial 36%. For any long-term shareholders, the last month ends a year to forget by locking in a 95% share price decline.

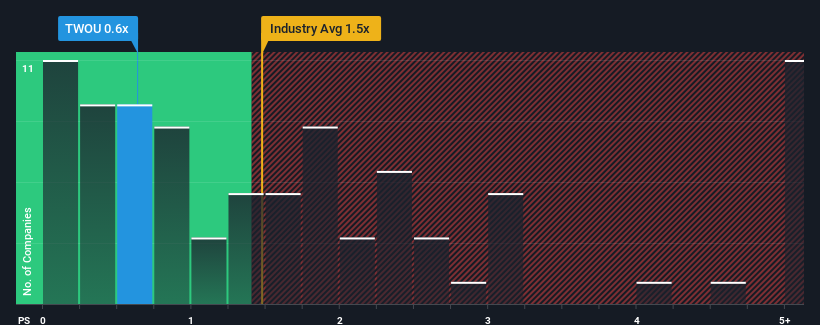

After such a large drop in price, given about half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider 2U as an attractive investment with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for 2U

What Does 2U's Recent Performance Look Like?

While the industry has experienced revenue growth lately, 2U's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think 2U's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For 2U?

The only time you'd be truly comfortable seeing a P/S as low as 2U's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.9% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 9.0% over the next year. With the industry predicted to deliver 15% growth, that's a disappointing outcome.

In light of this, it's understandable that 2U's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does 2U's P/S Mean For Investors?

The southerly movements of 2U's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that 2U maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for 2U (1 is concerning) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether 2U is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether 2U is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TWOU

2U

Operates as an online education platform company in the United States and internationally.

Fair value with imperfect balance sheet.