- United States

- /

- Hospitality

- /

- NasdaqCM:TH

The total return for Target Hospitality (NASDAQ:TH) investors has risen faster than earnings growth over the last three years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. For example, the Target Hospitality Corp. (NASDAQ:TH) share price is up a whopping 518% in the last three years, a handsome return for long term holders. In more good news, the share price has risen 14% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. It really delights us to see such great share price performance for investors.

Since the long term performance has been good but there's been a recent pullback of 5.2%, let's check if the fundamentals match the share price.

See our latest analysis for Target Hospitality

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

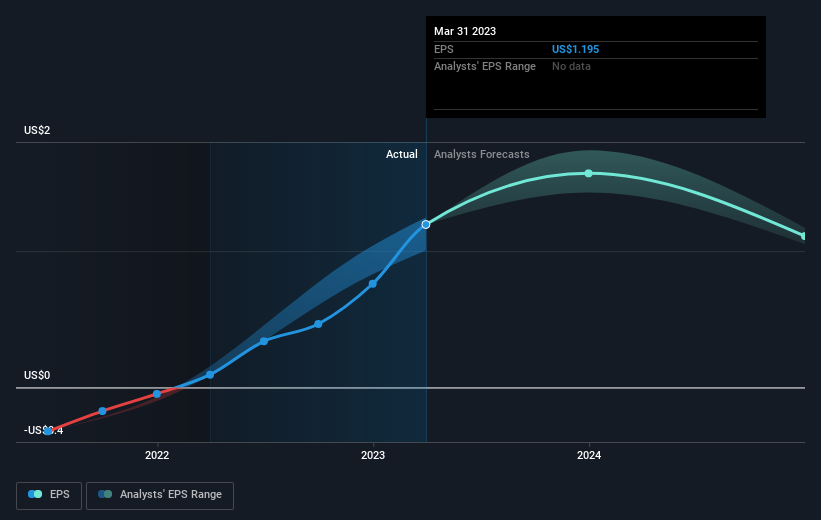

Target Hospitality was able to grow its EPS at 54% per year over three years, sending the share price higher. This EPS growth is lower than the 84% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. That's not necessarily surprising considering the three-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Target Hospitality has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Target Hospitality shareholders have gained 127% (in total) over the last year. That gain actually surpasses the 84% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Target Hospitality on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Target Hospitality (of which 1 is significant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Target Hospitality might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TH

Target Hospitality

Operates as a specialty rental and hospitality services company in North America.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives