- United States

- /

- Hospitality

- /

- NasdaqCM:TH

Despite Retreating US$85m Last Week, Target Hospitality Investors Are Up 401% Over Year

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the Target Hospitality Corp. (NASDAQ:TH) share price rocketed moonwards 401% in just one year. On top of that, the share price is up 34% in about a quarter. Looking back further, the stock price is 194% higher than it was three years ago.

Since the long term performance has been good but there's been a recent pullback of 5.0%, let's check if the fundamentals match the share price.

See our latest analysis for Target Hospitality

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Target Hospitality went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 65% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

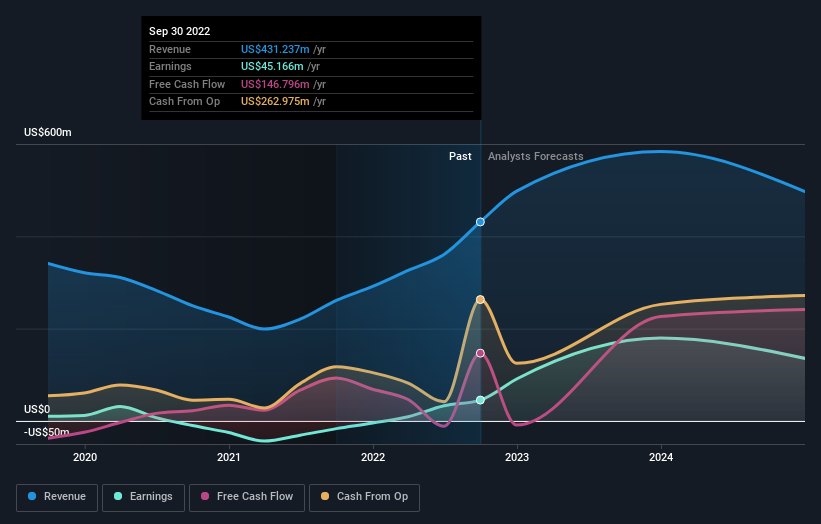

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pleasingly, Target Hospitality's total shareholder return last year was 401%. So this year's TSR was actually better than the three-year TSR (annualized) of 43%. Given the track record of solid returns over varying time frames, it might be worth putting Target Hospitality on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Target Hospitality you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Target Hospitality might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TH

Target Hospitality

Operates as a specialty rental and hospitality services company in North America.

Flawless balance sheet and good value.