- United States

- /

- Hospitality

- /

- NasdaqGS:TCOM

Trip.com Group (NASDAQ:TCOM) Will Be Hoping To Turn Its Returns On Capital Around

When researching a stock for investment, what can tell us that the company is in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after we looked into Trip.com Group (NASDAQ:TCOM), the trends above didn't look too great.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Trip.com Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.02 = CN¥2.7b ÷ (CN¥209b - CN¥75b) (Based on the trailing twelve months to March 2023).

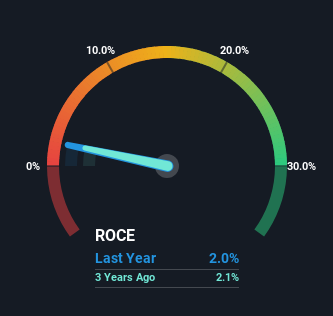

Thus, Trip.com Group has an ROCE of 2.0%. In absolute terms, that's a low return and it also under-performs the Hospitality industry average of 9.0%.

See our latest analysis for Trip.com Group

In the above chart we have measured Trip.com Group's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for Trip.com Group

- Debt is well covered by earnings.

- No major weaknesses identified for TCOM.

- Annual revenue is forecast to grow faster than the American market.

- Good value based on P/E ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

- Annual earnings are forecast to grow slower than the American market.

How Are Returns Trending?

In terms of Trip.com Group's historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 2.6%, however they're now substantially lower than that as we saw above. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Trip.com Group to turn into a multi-bagger.

Our Take On Trip.com Group's ROCE

In summary, it's unfortunate that Trip.com Group is generating lower returns from the same amount of capital. Investors haven't taken kindly to these developments, since the stock has declined 23% from where it was five years ago. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

One more thing to note, we've identified 1 warning sign with Trip.com Group and understanding this should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Trip.com Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TCOM

Trip.com Group

Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally.

Flawless balance sheet and undervalued.