- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

How Might Regulatory Risks Shape Sportradar's Global Ambitions and Valuation Narrative (SRAD)?

Reviewed by Sasha Jovanovic

- Sportradar Group AG recently presented at the 14th Annual ROTH Technology Conference in New York, with senior investor relations executives discussing business developments and market outlooks.

- This comes as the company grapples with heightened regulatory scrutiny regarding its involvement in sports betting markets that lack clear oversight.

- We'll examine how concerns about regulatory uncertainty and Sportradar's exposure to less-regulated jurisdictions may impact its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sportradar Group Investment Narrative Recap

To be a Sportradar Group shareholder, you need to believe that the continued expansion of global sports betting and the rising demand for advanced sports data will offset rising competition and regulatory remains the most important near-term catalyst. The recent appearance at the ROTH Technology Conference surfaces questions about regulatory risks and exposure to loosely regulated markets, but the news does not appear to materially alter the central catalyst or amplify existing risks at this stage.

The most relevant update in context is Sportradar’s raised fiscal 2025 guidance, signaling management confidence amid ongoing scrutiny. This aligns with the strong momentum seen in recent quarterly sales and partnership gains, suggesting that, at least currently, growth expectations remain intact despite regulatory uncertainties.

However, it is important for investors to note that, contrary to optimism around guidance upgrades, unresolved questions around regulatory oversight in emerging betting markets could...

Read the full narrative on Sportradar Group (it's free!)

Sportradar Group's outlook forecasts €1.8 billion in revenue and €262.9 million in earnings by 2028. This implies a 15.5% annual revenue growth rate and a €153.3 million increase in earnings from the current level of €109.6 million.

Uncover how Sportradar Group's forecasts yield a $33.18 fair value, a 57% upside to its current price.

Exploring Other Perspectives

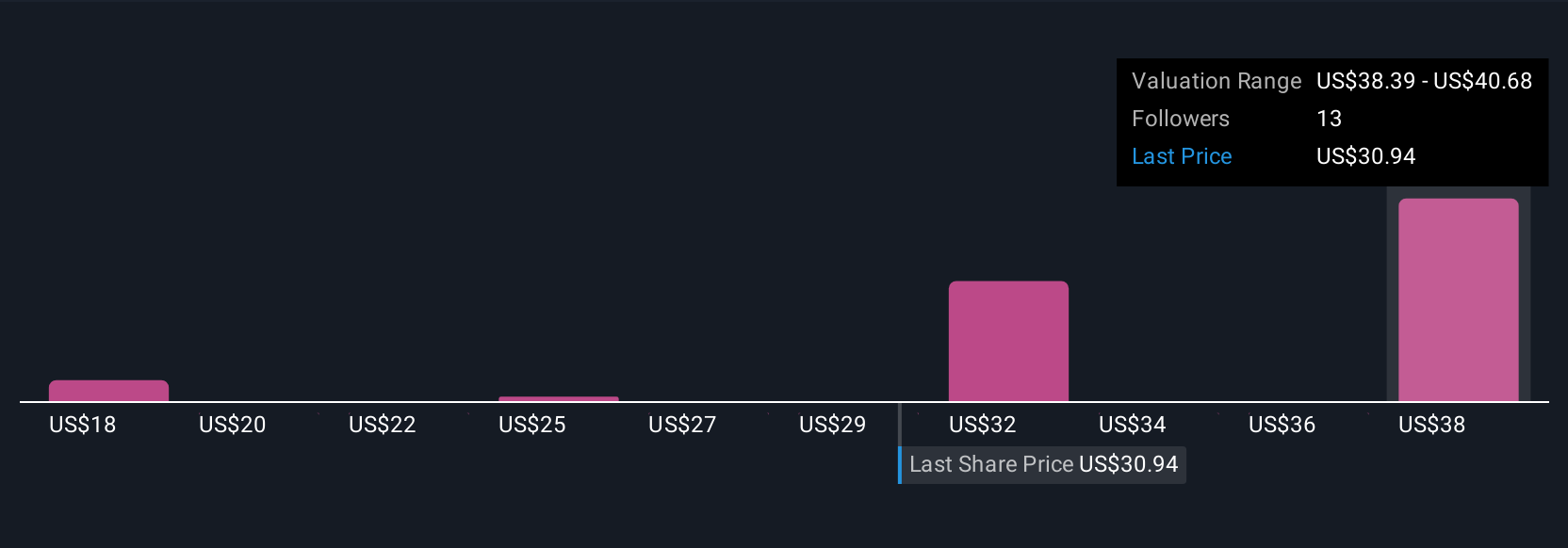

Four different Simply Wall St Community fair value estimates for Sportradar span from €17.81 to €45.83 per share, revealing varied opinions on potential upside. While many are bullish on recurring revenue growth as betting demand expands, some caution that evolving regulations may still test revenue stability and investor confidence. Review these viewpoints to consider the full picture for Sportradar Group.

Explore 4 other fair value estimates on Sportradar Group - why the stock might be worth over 2x more than the current price!

Build Your Own Sportradar Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sportradar Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sportradar Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sportradar Group's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives