- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

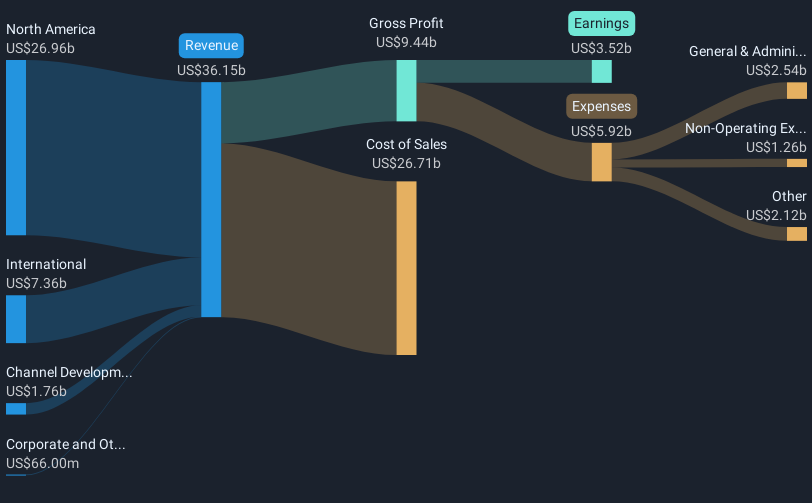

Starbucks (SBUX) Reports Q3 Revenue Growth But Net Income Falls YoY

Reviewed by Simply Wall St

Starbucks (SBUX) showcased a notable revenue increase in its third-quarter earnings report, despite a decline in net income and earnings per share. The company's stock price moved by 16% over the last quarter, potentially buoyed by a favorable dividend announcement and strategic board changes. The broader market trends, like optimism about corporate earnings and a stable monetary policy environment, likely also supported this stock movement, as investors maintained their focus on earnings and strategic outlooks. Other events, like discussions around the potential sale of operations in China, could have influenced the broader investor perception of Starbucks.

We've identified 3 weaknesses for Starbucks (1 is a bit unpleasant) that you should be aware of.

The news regarding Starbucks' revenue increase amidst declining net income and earnings per share, coupled with strategic board changes and a dividend announcement, may bolster confidence in the company's ongoing initiatives like the Back to Starbucks strategy and Green Apron model. These efforts aim to enhance customer satisfaction and operational efficiency, which could positively influence revenue growth projections and margins. The discussions around potential operations in China could further align with Starbucks' focus on expanding in growth markets.

Over the past five years, Starbucks has achieved a total shareholder return of 37.98%, including share price appreciation and dividends. While positive, this performance should be contextualized against the last year's underwhelming performance relative to the US Hospitality industry's 30.1% return. This indicates resilience but also highlights competitive pressures and economic challenges impacting the sector.

The recent share price movement of 16% over the last quarter situates Starbucks close to its analyst consensus price target of US$94.42. The current price of US$92.96 is only slightly below the target, reflecting market expectations of the company's future earnings growth and strategic execution. Investors may interpret this narrow gap as a sign of confidence in the company's initiatives and potential for revenue and earnings improvement, although any deviations in execution or external economic conditions could alter this outlook.

Dive into the specifics of Starbucks here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives