- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

Does SharpLink Gaming’s 125% Surge in 2025 Signal Real Value After DraftKings Collaboration?

Reviewed by Bailey Pemberton

If you have been eyeing SharpLink Gaming lately, you are definitely not alone. The stock has shown some serious moves recently, climbing 13.6% in just the past week and 8.1% over the past month. What really catches the eye is the staggering return year-to-date of 125.0%, and a robust 108.8% gain over the last year. For long-term followers, there is also the memory of an 81.1% drop over the last three years, reminding us that this stock is no stranger to volatility and high-stakes swings. This momentum raises the question: is it a sign of uncovering untapped value, or are we seeing investors amp up their risk appetite following some intriguing market developments in the online gaming sector?

When it comes to how the market actually values SharpLink Gaming, things get even more interesting. According to our valuation model, the company scores 1 out of a possible 6 on the undervaluation scale. This means it is considered undervalued on only one of the six main valuation metrics analysts tend to look at. It may not be a definitive sign, but perhaps an early signal worth further investigation. Next, we will break down exactly what those valuation methods reveal about the company and explore a more holistic way to assess its value that might give investors the clearest perspective yet.

SharpLink Gaming scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SharpLink Gaming Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those cash flows back to their present value. This approach helps investors assess what the business might realistically be worth right now, based on anticipated future performance.

For SharpLink Gaming, the company reported a negative Free Cash Flow (FCF) of -$4.00 Million in the last twelve months, reflecting recent challenges. Looking ahead, analysts forecast a significant turnaround, with FCF expected to reach $22.64 Million by 2026. Longer-term outlooks, modeled by Simply Wall St, extrapolate even more impressive growth, projecting cash flows exceeding $324.16 Million by 2035. This highlights the company's high-growth potential if these expectations are met.

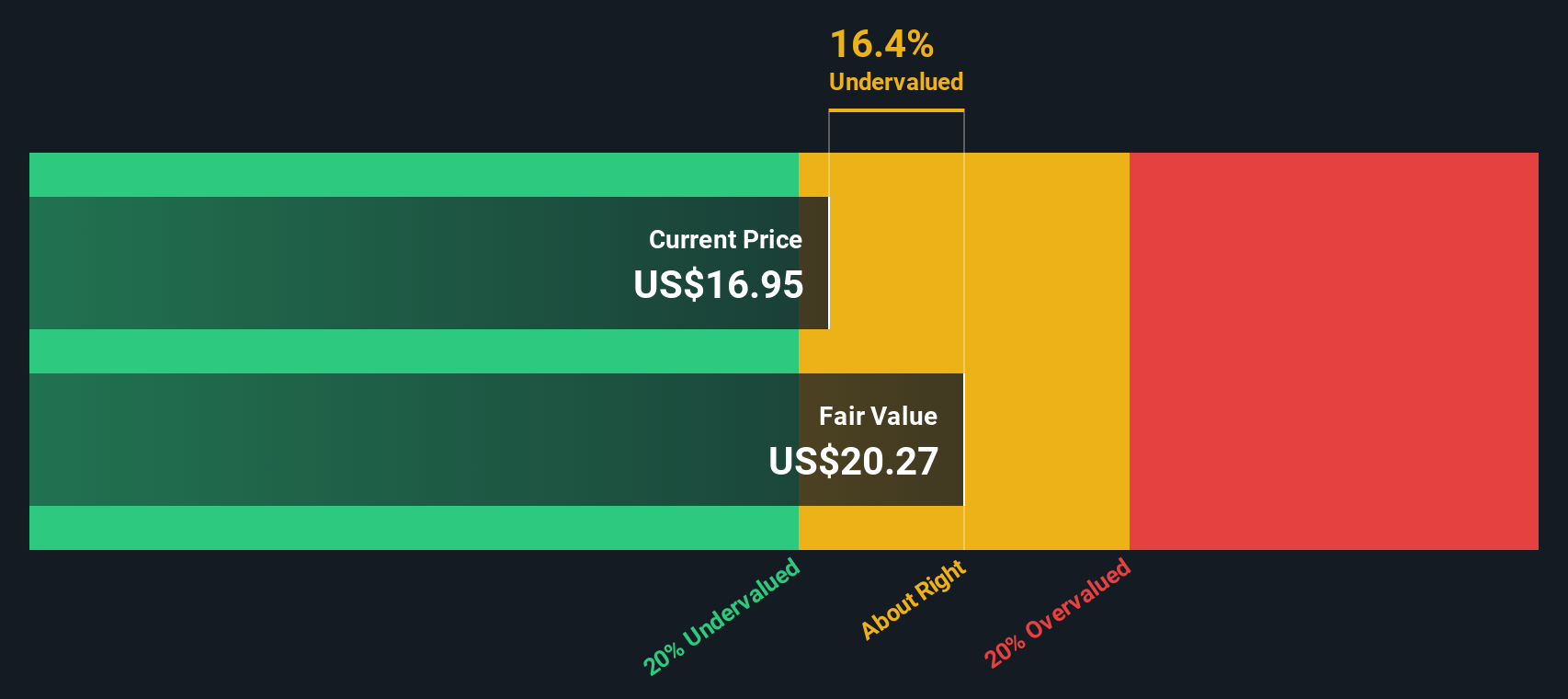

After discounting these future cash flows to their value today, the DCF model calculates an intrinsic value of $20.24 per share. Compared to the current market price, this suggests the stock is trading at a 10.2% discount, indicating that, by this measure, SharpLink Gaming is undervalued based on its long-term growth prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SharpLink Gaming is undervalued by 10.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: SharpLink Gaming Price vs Book

The Price-to-Book (P/B) ratio is a popular valuation metric for companies where profitability may still be developing or where assets play a major role in business value. It is particularly useful for evaluating firms in industries like hospitality, where book value, essentially net assets, remains a reliable foundation for comparison, especially when earnings are inconsistent or negative.

Growth expectations and risk can heavily influence what is considered a "normal" P/B ratio. Fast-growing companies or those with strong future prospects may command a higher multiple, while increased business risks or uncertain outlooks generally drag the ratio lower. The context of each company and its industry is crucial when making these comparisons.

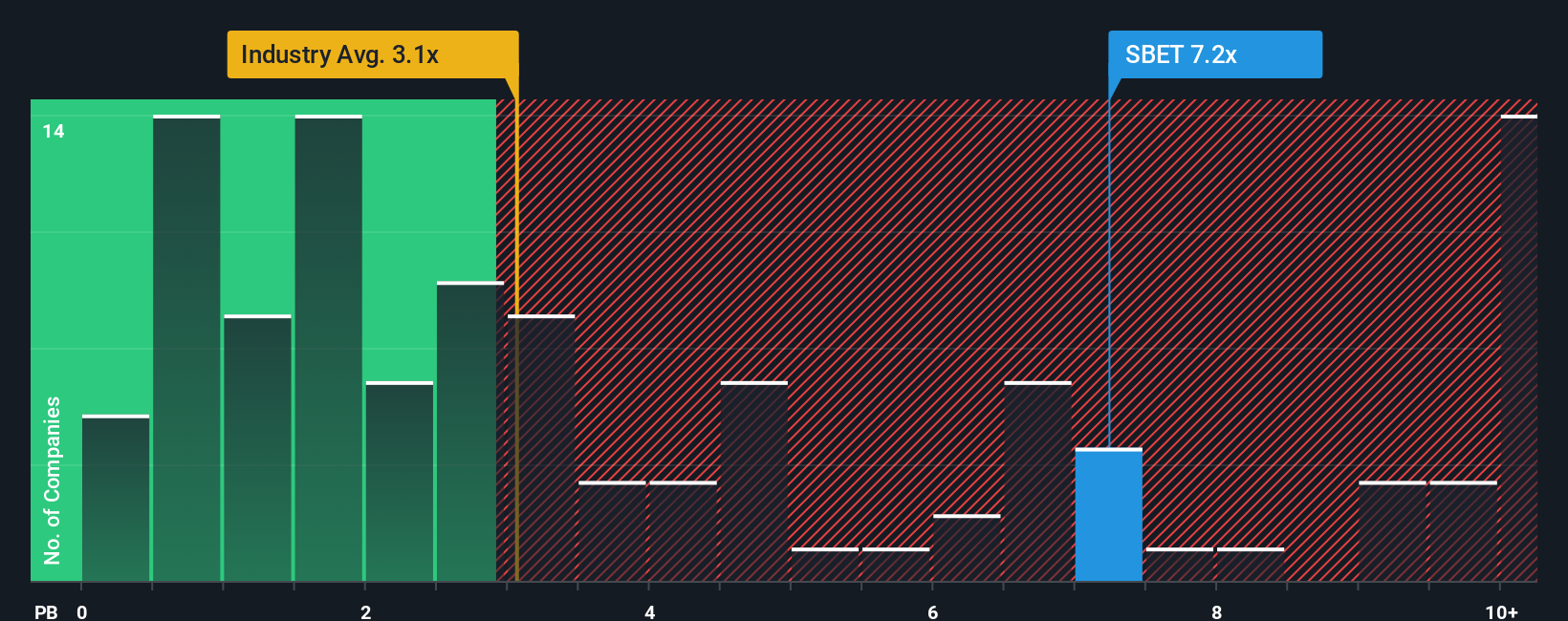

Currently, SharpLink Gaming trades at a P/B ratio of 7.76x. This is significantly above the hospitality industry average of 3.13x and also outpaces the peer average of 2.14x. On the surface, this suggests the stock carries a hefty premium compared to typical industry valuations. However, raw comparisons do not tell the full story, as they miss the nuances of SharpLink's specific growth profile, asset quality, risk level, and position within its market niche.

This is where the Simply Wall St “Fair Ratio” offers investors a more tailored benchmark. Unlike traditional methods that only consider broad industry or peer group averages, the Fair Ratio incorporates important details such as projected growth rates, profit margins, market cap, sector risks, and other unique factors that influence how the market should value this particular stock. By doing so, it provides a much more accurate sense of what an appropriate book multiple should be for SharpLink Gaming at this time.

Comparing the actual P/B ratio with the Fair Ratio allows us to see if the market price reflects the true underlying value. If the ratio is meaningfully higher, the stock is likely overvalued. In SharpLink's case, the difference between the current P/B ratio and its Fair Ratio is sizable, indicating a valuation above what its fundamentals suggest should be fair at this stage.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SharpLink Gaming Narrative

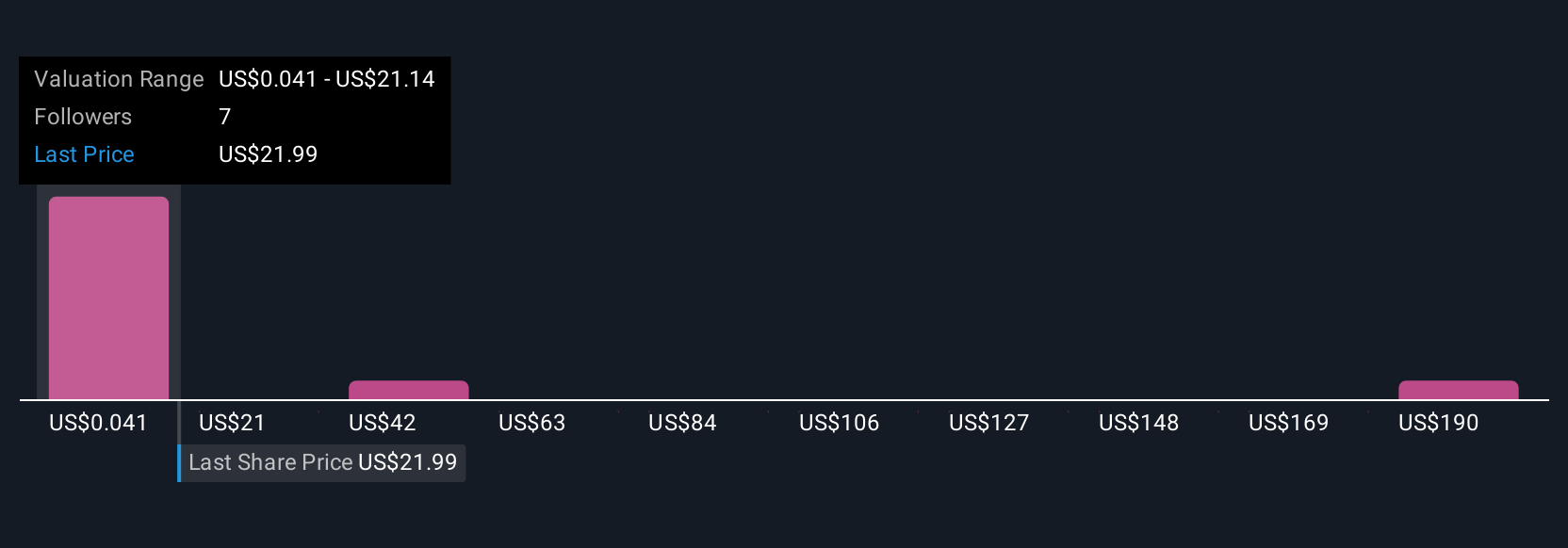

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful approach where you define your own story for a company, linking your perspective and expectations such as fair value, future revenue, earnings, and margins to a financial forecast.

By connecting a company’s story directly to the numbers and resulting fair value, Narratives empower you to make investment decisions with context and confidence. On Simply Wall St's Community page, used by millions of investors, anyone can quickly create or follow Narratives to see how different outlooks translate into actionable fair values.

This tool provides clear, side-by-side comparisons of each Narrative's fair value versus today's share price, helping you easily decide if you think it is time to buy or sell. As new information such as earnings or breaking news emerges, Narratives automatically update, ensuring your view remains relevant.

For example, in SharpLink Gaming’s case, one investor might build a bullish Narrative projecting rapid growth and a high fair value, while another could expect slower progress and assign a more conservative estimate.

Do you think there's more to the story for SharpLink Gaming? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

An online performance marketing company, delivers fan activation solutions to its sportsbook and casino partners.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives