- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

A Fresh Look at SharpLink Gaming (SBET) Valuation Following Tokenized Equity and Blockchain Expansion Announcement

Reviewed by Kshitija Bhandaru

SharpLink Gaming (SBET) just revealed plans to tokenize its SEC-registered common stock on the Ethereum blockchain, teaming up with Superstate as Digital Transfer Agent. This move demonstrates SharpLink’s commitment to advancing blockchain-integrated equity.

See our latest analysis for SharpLink Gaming.

SharpLink Gaming has made headlines not just for its plans to tokenize its equity, but also for a recent increase in authorized shares and its high-profile partnerships in the blockchain world. After accumulating one of the largest Ethereum corporate treasuries and launching a strategy aligned with digital asset innovation, the company’s momentum is getting noticed. The 1-year total shareholder return of nearly 0.85% hints at steady, if modest, progress, while the share price has recently inched higher as excitement builds around its blockchain-forward approach.

If all this talk of blockchain and transformation has your curiosity piqued, it might be the perfect moment to broaden your search and uncover fast growing stocks with high insider ownership

With shares up over 21% in the past month and trading at a considerable discount to analysts’ targets, the question becomes whether SharpLink’s digital-forward transformation leaves room for upside or if the market is already pricing in future growth.

Price-to-Book of 7.8x: Is it justified?

SharpLink Gaming’s shares currently change hands at 7.8 times book value, a figure that stands well above both the US hospitality sector’s 3.1x average and its main peer group’s 2.1x multiple. This elevated ratio signals that the market is pricing in significantly more optimism about future prospects compared to most rivals, despite the company’s recent share price gains.

The price-to-book ratio measures a company’s market value against its balance sheet equity. For hospitality businesses, which can have volatile profits, price-to-book offers insight into how much investors are willing to pay for each dollar of net assets. SharpLink’s high multiple indicates investors are paying a substantial premium to own the company compared to similar businesses.

SharpLink’s valuation premium appears even more significant when benchmarked against its own peer group, where the price-to-book stands at just 2.1x. This gap suggests expectations for faster growth or a digital breakthrough are being factored in. However, there is a risk if the market is too optimistic about near-term execution. There is no available fair ratio figure to compare just how far the market is willing to go.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 7.8x (OVERVALUED)

However, challenges like persistent net losses and uncertainty in delivering consistent revenue growth could quickly temper the current optimism surrounding SharpLink’s outlook.

Find out about the key risks to this SharpLink Gaming narrative.

Another View: DCF Points to Possible Value

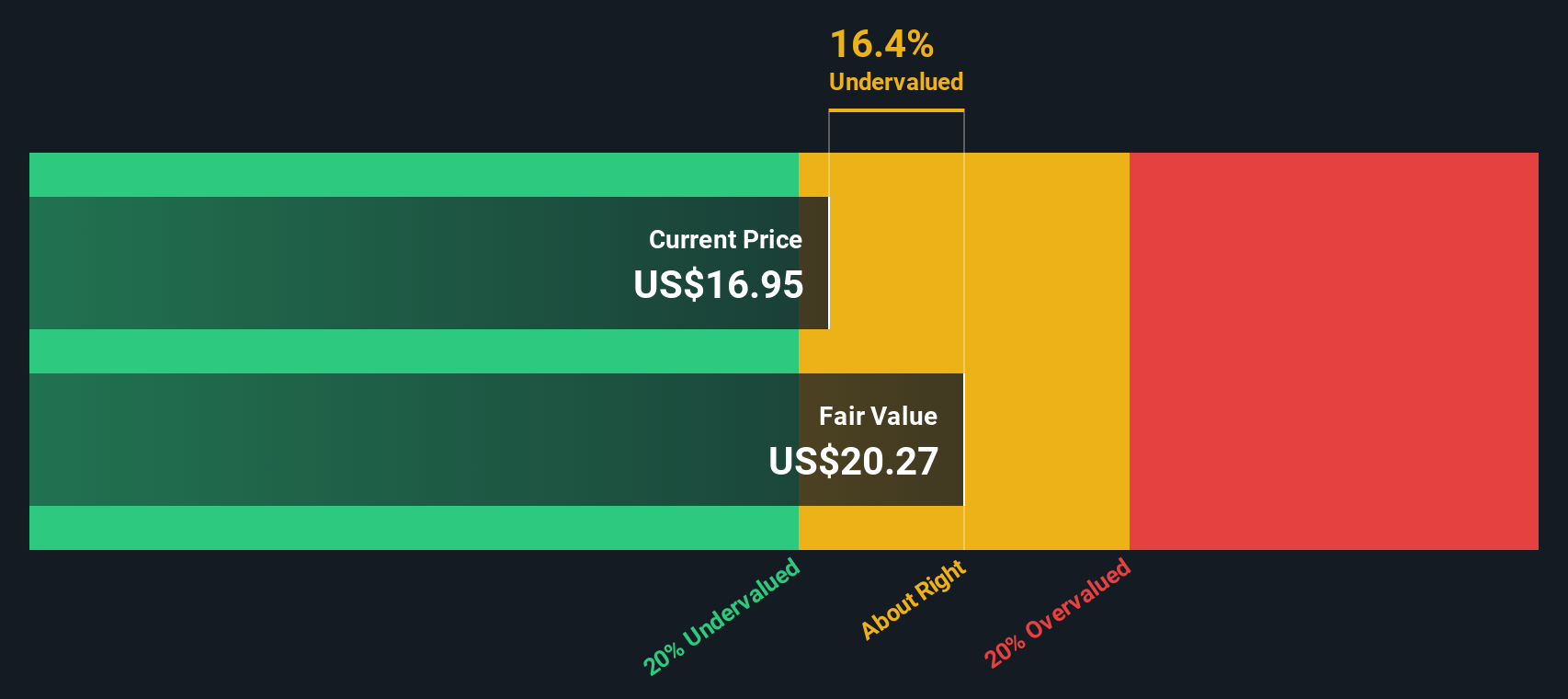

While the market’s optimism is reflected in the high price-to-book ratio, a look at value through our SWS DCF model tells a different story. By this method, SharpLink is trading about 10% below our fair value estimate, suggesting the shares could have more upside. Why are the two models telling different stories? Which should drive your next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

If you have a different perspective or want to examine the numbers hands-on, you can easily build your own story around SharpLink Gaming in just a few minutes. Do it your way

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Be proactive and expand your horizons. Some of the best returns come from where you least expect them. Don’t let tomorrow’s winners get away from you.

- Unlock potential by tracking these 886 undervalued stocks based on cash flows, uniquely priced below their true worth before the market catches on.

- Get ahead of exciting breakthroughs by following these 24 AI penny stocks, making waves in artificial intelligence across multiple industries today.

- Secure reliable income as you pursue these 19 dividend stocks with yields > 3%, offering robust yields and steady performance for the long haul.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

An online performance marketing company, delivers fan activation solutions to its sportsbook and casino partners.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives