- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

Does Durango Expansion Signal a New Growth Phase for Red Rock Resorts (RRR)?

Reviewed by Sasha Jovanovic

- Red Rock Resorts recently submitted plans to expand its Durango Casino & Resort in Las Vegas, including new amenities such as a bowling alley, pool hall, and movie theater.

- This move highlights the company's continued commitment to enhancing guest experience and investing in its high-performing casino operations for potential revenue growth.

- We'll explore how Red Rock Resorts' expansion plans for Durango Casino & Resort could influence expectations for its future earnings and market position.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Red Rock Resorts Investment Narrative Recap

Owning Red Rock Resorts means believing in the strength of Las Vegas's growing local market and the company's ability to capture rising visitation through continuous investment in its properties. While the news of the Durango Casino & Resort expansion may help drive further interest and boost visitor numbers, it does not change the company’s primary short-term risk, elevated capital expenditures for multiple ongoing projects, which could weigh on cash flow if anticipated returns take time to materialize.

A recent announcement that stands out is the company's ongoing series of quarterly dividends, including a declared US$0.25 per share payout for Q3 2025. This signal of capital return to shareholders is particularly interesting given Red Rock's heavy near-term investment cycle and the accompanying pressure on free cash flow, highlighting the company's balancing act between growth and returns to shareholders.

On the flip side, investors should be aware that concentrated exposure to Las Vegas’s local economy could mean a...

Read the full narrative on Red Rock Resorts (it's free!)

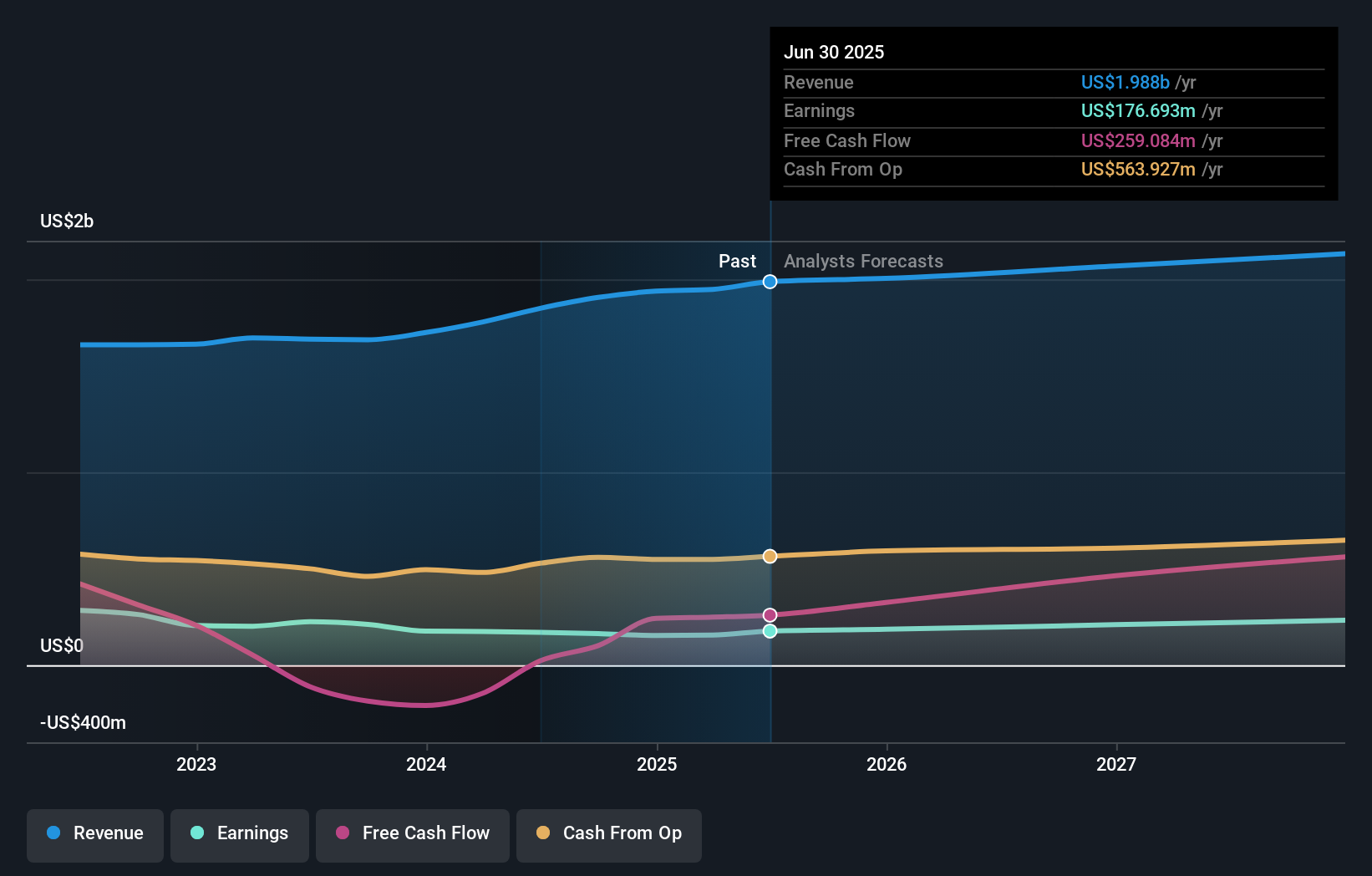

Red Rock Resorts is projected to reach $2.2 billion in revenue and $249.6 million in earnings by 2028. This forecast implies annual revenue growth of 2.9% and a $72.9 million increase in earnings from the current level of $176.7 million.

Uncover how Red Rock Resorts' forecasts yield a $64.08 fair value, a 8% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community fair value estimate is US$100.64, reflecting only one perspective so far. Alongside the company’s increased capital spending for new amenities, this invites you to consider how your outlook stacks up next to others.

Explore another fair value estimate on Red Rock Resorts - why the stock might be worth as much as 70% more than the current price!

Build Your Own Red Rock Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Rock Resorts research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Red Rock Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Rock Resorts' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion