- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Papa John’s (PZZA): Assessing Valuation Following Major Refranchising Deal and Growth Expansion Plans

Reviewed by Simply Wall St

Papa John's International (PZZA) has launched a new phase in its growth strategy, announcing the refranchising of 85 restaurants to Pie Investments and introducing plans to open 52 additional locations by 2030.

See our latest analysis for Papa John's International.

The past year has seen Papa John's implement leadership changes and pursue bold expansion, but the 1-year total shareholder return of -11.2% and a 3-year total return down 43.5% show investors remain cautious despite glimmers of momentum. Still, recent refranchising and steady leadership shifts suggest the company is working to reignite growth and rebuild confidence for the long haul.

If you’re curious about what other growth-focused companies are capturing attention, this is an ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

The company’s latest moves have shifted the spotlight onto its valuation, with shares recently showing a notable discount to analyst price targets. Is Papa John’s setting up a buying opportunity, or is the market already pricing in its next chapter of growth?

Most Popular Narrative: 12% Undervalued

Papa John’s most widely-followed narrative calls for a fair value higher than the last close, suggesting share price upside if key drivers are realized. The current price lags the narrative fair value, even after factoring in cautious earnings and margin projections.

The international expansion with emphasis on key growth markets, such as the Middle East and Latin America, aims to generate higher average unit volumes, contributing to revenue growth and increased earnings. The review of the North American commissary and distribution network to improve supply chain efficiency is likely to enhance franchisee profitability and support net margins through cost savings.

Want to know what drives this value call? The narrative banks on big overseas gains and sharply shifting margins. The true twist lies in bold future earnings forecasts. Think you can predict the specific numbers driving this outlook? Dive in, as the biggest surprises might be hidden in plain sight.

Result: Fair Value of $47.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a decline in comparable sales or a lack of progress in international growth could quickly undermine the optimistic case for Papa John's share price.

Find out about the key risks to this Papa John's International narrative.

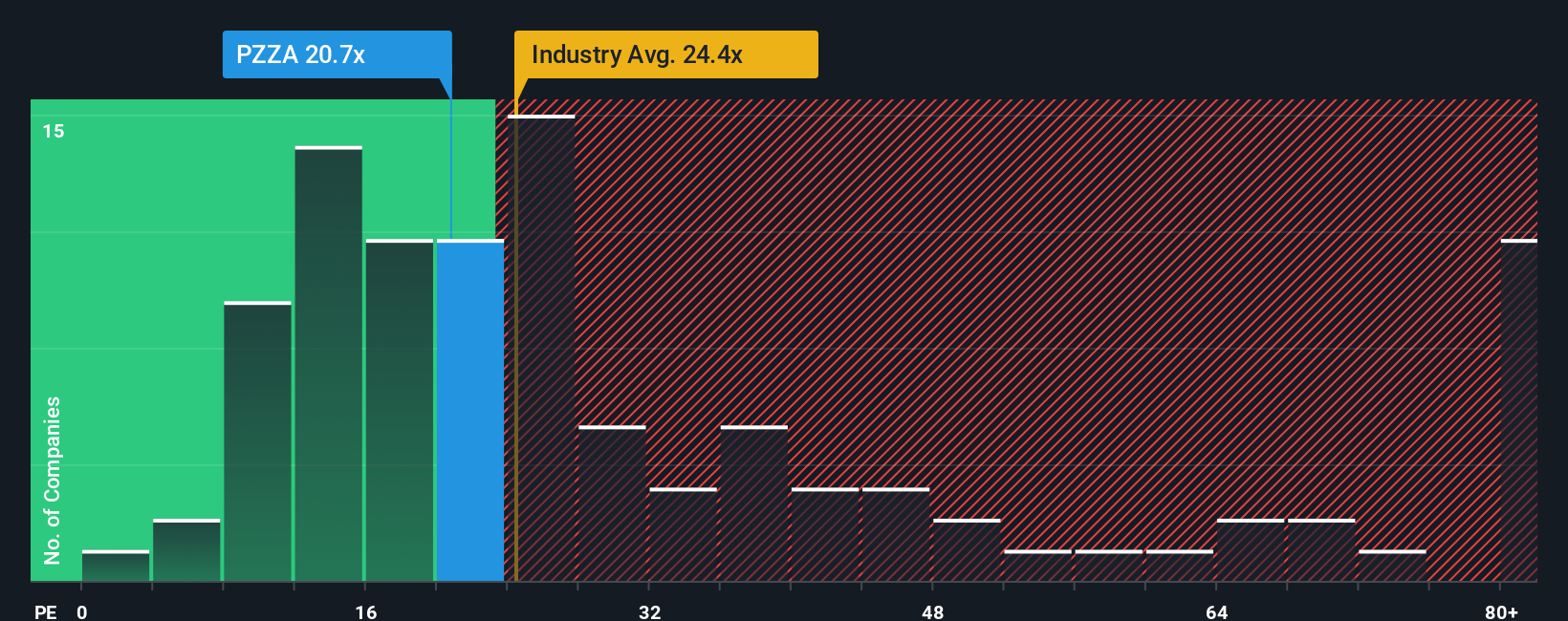

Another View: Multiples Raise Red Flags

While analyst narratives and fair value estimates point to upside, the company’s price-to-earnings ratio stands much higher than both industry and peer averages. With 36.9x compared to the industry at 21.3x and a peer average of 14x, there is a real risk the market eventually reverts toward a fair ratio of 33.6x. Is the premium a sign of hidden strength or just an expensive bet?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Papa John's International Narrative

If you want a deeper dive or feel that your perspective brings something new, you can put together your own take in just minutes. Do it your way

A great starting point for your Papa John's International research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready to Expand Your Watchlist?

Act now and plug into handpicked investment themes that could reshape your financial future. Don’t let fresh opportunities pass you by when they’re this accessible.

- Unlock the potential for steady income streams by scanning these 15 dividend stocks with yields > 3% with yields above 3% for your portfolio’s next stable pillar.

- Capitalize on the healthcare revolution by zeroing in on breakthroughs in treatment and diagnostics with these 30 healthcare AI stocks.

- Seize undervalued prospects based on cash flows and spot tomorrow’s winners early through these 913 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026