- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Even With A 27% Surge, Cautious Investors Are Not Rewarding Papa John's International, Inc.'s (NASDAQ:PZZA) Performance Completely

Those holding Papa John's International, Inc. (NASDAQ:PZZA) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.2% over the last year.

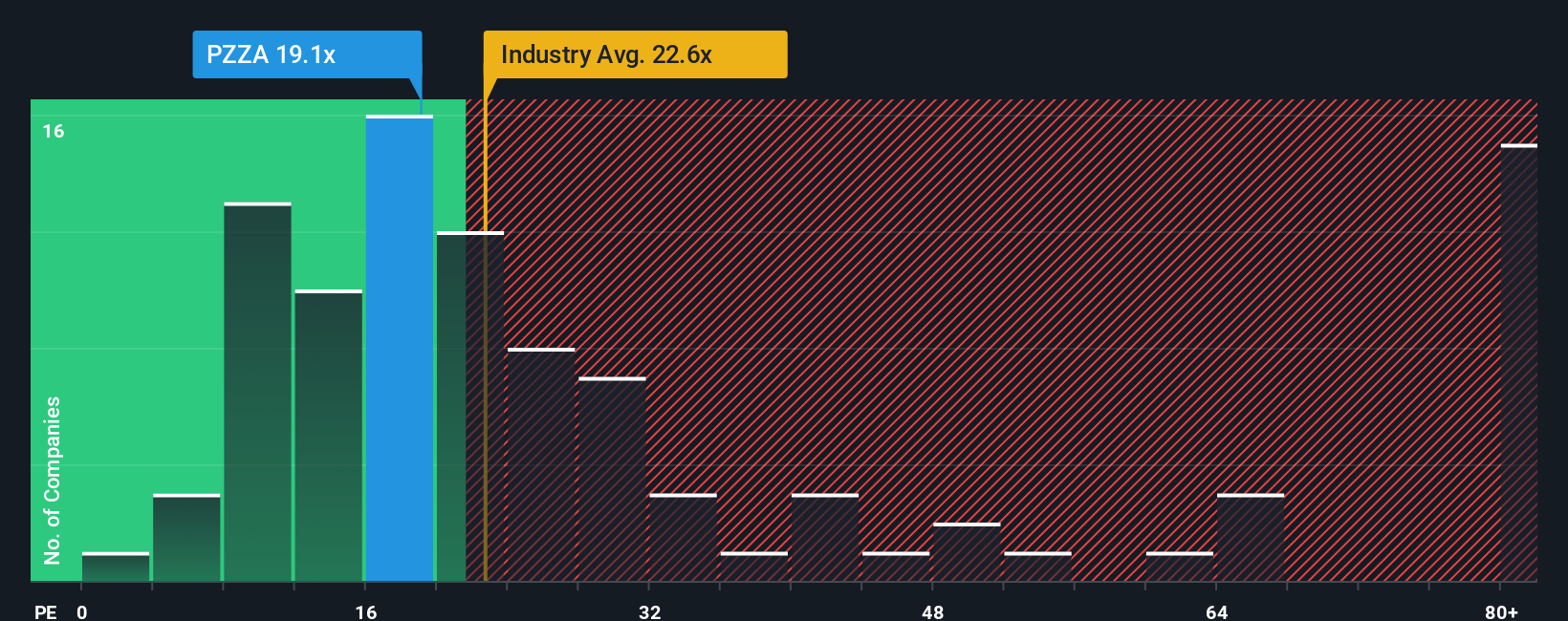

Although its price has surged higher, there still wouldn't be many who think Papa John's International's price-to-earnings (or "P/E") ratio of 19.1x is worth a mention when the median P/E in the United States is similar at about 18x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Papa John's International's and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Check out our latest analysis for Papa John's International

How Is Papa John's International's Growth Trending?

The only time you'd be comfortable seeing a P/E like Papa John's International's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 3.8%. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the analysts watching the company. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Papa John's International's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Papa John's International's P/E

Papa John's International's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Papa John's International's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Papa John's International (1 is concerning!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives