- United States

- /

- Consumer Services

- /

- NasdaqGS:PRDO

Perdoceo Education Corporation's (NASDAQ:PRDO) Shares Bounce 31% But Its Business Still Trails The Market

Perdoceo Education Corporation (NASDAQ:PRDO) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

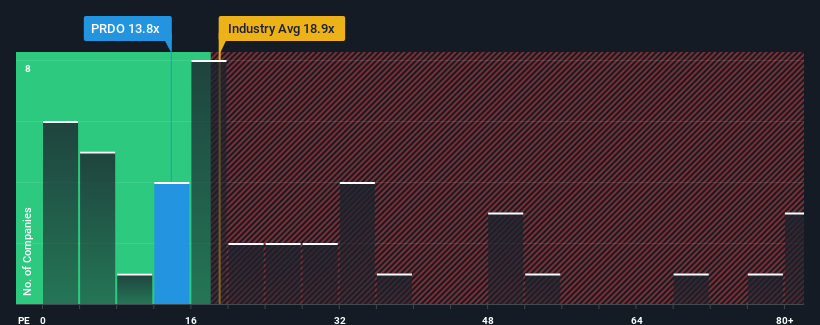

Although its price has surged higher, Perdoceo Education may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.8x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 36x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Perdoceo Education hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Perdoceo Education

How Is Perdoceo Education's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Perdoceo Education's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 11% during the coming year according to the lone analyst following the company. That's shaping up to be materially lower than the 15% growth forecast for the broader market.

With this information, we can see why Perdoceo Education is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Perdoceo Education's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Perdoceo Education's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Perdoceo Education that we have uncovered.

If these risks are making you reconsider your opinion on Perdoceo Education, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRDO

Perdoceo Education

Provides postsecondary education through online, campus-based, and blended learning programs in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives