- United States

- /

- Hospitality

- /

- NasdaqGS:PLAY

Slammed 26% Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) Screens Well Here But There Might Be A Catch

Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

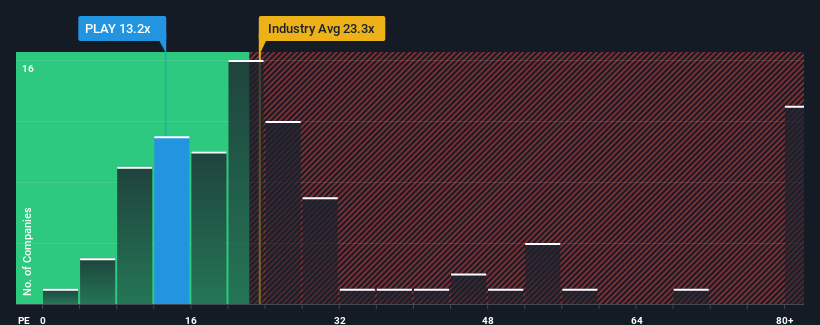

Following the heavy fall in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Dave & Buster's Entertainment as an attractive investment with its 13.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Dave & Buster's Entertainment could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Dave & Buster's Entertainment

How Is Dave & Buster's Entertainment's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Dave & Buster's Entertainment's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 25%. Even so, admirably EPS has lifted 304% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 30% during the coming year according to the ten analysts following the company. That's shaping up to be materially higher than the 15% growth forecast for the broader market.

With this information, we find it odd that Dave & Buster's Entertainment is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Dave & Buster's Entertainment's P/E

Dave & Buster's Entertainment's recently weak share price has pulled its P/E below most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Dave & Buster's Entertainment's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Dave & Buster's Entertainment (1 doesn't sit too well with us) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLAY

Dave & Buster's Entertainment

Owns and operates entertainment and dining venues for adults and families in North America.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026