- United States

- /

- Hospitality

- /

- NasdaqGS:PENN

One Crow Doesn't Make a Winter for Penn National Gaming (NASDAQ:PENN)

After a long period of ranging, Penn National Gaming, Inc. (NASDAQ: PENN) stock broke out. Unfortunately for the shareholders, it went in the wrong direction – dropping as much as 21% in a single session. While the earnings miss initiated the downward move, a controversial article by Business Insider about the Barstool Sports founder Dave Portnoy added oil to the fire.

View our latest analysis for Penn National Gaming

The company reported a mediocre third-quarter result with weaker earnings and profit margins, although revenues improved.

Third-quarter 2021 results

- Revenue: US$1.51b (up 34% from 3Q 2020).

- Net income: US$86.1m (down 39% from 3Q 2020).

- Profit margin: 5.7% (down from 13% in 3Q 2020).

The company reported a mediocre third-quarter result with weaker earnings and profit margins, although revenues improved. Higher expenses drove the decrease in the margin. Over the last 3 years, on average, earnings per share have fallen by 3% per year, but its share price has increased by 43% per year, which means it is well ahead of earnings.

The company got in the spotlight, not because of the mildly disappointing earnings report, but primarily thanks to the article by Business Insider that painted a negative picture about the Barstool founder Dave Portnoy. As a reminder, Penn has a 36% stake in Barstool Sports, which they acquired in January 2020.

While Business Insider reflected on Mr. Portnoy's lifestyle, it is worth noting that he is a person that has been very open about it for years. In market terms, one could say that his behavior should be priced-in his projects.

Yet, capitalism is somewhat amoral, and institutions like Credit Suisse recognize that. Their analyst Benjamin Chaiken reiterated the Outperform rating, quoting the intact long-term story and expecting a positive surprise with Score business in Canada.

Furthermore, Prescience Point Capital Management called the sell-off a "huge dislocation from actual biz fundamentals," putting a price target of US$75 on just the core casino business.

Estimating Value using a Discounted Cash Flow (DCF) Model

Companies can be valued in many ways, so we would point out that a DCF is not perfect for every situation. If you want to learn more about discounted cash flow, the rationale behind this calculation can be read in detail in the Simply Wall St analysis model.

What's the estimated Valuation?

We use what is known as a 2-stage model, which means we have two different periods of growth rates for the company's cash flows. Generally, the first stage is higher growth, and the second stage is a lower growth phase. To begin with, we have to get estimates of the next ten years of cash flows. Where possible, we use analyst estimates, but when these aren't available, we extrapolate the previous free cash flow (FCF) from the last estimate or reported value.

We assume companies with shrinking free cash flow will slow their rate of shrinkage and that companies with growing free cash flow will see their growth rate slow over this period. We do this to reflect that growth tends to slow more early than in later years.

Generally, we assume that a dollar today is more valuable than a dollar in the future, and so the sum of these future cash flows is then discounted to today's value:

10-year free cash flow (FCF) forecast

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF ($, Millions) | US$665.1m | US$727.3m | US$773.2m | US$811.9m | US$845.1m | US$874.2m | US$900.5m | US$924.7m | US$947.5m | US$969.5m |

| Growth Rate Estimate Source | Analyst x7 | Analyst x5 | Est @ 6.3% | Est @ 5% | Est @ 4.09% | Est @ 3.45% | Est @ 3% | Est @ 2.69% | Est @ 2.47% | Est @ 2.32% |

| Present Value ($, Millions) Discounted @ 9.8% | US$606 | US$604 | US$585 | US$559 | US$530 | US$500 | US$469 | US$439 | US$410 | US$382 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$5.1b

The second stage is also known as Terminal Value. This is the business's cash flow after the first stage. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.0%. We discount the terminal cash flows to today's value at the cost of equity of 9.8%.

Terminal Value (TV)= FCF2031 × (1 + g) ÷ (r – g) = US$970m× (1 + 2.0%) ÷ (9.8%– 2.0%) = US$13b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$13b÷ ( 1 + 9.8%)10= US$5.0b

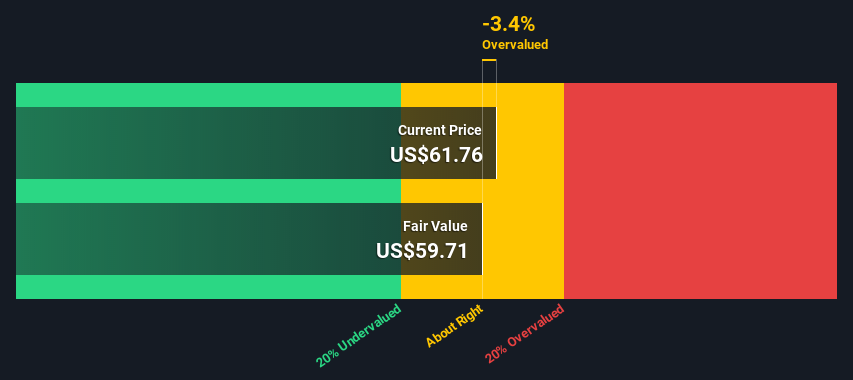

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$10b. The last step is to then divide the equity value by the number of shares outstanding. Compared to the current share price of US$61.8, the company appears around fair value at the time of writing.

Important assumptions

We would point out that the most critical inputs to a discounted cash flow are the discount rate and, of course, the actual cash flows. The DCF does not consider the possible cyclicality of an industry or its future capital requirements, so it does not give a complete picture of its potential performance.

Given that we are looking at Penn National Gaming as potential shareholders, the cost of equity is used as the discount rate rather than the cost of capital (or the weighted average cost of capital, WACC), which accounts for debt. We've used 9.8% in this calculation, which is based on a levered beta of 1.783. Beta is a measure of a stock's volatility compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, a reasonable range for a stable business.

Next Steps:

The recent turmoil pushed the PENN valuation down, but our model shows that this isn't the reason to give up on the stock. Furthermore, institutions remain optimistic, valuing it over 20% from the current levels.

Although the company's valuation is important, it shouldn't be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Instead, the best use for a DCF model is to test certain assumptions and theories to see if they would lead to the company being undervalued or overvalued.

For Penn National Gaming, we've put together three fundamental factors you should further examine:

- Risks: For example, we've discovered 3 warning signs for Penn National Gaming (1 is a bit concerning!) that you should be aware of before investing here.

- Future Earnings: How does PENN's growth rate compare to its peers and the broader market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High-Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high-quality stocks to get an idea of what else is out there you may be missing!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQGS every day. If you want to find the calculation for other stocks, just search here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:PENN

PENN Entertainment

Provides integrated entertainment, sports content, and casino gaming experiences.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives