- United States

- /

- Hospitality

- /

- NasdaqGS:PENN

Will Anticipation of Q3 Earnings Outperformance Change PENN Entertainment's (PENN) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, investors grew optimistic ahead of PENN Entertainment's third-quarter 2025 earnings report, encouraged by expectations of significant profit growth and a history of outperforming prior estimates.

- An interesting development is JMP Securities' decision to maintain its positive outlook on the stock, reflecting continued confidence in the company's online gaming momentum and omni-channel strategy.

- We'll examine how investor anticipation for potential earnings outperformance may impact PENN's investment narrative and sector positioning.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

PENN Entertainment Investment Narrative Recap

For investors considering PENN Entertainment, belief in the company’s ability to successfully scale its online gaming operations while balancing ongoing investments in both digital and retail channels is central. While a recent rally ahead of Q3 2025 earnings on positive analyst sentiment has driven optimism, the biggest near-term catalyst remains the earnings report itself, and whether PENN’s growing online division shows improvement toward profitability; however, the company’s persistent cash burn and pressure from competitive digital operators remain key risks. At this stage, the recent analyst rating changes and stock movement do not materially shift these fundamental considerations. Of the recent company announcements, the August launch of new ESPN BET Sportsbook features stands out, especially as it aligns closely with investor focus on PENN’s omni-channel strategy and online growth potential leading into the critical earnings period. Enhanced offerings like FanCenter and deeper ESPN integrations are widely seen as crucial elements that could help PENN reach larger, more engaged audiences and drive user growth, an important consideration ahead of the upcoming results, given the ongoing profitability challenges in the digital segment. Yet, in contrast to the optimism surrounding upcoming earnings, investors should be aware that persistently high digital losses may ...

Read the full narrative on PENN Entertainment (it's free!)

PENN Entertainment's projections call for $8.0 billion in revenue and $471.4 million in earnings by 2028. This reflects a 6.0% annual revenue growth rate and an earnings increase of $547 million from the current -$75.6 million.

Uncover how PENN Entertainment's forecasts yield a $22.00 fair value, a 29% upside to its current price.

Exploring Other Perspectives

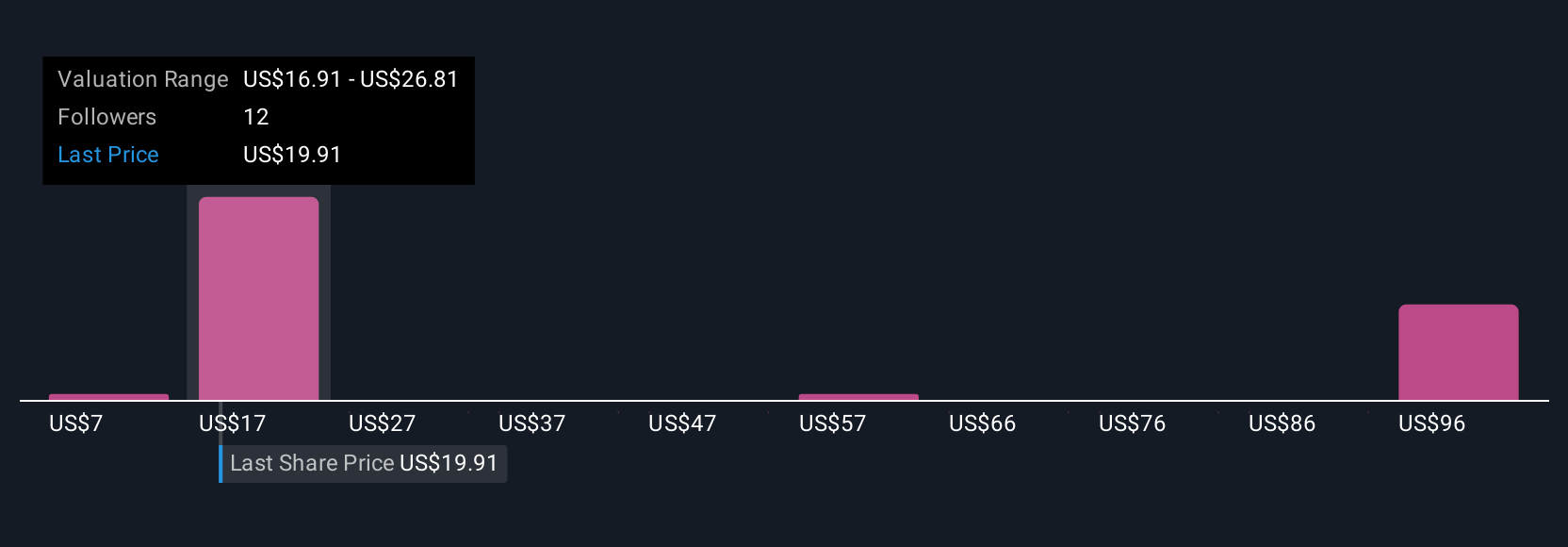

Three Simply Wall St Community fair value estimates for PENN range from US$22 to US$89.91 per share, with one at the lowest band and another at the highest. Online division profitability is a main focus this earnings season, and opinions reflect how outcomes here may reshape PENN’s longer-term performance, see how others weigh the risks and potential reward.

Explore 3 other fair value estimates on PENN Entertainment - why the stock might be worth just $22.00!

Build Your Own PENN Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PENN Entertainment research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PENN Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PENN Entertainment's overall financial health at a glance.

No Opportunity In PENN Entertainment?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENN

PENN Entertainment

Provides integrated entertainment, sports content, and casino gaming experiences.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives