- United States

- /

- Hospitality

- /

- NasdaqGS:PENN

Is PENN Entertainment’s 2.4% Weekly Rebound the Start of a Recovery?

Reviewed by Bailey Pemberton

If you have been keeping an eye on PENN Entertainment’s share price lately, you are not alone. Investors are weighing up whether this battered stock could be ripe for a comeback or still has further to fall. After a bumpy year, PENN closed at $17.57, a level that reflects both wary outlooks and lingering optimism. Over the past week, PENN shares managed a modest rebound of 2.4%, suggesting there is some appetite for risk after a tough stretch. However, if you look at a longer timeframe, skepticism remains. The stock is still down 8.3% over the last month and 8.7% year-to-date. Looking back three or even five years highlights an even starker picture, with drops of 43.9% and 69.0% respectively.

Why are some investors perking up now? Several developments in the gaming and digital betting space have added new context to the PENN story, fueling talk that the company’s current price may underplay its real potential. Whether it involves evolving partnerships, industry shifts, or regulatory changes attracting new eyes to this stock, the conversation keeps circling back to one key question: is PENN undervalued relative to its prospects?

This is where the numbers get interesting. On a scale where each valuation check adds a point to the score, PENN gets a 5 out of 6, which is a strong sign the company is undervalued by most traditional standards. Still, numbers alone do not always tell the full story. Read on as we walk through how those valuations stack up and explore an even more insightful way to assess PENN’s true worth later in the article.

Why PENN Entertainment is lagging behind its peers

Approach 1: PENN Entertainment Discounted Cash Flow (DCF) Analysis

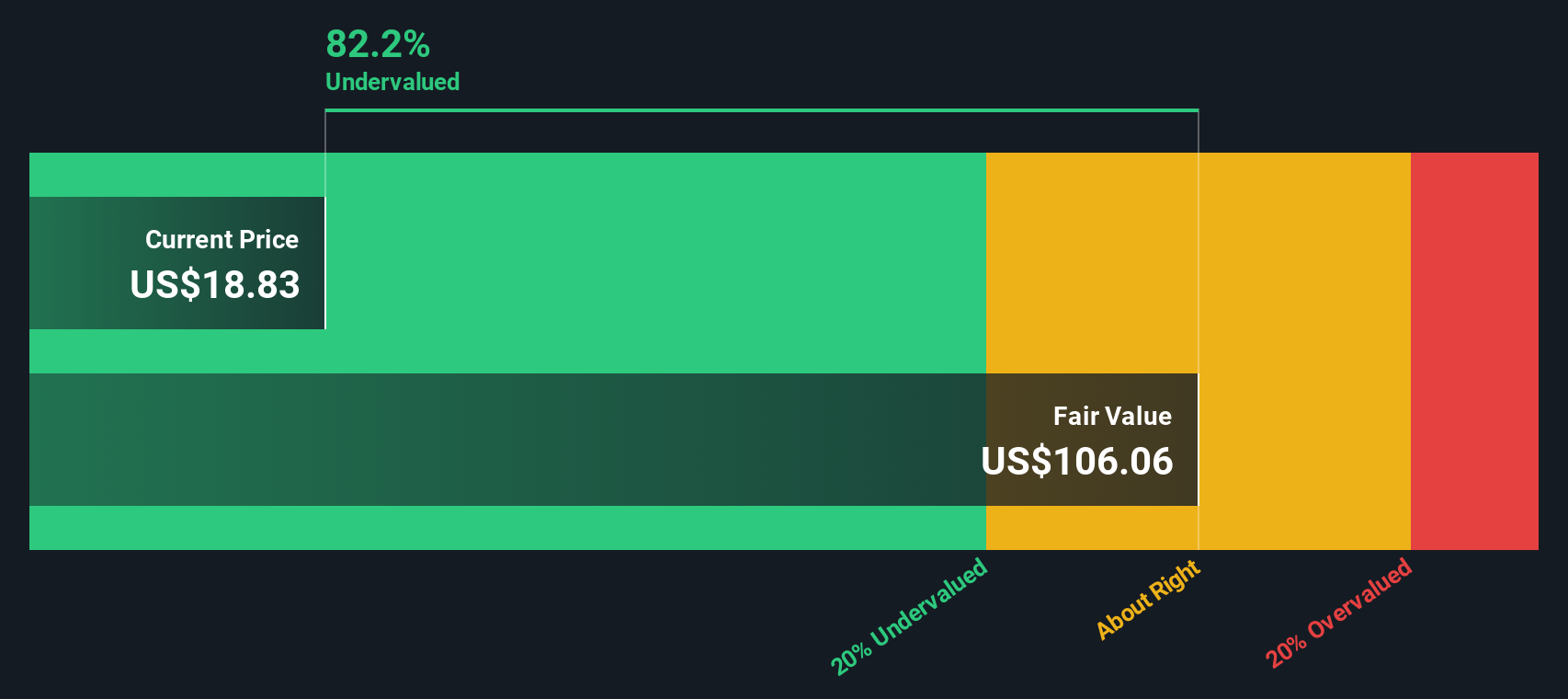

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting all its future cash flows and discounting them back to today. This provides a present value based on expected performance. This approach is widely used because it directly ties a company’s long-term profit potential to its current market value.

According to the DCF analysis for PENN Entertainment, the company last posted a Free Cash Flow (FCF) of $25.2 million. Analyst estimates guide projections for the next few years, with FCF expected to rise to $204.98 million by 2026 and $452.5 million by 2027. Projections beyond that rely on growth rates extrapolated from recent years, pushing annual FCF estimates to more than $2 billion by 2035.

Using these forecasts, the DCF model calculates PENN’s intrinsic share value at $89.91. When compared to the recent closing price of $17.57, this suggests the stock is trading at roughly an 80.5% discount to its projected fair value. Based on today’s cash flow outlook, PENN appears significantly undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PENN Entertainment is undervalued by 80.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

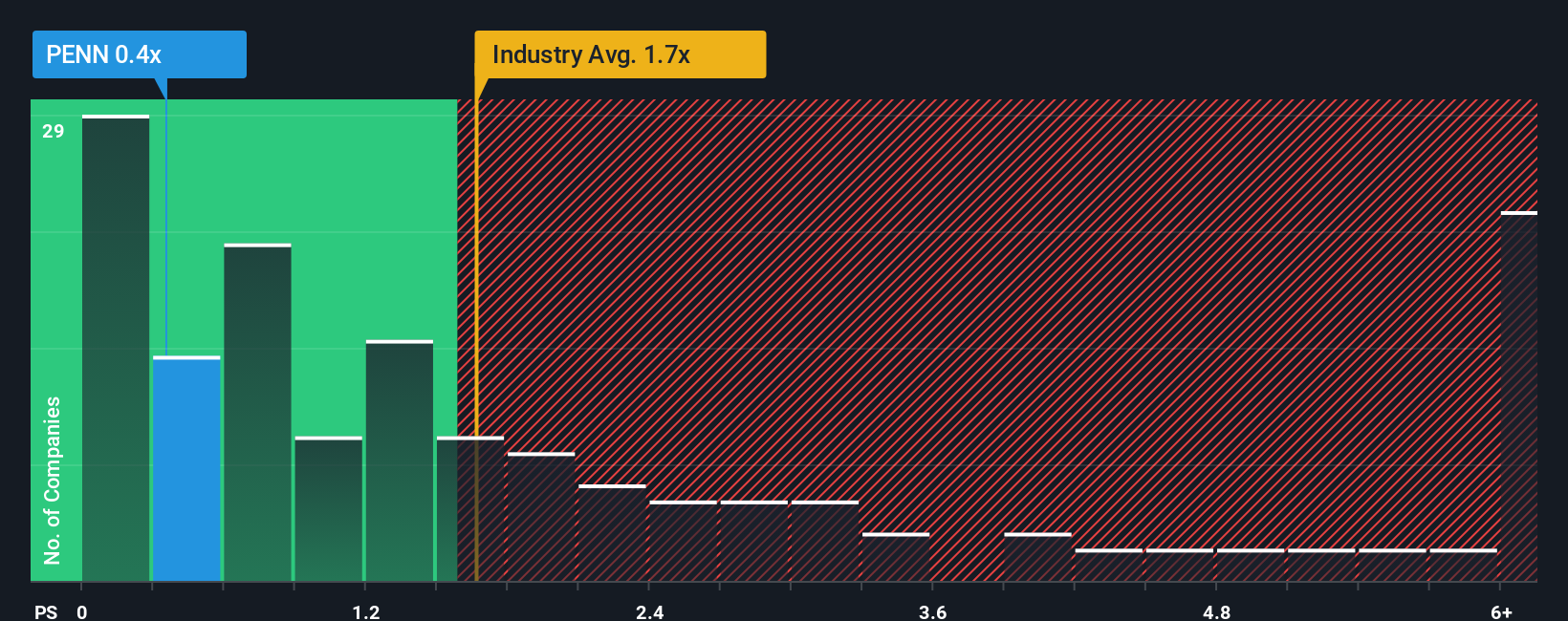

Approach 2: PENN Entertainment Price vs Sales

For companies like PENN Entertainment, where current profits can be volatile or even negative, the Price-to-Sales (PS) ratio is often the preferred valuation measure. This ratio helps investors understand how highly the market is valuing each dollar of the company’s revenue. This is especially useful in sectors like hospitality and gaming where margins and earnings can swing from year to year.

The PS ratio is shaped by factors such as growth expectations, risks unique to the business, and typical industry profitability. Rapidly growing companies or those with high profit potential generally warrant a higher PS ratio. In contrast, less certain prospects are priced more conservatively by the market.

PENN’s current PS ratio sits at 0.37x, which is strikingly low compared to both its industry’s average of 1.72x and its peer group’s average of 2.47x. While these benchmarks are useful, Simply Wall St goes a step further with its “Fair Ratio” metric. For PENN, this is calculated at 1.21x. The Fair Ratio factors in important variables like PENN's growth path, industry trends, profit margins, market cap, and specific business risks. This approach delivers a more personalized and accurate view of what the company should be worth compared to simple peer or industry averages.

Comparing PENN’s actual PS ratio of 0.37x to its Fair Ratio of 1.21x shows that the stock is trading well below what this in-depth analysis suggests is fair value. According to this metric, PENN appears considerably undervalued on a price-to-sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PENN Entertainment Narrative

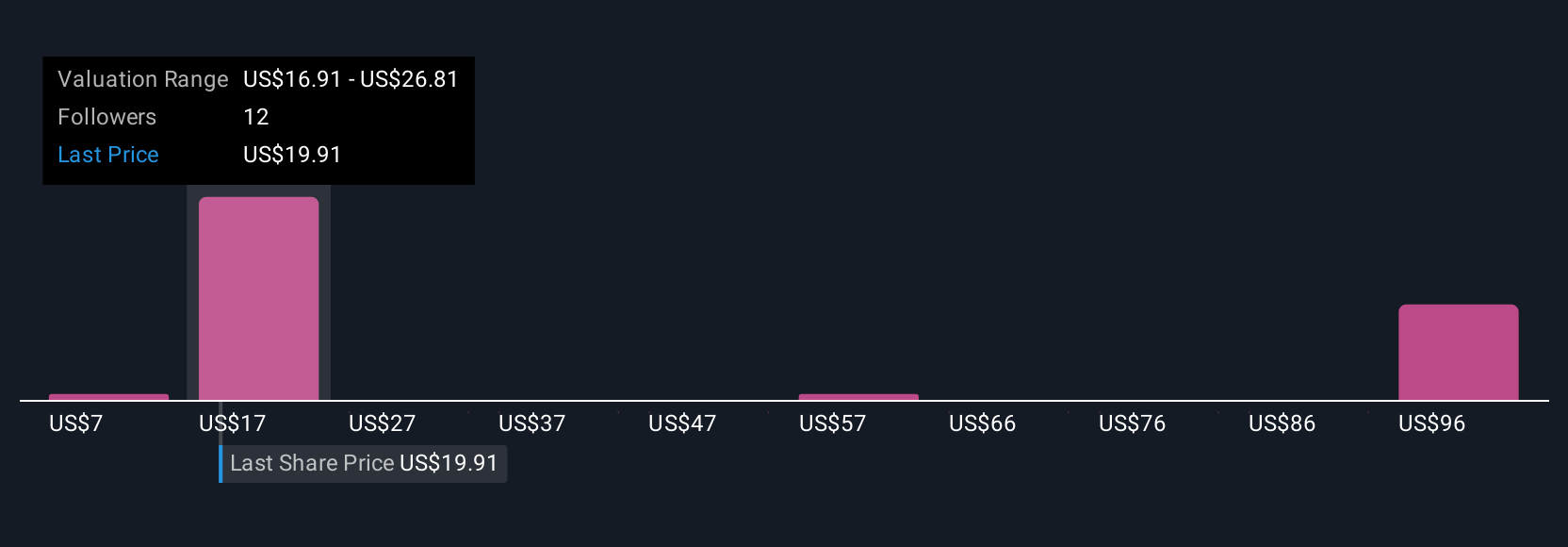

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative puts your perspective at the center of the process, allowing you to craft a story behind the numbers by combining your assumptions about PENN Entertainment’s future revenue, margins, and fair value into a clear, evidence-based outlook.

Rather than relying solely on static financial ratios or analyst targets, Narratives link the company's evolving story to financial forecasts and then to a dynamic fair value. This chain helps you see how today’s price stacks up against what you believe the company is truly worth.

Narratives are easy and accessible to use on the Simply Wall St platform, available right on the Community page where millions of investors share and refine their investment stories in real time.

With Narratives, you can continually update your outlook when new information such as breaking news or a fresh earnings release comes in, helping you quickly decide how PENN fits your investment strategy based on your own fair value compared to the market price.

For example, among Simply Wall St users following PENN Entertainment, some have a bullish narrative with a fair value above $30 while others are more cautious with a fair value closer to $17, each reflecting their unique expectations and research.

Do you think there's more to the story for PENN Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENN

PENN Entertainment

Provides integrated entertainment, sports content, and casino gaming experiences.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives