- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

How Investors Are Reacting To OneSpaWorld Holdings (OSW) Analyst Upgrade and Upbeat Earnings Outlook

Reviewed by Sasha Jovanovic

- OneSpaWorld Holdings was recently upgraded to a Zacks Rank #2 (Buy) following an upward revision in its earnings estimates, reflecting growing optimism about its business outlook.

- This rating upgrade highlights increasing confidence in OneSpaWorld’s underlying performance, underscoring analyst expectations for improved profitability and operational success.

- We'll explore how the improved earnings outlook and analyst upgrade provide fresh context for OneSpaWorld's investment narrative and growth potential.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OneSpaWorld Holdings Investment Narrative Recap

To be a shareholder in OneSpaWorld Holdings, you need to believe in the continued growth of cruise-based wellness experiences and the company's ability to capture rising onboard consumer spend. The recent Zacks Rank upgrade signals a favorable near-term outlook, likely tied to improving earnings estimates, but does not fundamentally alter the biggest short-term catalyst, continued expansion with new cruise line brands, nor does it eliminate the primary risk of revenue vulnerability to fluctuations in cruise passenger volumes.

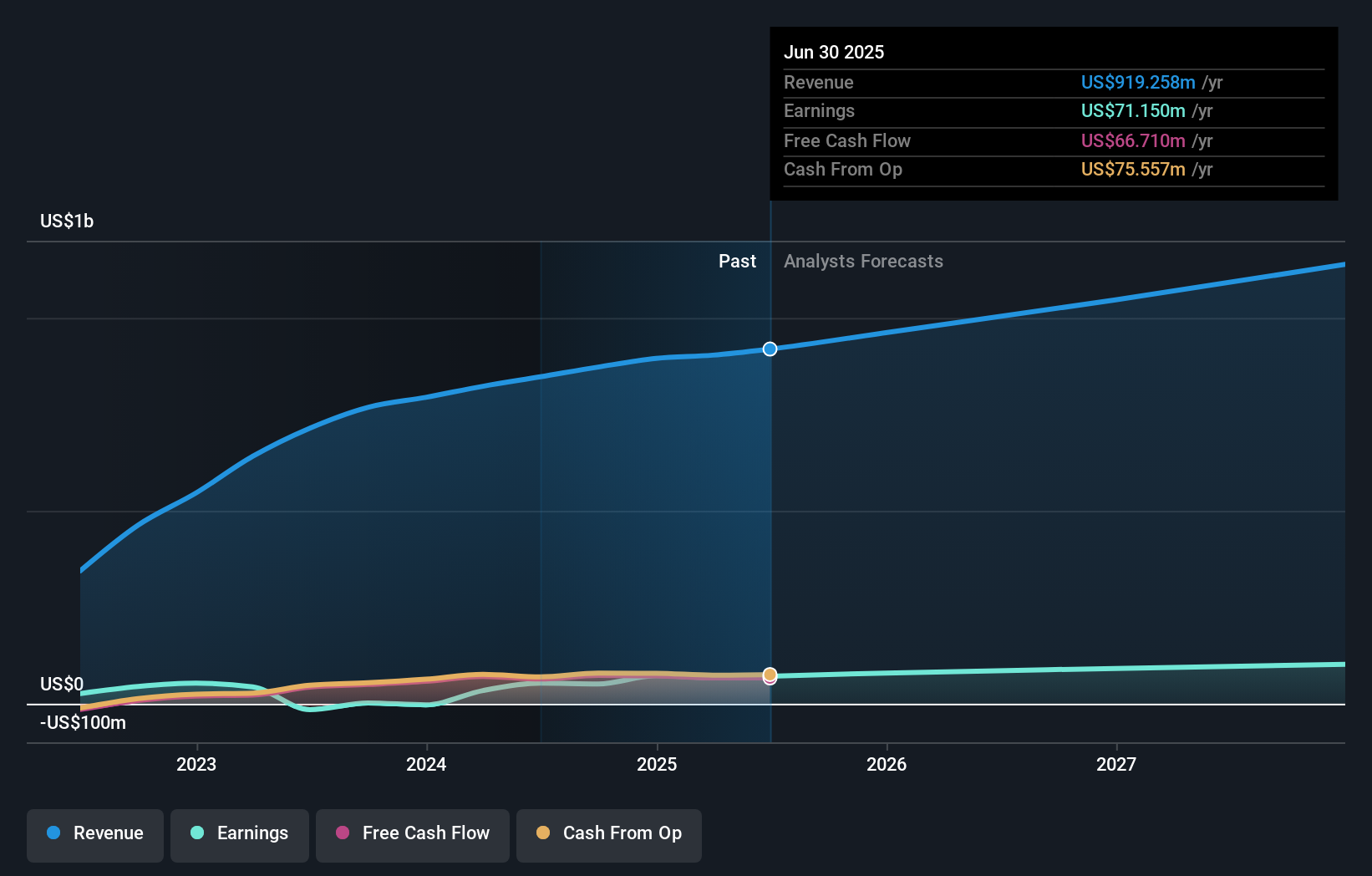

Recent Q2 earnings showed year-over-year growth in both revenue and net income, which supports analyst optimism reflected in the rating upgrade. Higher financial performance across core metrics aligns with the improving earnings outlook, adding context to possible near-term momentum if cruise market demand holds up.

However, investors should be aware that despite positive analyst revisions, the company's heavy reliance on cruise industry dynamics still means that its fortunes could be quickly challenged by sudden disruptions from…

Read the full narrative on OneSpaWorld Holdings (it's free!)

OneSpaWorld Holdings is expected to reach $1.2 billion in revenue and $110.6 million in earnings by 2028. This outlook relies on annual revenue growth of 8.9% and a $39.5 million increase in earnings from the current $71.1 million level.

Uncover how OneSpaWorld Holdings' forecasts yield a $24.67 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Two estimates from the Simply Wall St Community place OneSpaWorld's fair value between US$18.65 and US$24.67. While some see further upside, ongoing reliance on cruise passenger volumes remains a central point of debate for the company's future performance.

Explore 2 other fair value estimates on OneSpaWorld Holdings - why the stock might be worth 11% less than the current price!

Build Your Own OneSpaWorld Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OneSpaWorld Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneSpaWorld Holdings' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives