- United States

- /

- Hospitality

- /

- NasdaqGS:NDLS

Noodles & Company (NASDAQ:NDLS) Shares Fly 62% But Investors Aren't Buying For Growth

Those holding Noodles & Company (NASDAQ:NDLS) shares would be relieved that the share price has rebounded 62% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 58% share price decline over the last year.

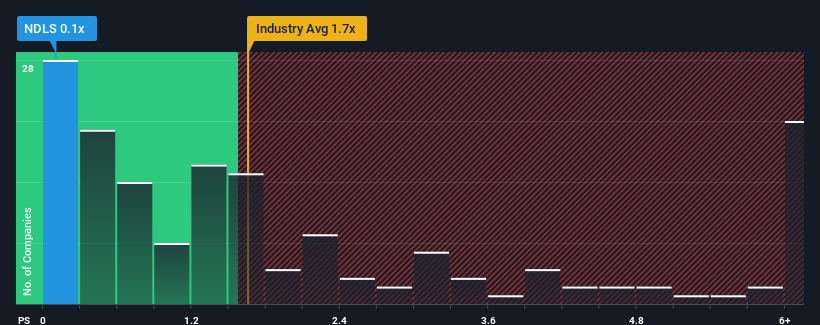

Although its price has surged higher, Noodles may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Hospitality industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Noodles

How Has Noodles Performed Recently?

Noodles hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Noodles' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Noodles' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.8%. Regardless, revenue has managed to lift by a handy 6.1% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 0.3% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 13%.

With this in consideration, we find it intriguing that Noodles' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Despite Noodles' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Noodles' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 4 warning signs for Noodles (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Noodles, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Noodles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NDLS

Noodles

A restaurant concept company, develops and operates fast-casual restaurants in the United States.

Moderate and good value.

Similar Companies

Market Insights

Community Narratives