- United States

- /

- Hospitality

- /

- NasdaqGS:NATH

Read This Before Buying Nathan's Famous, Inc. (NASDAQ:NATH) Shares

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Nathan's Famous, Inc. (NASDAQ:NATH).

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock on the market. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

See our latest analysis for Nathan's Famous

Nathan's Famous Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by Independent Director Robert Eide for US$514k worth of shares, at about US$70.03 per share. That means that an insider was selling shares at around the current price of US$68.88. While their view may have changed since the sale, this is not a particularly positive fact. We usually pause to reflect on the potential that a stock has a high valuation, if insiders have been selling at around the current price.

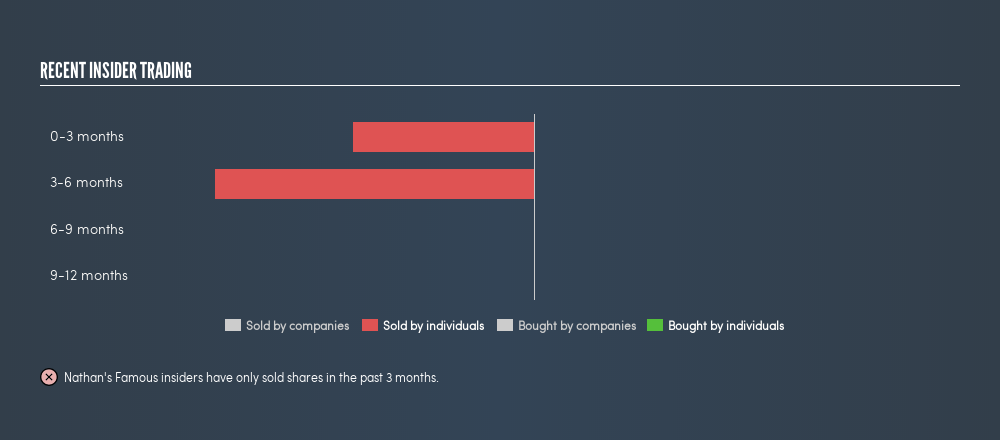

Over the last year, we note insiders sold 13.83k shares worth US$973k. All up, insiders sold more shares in Nathan's Famous than they bought, over the last year. The sellers received a price of around US$70.35, on average. It's not particularly great to see insiders were selling shares around current prices. While some insiders have decided to take some money off the table, we wouldn't put too much weight on this fact. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Nathan's Famous Insiders Are Selling The Stock

The last quarter saw substantial insider selling of Nathan's Famous shares. In total, Independent Director Brian Genson dumped US$353k worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the directors think that the shares are a bargain.

Does Nathan's Famous Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Insiders own 31% of Nathan's Famous shares, worth about US$89m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Nathan's Famous Insiders?

An insider hasn't bought Nathan's Famous stock in the last three months, but there was some selling. And there weren't any purchases to give us comfort, over the last year. But it is good to see that Nathan's Famous is growing earnings. Insiders own shares, but we're still pretty cautious, given the history of sales. We're in no rush to buy! Along with insider transactions, I recommend checking if Nathan's Famous is growing revenue. This free chart of historic revenue and earnings should make that easy.

Of course Nathan's Famous may not be the best stock to buy. So you may wish to see this freecollection of high quality companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:NATH

Nathan's Famous

Nathan's Famous, Inc., along with its subsidiaries, operates in the foodservice industry both in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives