- United States

- /

- Hospitality

- /

- NasdaqGS:MMYT

MakeMyTrip (NasdaqGS:MMYT): Weighing Valuation After Recent Share Price Declines

Reviewed by Kshitija Bhandaru

MakeMyTrip (NasdaqGS:MMYT) has experienced some movement in its share price over the past month, which has caught the attention of investors evaluating the outlook for this travel platform. The company's stock performance reflects shifting sentiment following recent company updates.

See our latest analysis for MakeMyTrip.

After a steady run-up in recent years, MakeMyTrip's share price has softened, with a 30-day share price return of -8.2% and a year-to-date slide of -23.4%. Still, its 3-year total shareholder return of 213.8% and 5-year total return of 310.4% highlight just how strong the long-term story has been, even as near-term momentum has faded and investors weigh future growth versus emerging risks.

If you're keeping an eye on travel and tech trends, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With solid long-term gains but recent declines, the question becomes whether MakeMyTrip is now trading below its true value or if the market has already accounted for all its expected growth, leaving little room for upside.

Most Popular Narrative: 26% Undervalued

Compared to the last close of $89.02, the most widely followed narrative places MakeMyTrip's fair value far higher. This suggests there may be considerable upside and sets the stage for a closer look at what is powering such optimism for the stock.

Ongoing investment in product innovation, particularly in AI-powered personalization and user experience improvements, positions MakeMyTrip for higher conversion rates, better customer retention, and ultimately supports expanding net margins through improved operating leverage.

Want to know what's behind this bold valuation? The forecast hinges on a unique blend of rapid revenue growth, surging profit margins, and an ambitious outlook for earnings expansion. The ingredients driving up that fair value target might surprise you.

Result: Fair Value of $121 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high customer acquisition costs and intensifying competition could limit MakeMyTrip's profitability and challenge this bullish outlook.

Find out about the key risks to this MakeMyTrip narrative.

Another View: Expensive by Market Comparison

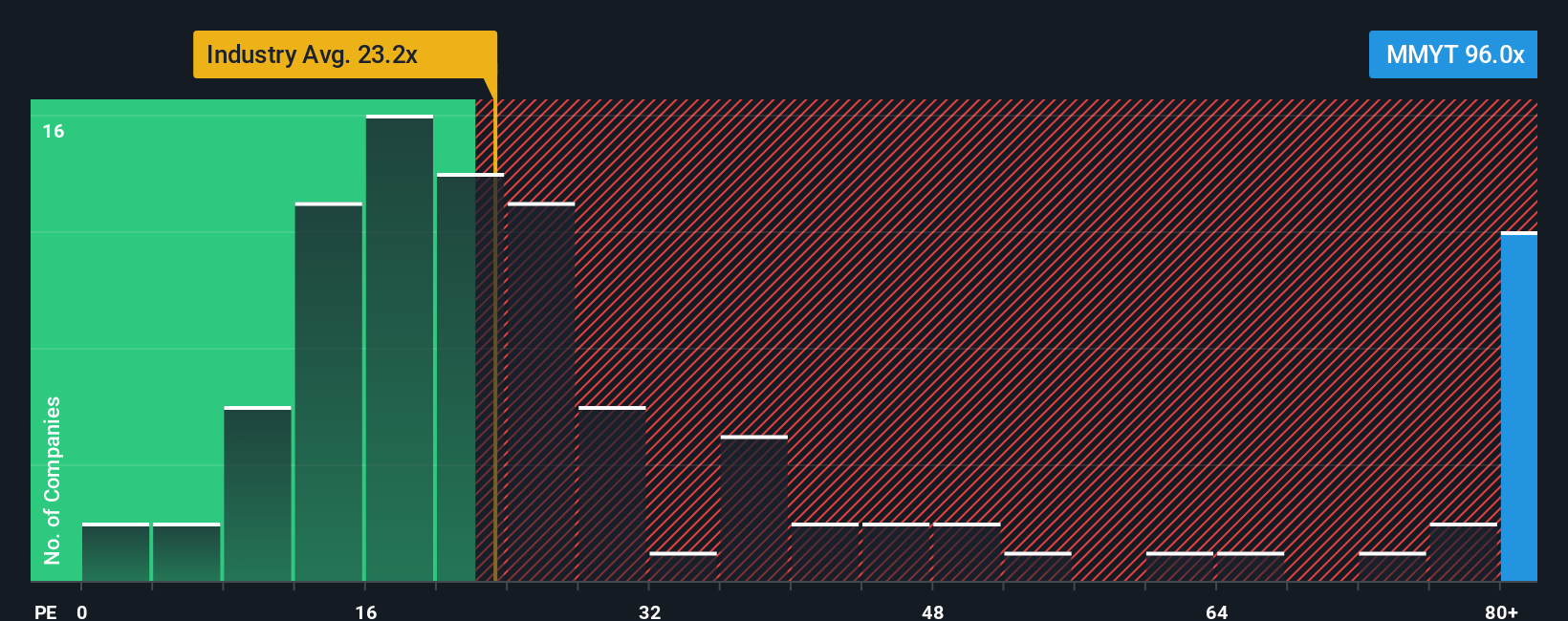

While analyst forecasts suggest MakeMyTrip is undervalued, comparing its current price-to-earnings ratio of 84.7x to industry peers, which average just 21.6x, paints a different picture. This is more than double the fair ratio of 38.4x, signaling a potential pricing risk unless future growth far outstrips expectations. Is the optimism already reflected in the price, or does room remain for upward surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MakeMyTrip Narrative

If you're not convinced by the verdict above or enjoy digging into the numbers yourself, it's easy to build your own perspective in just a few minutes and Do it your way

A great starting point for your MakeMyTrip research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss your chance to level up your investing strategy. There are standout opportunities just waiting for you in sectors primed for growth and innovation.

- Ramp up your portfolio potential with these 18 dividend stocks with yields > 3% offering reliable income from companies committed to strong and consistent payouts.

- Capitalize on the boom in artificial intelligence by starting with these 24 AI penny stocks that are driving industry disruption and future profits.

- Want to spot tomorrow’s bargains today? Pursue these 878 undervalued stocks based on cash flows spotlighting companies trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMYT

MakeMyTrip

Operates as a travel service provider in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, Cambodia, and Indonesia.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives