- United States

- /

- Hospitality

- /

- NasdaqGS:MMYT

Additional Considerations Required While Assessing MakeMyTrip's (NASDAQ:MMYT) Strong Earnings

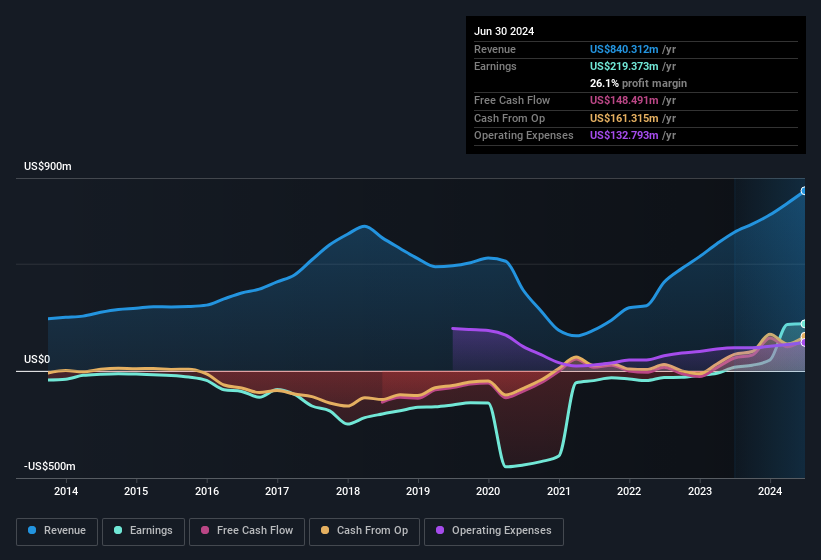

Despite posting some strong earnings, the market for MakeMyTrip Limited's (NASDAQ:MMYT) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for MakeMyTrip

An Unusual Tax Situation

MakeMyTrip reported a tax benefit of US$115m, which is well worth noting. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On MakeMyTrip's Profit Performance

MakeMyTrip received a tax benefit in its last reported period, as we have mentioned already. Tax is usually an expense, not a benefit, so we don't think the reported profit number is a particularly good guide to the earning potential of the business. As a result, we think it may well be the case that MakeMyTrip's underlying earnings power is lower than its statutory profit. The silver lining is that its EPS growth over the last year has been really wonderful, even if it's not a perfect measure. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. You'd be interested to know, that we found 1 warning sign for MakeMyTrip and you'll want to know about it.

Today we've zoomed in on a single data point to better understand the nature of MakeMyTrip's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMYT

MakeMyTrip

Operates as a travel service provider in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, Cambodia, and Indonesia.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Buy-out proposal for BARK Inc., at $1.10 has be confirmed by the acquisition group

Paladin Energy: Betting on the Nuclear Renaissance

Basic-Fit: Why the Market Is Mispricing Europe’s Largest Low-Cost Gym Operator

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks