- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Slammed 29% Melco Resorts & Entertainment Limited (NASDAQ:MLCO) Screens Well Here But There Might Be A Catch

Melco Resorts & Entertainment Limited (NASDAQ:MLCO) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

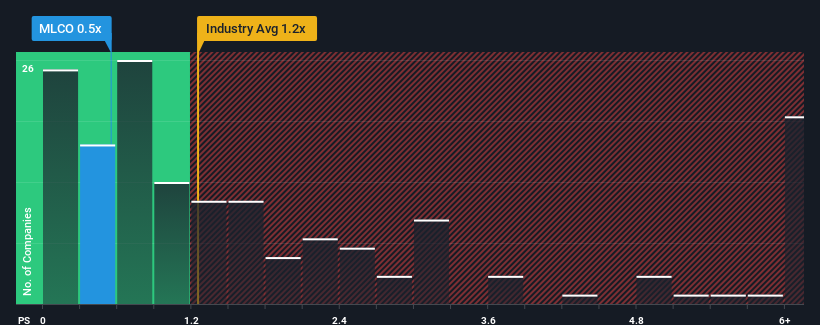

After such a large drop in price, given about half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Melco Resorts & Entertainment as an attractive investment with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Melco Resorts & Entertainment

How Has Melco Resorts & Entertainment Performed Recently?

With revenue growth that's superior to most other companies of late, Melco Resorts & Entertainment has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Melco Resorts & Entertainment.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Melco Resorts & Entertainment's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 162%. The strong recent performance means it was also able to grow revenue by 191% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is not materially different.

With this in consideration, we find it intriguing that Melco Resorts & Entertainment's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Melco Resorts & Entertainment's P/S Mean For Investors?

The southerly movements of Melco Resorts & Entertainment's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Melco Resorts & Entertainment's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you settle on your opinion, we've discovered 1 warning sign for Melco Resorts & Entertainment that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Reasonable growth potential and fair value.

Market Insights

Community Narratives