- United States

- /

- Hospitality

- /

- NasdaqGS:MCRI

Monarch Casino & Resort (MCRI): One-Off Loss Pressures Margins, Challenges Profit Durability Narrative

Reviewed by Simply Wall St

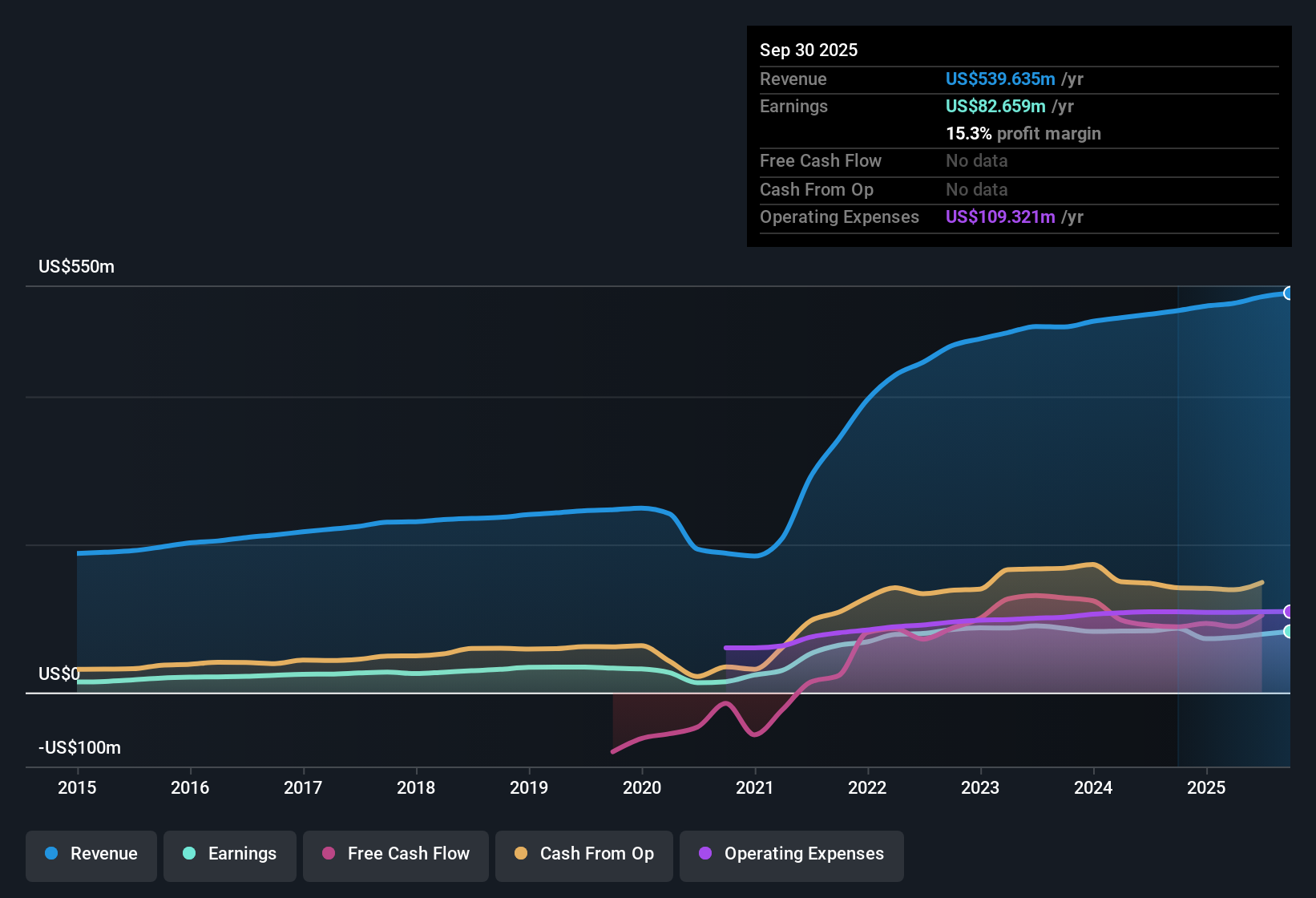

Monarch Casino & Resort (MCRI) posted a net profit margin of 15.3%, down from 16.8% a year earlier, signaling a slight dip in profitability. Over the last five years, the company's earnings have grown at 14% per year, even after accounting for a significant one-off loss of $28.6 million in the most recent period. Forward guidance now points to annual earnings and revenue growth of 9.58% and 2.3% respectively, both trailing the US market averages. With investors weighing the impact of a non-recurring expense against steady long-term growth and an attractive valuation, these results create a nuanced setup for the stock.

See our full analysis for Monarch Casino & Resort.Now that the numbers are in, it’s time to see how the latest results compare to the prevailing narratives driving expectations. Some may get confirmation, while others could face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss Brings Earnings Quality into Focus

- The sharp $28.6 million one-off loss reported in the period stands out as a clear swing factor in Monarch's net profit margin. This explains why the margin slipped to 15.3%, despite a strong five-year annualized earnings growth rate of 14%.

- While the prevailing market view is that Monarch’s long-term growth trends are supportive, the presence of a significant non-recurring expense creates tension for investors deciding whether recent profitability truly reflects the company's steady growth.

- The persistent annual earnings growth of 14% over five years heavily supports arguments for earnings durability. However, short-term numbers became less reliable because of the one-off loss.

- Some investors might hesitate to fully trust recent figures, even as fundamentals beyond this unusual expense, such as historical growth and profitability, remain favorable.

Valuation Remains Attractive Against Peers and Industry

- Monarch trades at a Price-To-Earnings Ratio of 20.6x, meaning the stock is priced lower than its peers (31.9x) and the US hospitality industry (24.2x). Its share price of $93.21 sits below the DCF fair value estimate of $153.99.

- The prevailing market view highlights how this valuation gap could appeal to value-focused investors, particularly those weighing steady long-term growth against modest revenue expectations.

- The current discount to fair value and peers challenges concerns that softer growth projections and lower profit margins automatically make the stock overvalued.

- Notably, even factoring in muted forward revenue growth of just 2.3% per year, Monarch’s valuation remains a relative bright spot. This creates a cushion against major downside risk.

Forward Growth Forecast Trails Broader Market

- Monarch’s forward earnings and revenue growth guidance is set at 9.58% and 2.3% annually, both lagging broader US market averages. This places the company in a slower-growth camp for the foreseeable future.

- The prevailing market view is that, while Monarch’s fundamentals provide stability, the slower projected growth makes the stock less likely to deliver outsized upside compared to companies riding higher sector or market trends.

- Bulls looking for strong momentum plays may look elsewhere, especially since Monarch’s growth outlook signals a focus on reliable returns rather than breakout expansion.

- Still, management’s steady approach and history of profit growth help balance expectations against broader market excitement.

If you're weighing Monarch's valuation and guidance, see the full investment breakdown and judge how the steady growth stacks up with today's price. See our latest analysis for Monarch Casino & Resort.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Monarch Casino & Resort's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Monarch’s slower forecasted growth and industry-lagging revenue outlook suggest it may not deliver the strong upside available in faster-growing peers.

For investors targeting companies positioned for stronger expansion, discover your next opportunity among high growth potential stocks screener (52 results) and spot firms set to outpace the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCRI

Monarch Casino & Resort

Through its subsidiaries, owns and operates hotels and casinos.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives